Panel: Healthcare for Illegal Immigrants: What would it cost?

Download a PDF of this Backgrounder.

Steven A. Camarota is the director of research and Karen Zeigler is a demographer at the Center. Jason Richwine, PhD, is a public policy analyst based in Washington, D.C., and a contributing writer at National Review.

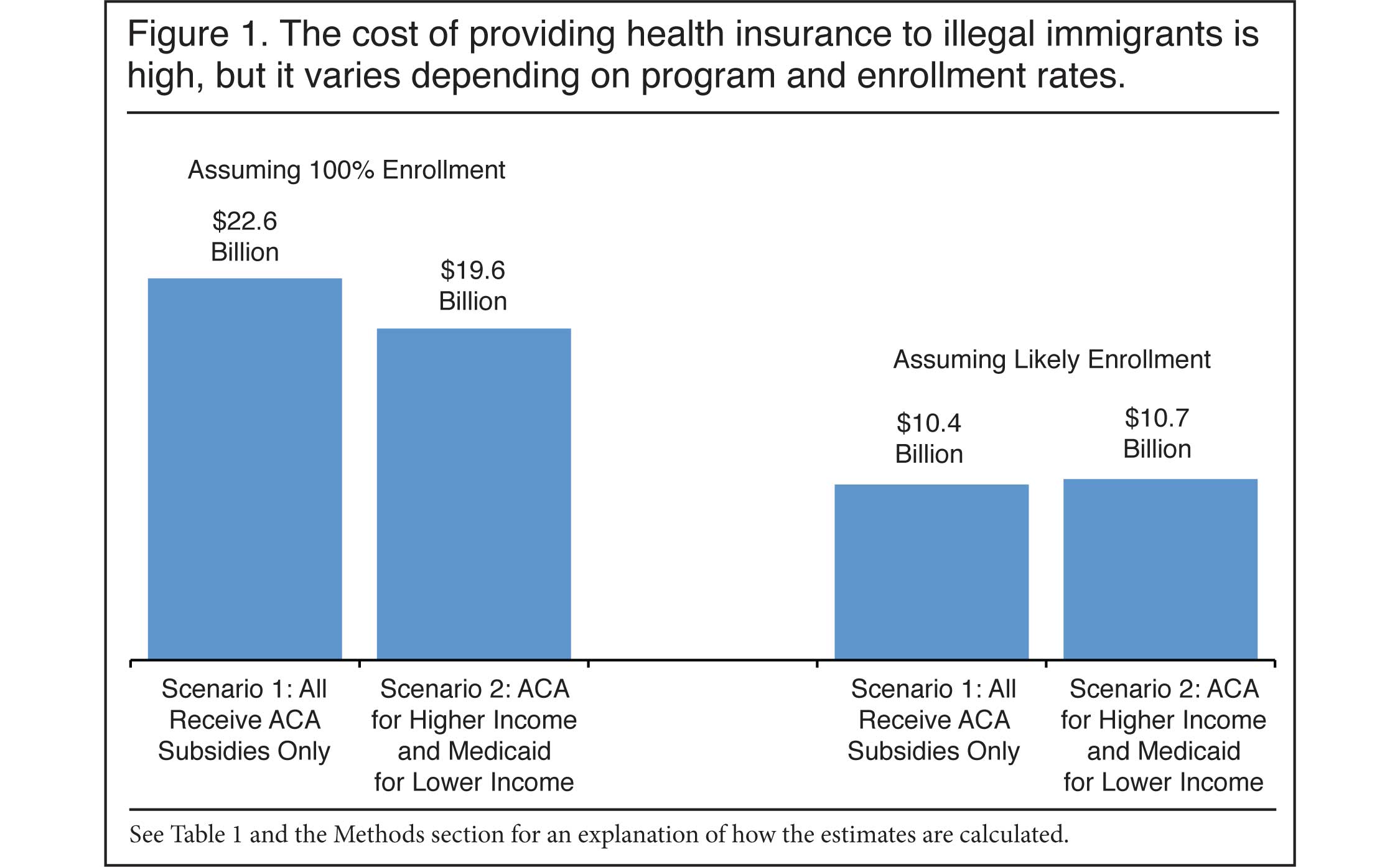

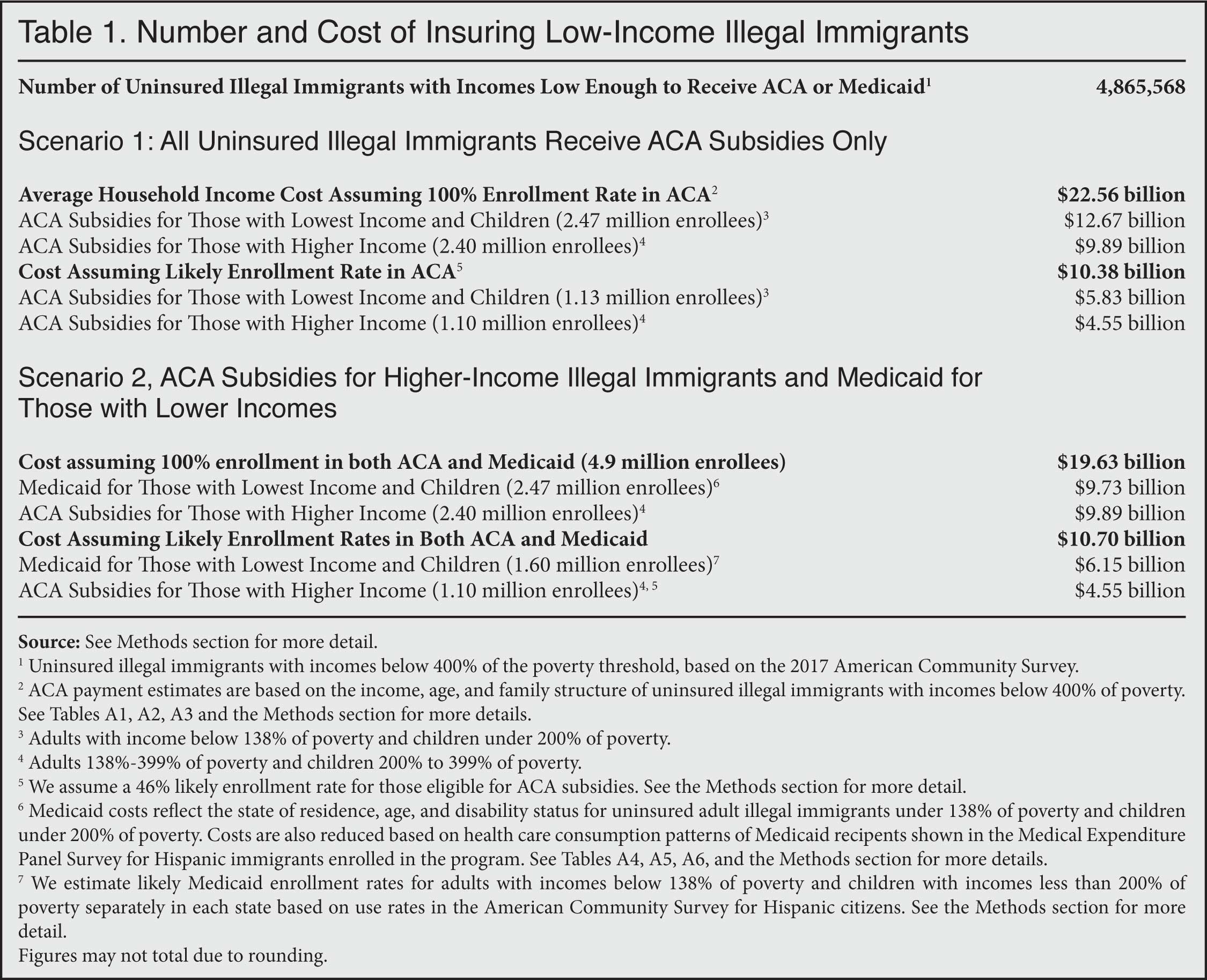

Many of the Democratic candidates for president have endorsed providing health insurance to illegal immigrants. This analysis estimates the cost of providing illegal immigrants access to the existing system of government health benefits for low-income people. (We do not model the costs of scrapping the current system and giving all U.S. residents free government health insurance, as some candidates have proposed.) We estimate that there are 4.9 million uninsured illegal immigrants with incomes low enough to qualify for Medicaid or Advanced Premium Tax Credits (APTC), which are the subsidies provided by the Affordable Care Act (ACA). Assuming a realistic enrollment rate, the cost of providing ACA subsidies to illegal immigrants would be about $10 billion per year, with costs rising to as much as $23 billion per year if all eligible illegal immigrants enrolled. Costs would be similar under a hybrid approach that provides Medicaid for the lowest-income illegal immigrants and ACA subsidies for those with higher incomes.

- Consistent with other research, we estimate that there are 4.9 million uninsured illegal immigrants with incomes low enough (less than 400 percent of the poverty threshold) to qualify for subsidies under the ACA.

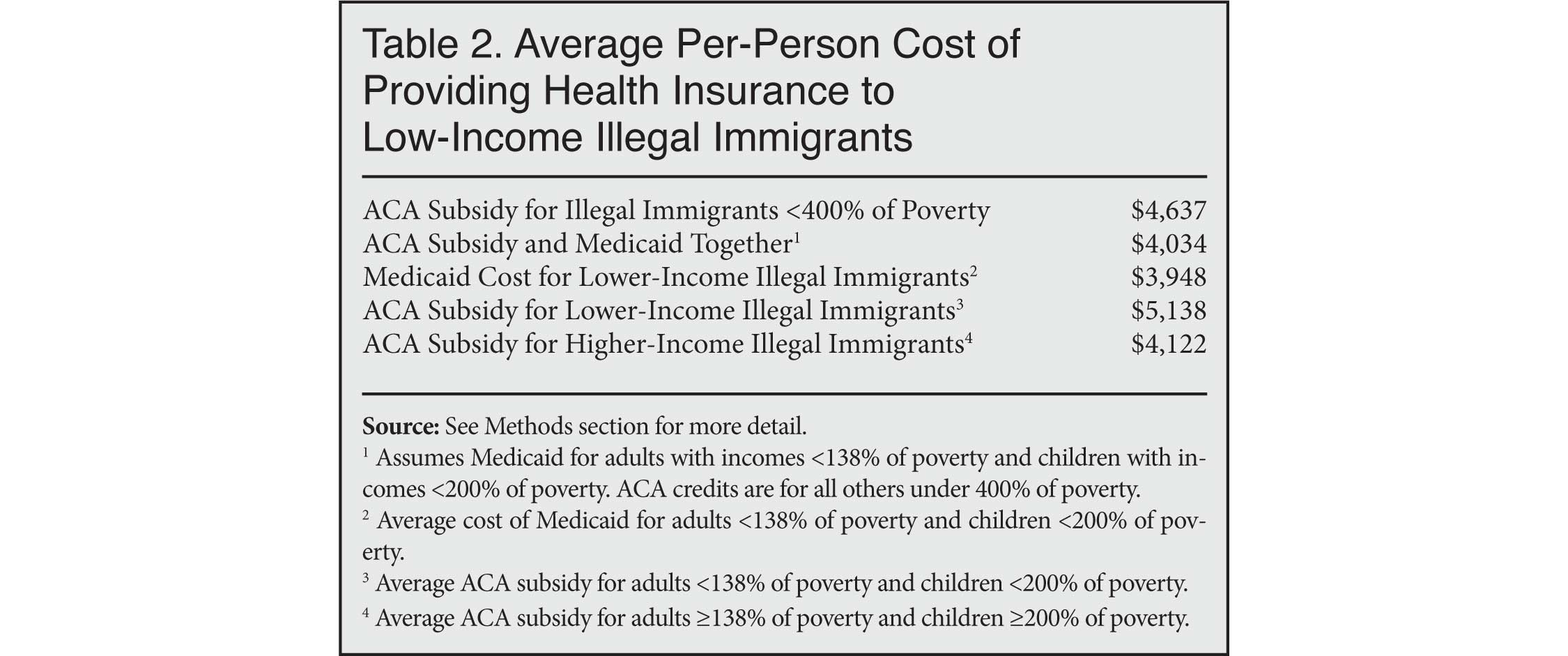

- Given their age and income, the average cost of providing an ACA subsidy for an illegal immigrant would be about $4,600 each year.

- The total cost of providing ACA subsidies to illegal immigrants could be $22.6 billion annually if they all enrolled. The total cost assuming a more realistic enrollment rate is $10.4 billion per year.

- While the overall cost would be large, the average subsidy illegal immigrants would receive is still smaller than the average ACA subsidy. This is primarily because illegal immigrants are a relatively young population.

- Although we consider an ACA-only approach the most likely, we also estimate the costs of a hybrid ACA-Medicaid scenario, in which the lowest-income illegal immigrants (about half of the illegal population) are given Medicaid, while those with higher incomes still receive ACA subsidies.

- Compared to an ACA-only approach, the total cost of the ACA-Medicaid hybrid would be similar — $19.6 billion when assuming 100 percent enrollment, and $10.7 billion assuming a more realistic enrollment rate in both programs.

- We do not attempt to estimate indirect or second-level costs, such as the possibility that offering government health benefits could incentivize more illegal immigration.

Introduction

Under current law, illegal immigrants are not allowed to participate in the healthcare exchanges established by the Affordable Care Act (ACA). As a result, they cannot receive Advanced Premium Tax Credits (APTC), which are the subsidies paid to insurance companies to help low-income people afford coverage. Illegal immigrants are also generally barred from participating in Medicaid, with the exception of minors in certain states and pregnant women nationwide. At the June 27 Democratic presidential debate, all of the candidates endorsed giving government health benefits to illegal immigrants, but there was no discussion of exactly how that would work or how much it would cost. According to a subsequent survey by The Atlantic, Bernie Sanders, Kamala Harris, Elizabeth Warren, Cory Booker, and Julian Castro all would "provide full benefits to the undocumented." On the other side of the spectrum, Michael Bennet and Joe Biden suggested only allowing illegal immigrants to buy unsubsidized insurance on the healthcare exchanges.1

In response to these proposals, the Center for Immigration Studies has issued two new reports. The first report details the participation rate and cost of Medicaid usage by immigrants under existing policy, which offers noncitizens less access to the program compared to citizens.2 This second report explores the added costs of offering public health benefits to illegal immigrants.3

The two public health benefits typically offered to low-income uninsured people are ACA subsidies and Medicaid. There are nearly five million illegal immigrants in the country without health insurance with incomes low enough to qualify for these benefits. Since the average annual cost of these benefits is several thousand dollars per person, the total price tag for insuring illegal immigrants must be in the billions of dollars. Assuming 100 percent enrollment, we calculate the annual cost of providing ACA subsidies to be $22.6 billion, and $19.6 billion if illegal immigrants receive a mix of ACA credits and Medicaid. Assuming likely enrollment rates, the costs would be $10.4 billion for an ACA-only approach and $10.7 billion for a mix of ACA subsidies and Medicaid.

How the ACA Works

Those with incomes under 400 percent of poverty ($83,120 for a family of three in 2018) are eligible for ACA subsidies that reduce the amount they pay for health insurance. ACA subsidies are typically paid by the federal government to insurance companies on behalf of low-income consumers who buy health insurance on the federal or state-run exchanges.4 For the most part, those purchasing insurance through the exchanges are either self-employed or not offered insurance through their employer.5 The ACA was designed to provide Medicaid coverage to all adults with incomes below 138 percent of poverty ($28,676 in 2018 for a family of three). Empowered by a 2012 Supreme Court ruling, many states have chosen not to expand Medicaid coverage, but ACA subsidies are still available to all low-income people (except illegal immigrants) in non-expansion states.6

The size of the ACA subsidy primarily reflects a person's age and income, with income measured relative to the poverty threshold. The size of the subsidy goes up as a person's income goes down. Those with the lowest incomes are typically on Medicaid, especially in the expansion states. Factors such as overall health or pre-existing conditions do not impact the size of the premium or the subsidy.

Findings

A detailed explanation of methods can be found at the end of this report. To summarize, we estimate the age and poverty status of illegal immigrants based on Census Bureau data and then calculate an ACA subsidy for those with incomes low enough to qualify. For the lowest-income uninsured illegal immigrants, we also estimate the cost of providing Medicaid based on state of residence, age, and disability status. Costs are calculated alternatively under the assumption of a 100 percent enrollment rate for all eligible illegal immigrants, and also under the assumption of a lower "likely" enrollment rate.

Figure 1 and Tables 1 and 2 summarize our findings. We estimate there are 4.9 million illegal immigrants who have incomes below 400 percent of the poverty threshold and who do not have insurance. This is the cutoff for premium subsidies. We run two scenarios: In Scenario 1, we estimate the cost if illegal immigrants receive ACA subsidies only. In Scenario 2, we examine the cost if the lowest-income illegal immigrants receive Medicaid, while the higher-income illegal immigrants receive ACA subsidies.

|

|

|

ACA Subsidies Only, 100 Percent Enrollment. Turning first to Scenario 1, we estimate that if all income-eligible uninsured illegal immigrants receive ACA subsidies, the total cost would be $22.6 billion in 2019. This total cost reflects the large number of uninsured illegal immigrants, coupled with the significant average cost associated with subsidizing their premiums — $4,637, on average, shown in Table 2. While the overall cost would be large, the average ACA subsidy in 2019 for those buying insurance on one of the exchanges was more than $7,000.7 The primary reason illegal immigrants would receive a smaller average subsidy is that they are a relatively young population.

Likely Enrollment in ACA Subsidies Only. The above estimate is the cost of providing ACA credits to all 4.9 million low-income, uninsured illegal immigrants. However, as is the case with any government program, not all of those eligible will enroll. For 2018, the Kaiser Family Foundation has estimated that 46 percent of those with incomes low enough to qualify for a subsidy actually purchased insurance through one of the healthcare exchanges.8 We assume this would be true of illegal immigrants as well. If so, the total cost of providing ACA subsidies would be $10.4 billion annually, as shown in Figure 1 and Table 1. Though still substantial, this is less than half the $22.6 billion cost if all income-eligible uninsured illegal immigrants were to enroll.9

It is possible to use our analysis to generate alternative estimates by multiplying the average ACA subsidy in Table 2 ($4,637) by the number of uninsured illegal immigrants one thinks will actually use the program. For every one million uninsured illegal immigrants who sign up for ACA insurance and receive a subsidy, the cost to taxpayers would be $4.6 billion per year.

ACA Subsidies and Medicaid, 100 Percent Enrollment. In addition to showing the cost of ACA subsidies, Figure 1 and Table 1 provide a second scenario in which the lowest-income illegal immigrants (adults with income under 138 percent of poverty and children under 200 percent of poverty) are allowed to access Medicaid, while higher-income illegal immigrants still receive ACA subsidies.10 We estimate the total cost of such a mixed approach would be $19.6 billion in 2019, which is less than the ACA-only estimate. The lower Medicaid cost reflects the tendency of immigrants to consume fewer healthcare dollars when on Medicaid. By contrast, ACA subsidies primarily reflect age and income, not actual consumption of care. For more discussion of the lower cost of providing Medicaid relative to ACA subsidies, see "Calculating the Cost of Medicaid" in the Methods section at the end of this report.

Likely Enrollment in ACA Subsidies and Medicaid. Using the American Community Survey, we estimate Medicaid enrollment rates in each state for a surrogate population of low-income, Hispanic citizens and apply these rates to the lowest-income, uninsured illegal immigrant population. Though the rates differ significantly across states, nationally we find that 93 percent of children with incomes less than 200 percent of poverty are enrolled in Medicaid, as are 70 percent of adults with incomes below 138 percent of poverty. The overall cost of "likely" Medicaid enrollment is $6.1 billion, which is still higher than the $5.8 billion cost for ACA subsidies for this low-income population. The reason is that even though Medicaid average costs are less than ACA subsidies, the likely enrollment rate for Medicaid is much higher than what is likely for the ACA.

Together, the cost of providing Medicaid for the lowest-income, uninsured illegal immigrants and ACA subsidies for those with higher incomes would be $10.7 billion annually, as shown in Figure 1 and Table 1, assuming likely enrollment rates. This cost is quite similar to the ACA-only scenario, assuming likely enrollment, of $10.4 billion.

Conclusion

Providing illegal immigrants with public health benefits may soon become a reality depending on how the political situation evolves. Of course, the cost of providing health insurance to illegal immigrants would be dependent on the specific type of coverage offered. At present, the two primary ways of delivering free or reduced-cost health insurance to low-income residents are Medicaid and ACA subsidies. Our analysis indicates that allowing uninsured, low-income illegal immigrants access to these programs would likely cost taxpayers around $10 billion per year, assuming many chose not to enroll, with costs potentially rising as high as $23 billion.

Numbers aside, the fact that presidential candidates are advocating spending billions of dollars on people who are in the country illegally is significant in its own right. It suggests that allowing in large numbers of less-educated workers will inevitably generate significant political pressure to provide them access to social programs. If there is significant political pressure to provide coverage to people in the country illegally, it seems almost certain that over time pressure will grow to provide healthcare to low-wage guestworkers and other "temporary" immigrants as well. The high cost of providing healthcare to less-educated workers who earn modest wages is a reminder that tolerating illegal immigration or allowing such workers into the country legally is likely to create a significant burden for taxpayers.

Methods

Identifying the Low-Income and Uninsured Population of Illegal Immigrants. Illegal immigrants are present in Census data, but they are never explicitly identified by the bureau. To determine which respondents are most likely to be illegal aliens, CIS first excludes immigrant respondents who are almost certainly not illegal aliens — for example, spouses of native-born citizens; veterans; people who receive direct welfare payments (except Medicaid for women who gave birth within the past year and for residents of certain states); people who have government jobs; Cubans (because of special rules for that country); immigrants who arrived before 1980 (because the 1986 amnesty should have already covered them); people in certain occupations requiring licensing, screening, or a government background check (e.g., doctors, pharmacists, and law enforcement); and people likely to be on student visas.

The remaining candidates are weighted to replicate known characteristics of the illegal population (population size, age, gender, region or country of origin, state of residence, and length of residence in the United States). CIS has previously used the Department of Homeland Security (DHS) as the source of those known characteristics; however, DHS data were last published in 2015. For 2017 data, we turn to estimates from the Center for Migration Studies (CMS).11 The resulting illegal population, which consists of a weighted set of ACS respondents, is designed to match CMS on the additional characteristics of education, poverty, and the uninsured rate. Estimates published by Pew Research, though less detailed, are very similar to those from CMS, and so matching Pew would produce similar cost estimates as those reported here.

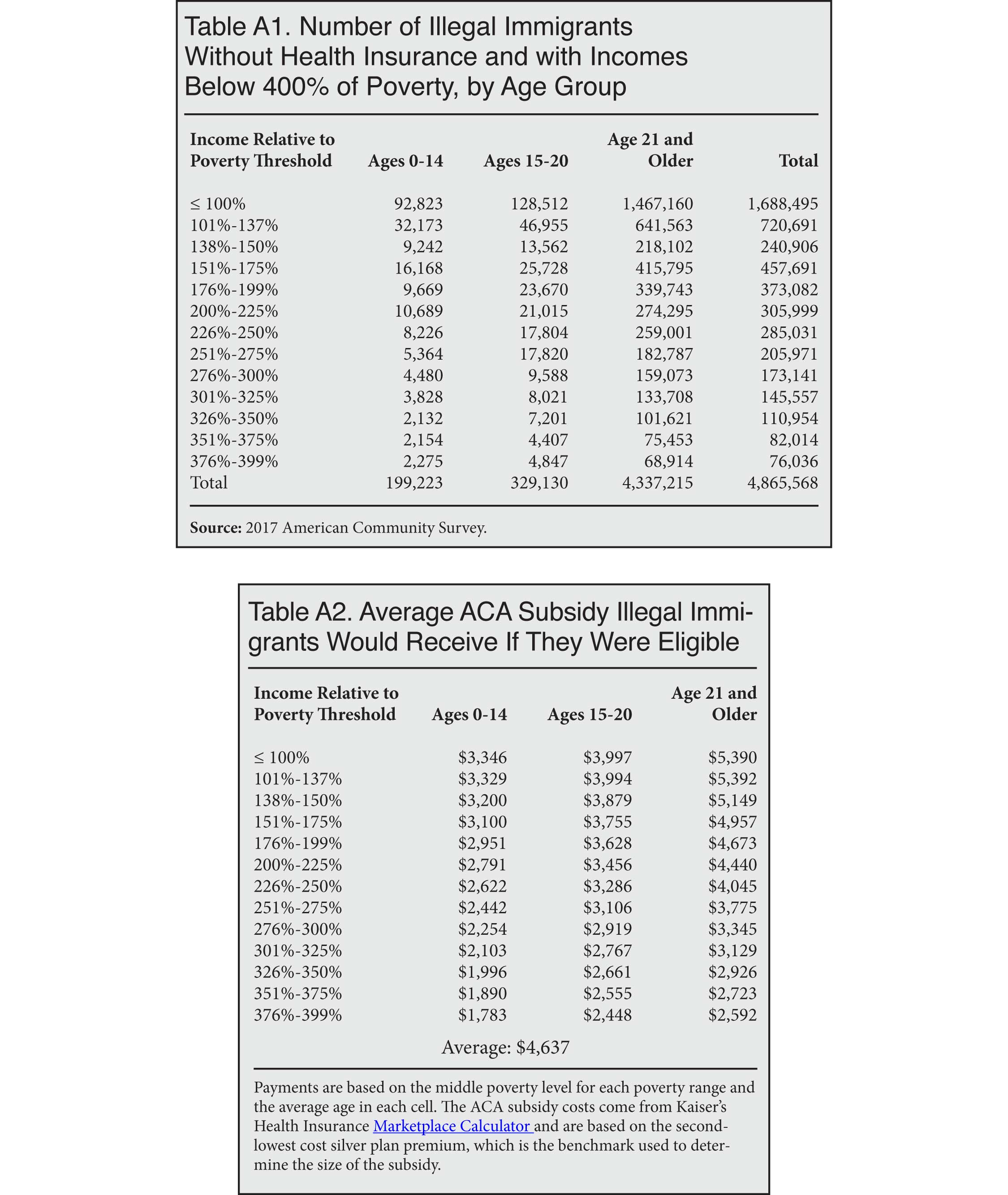

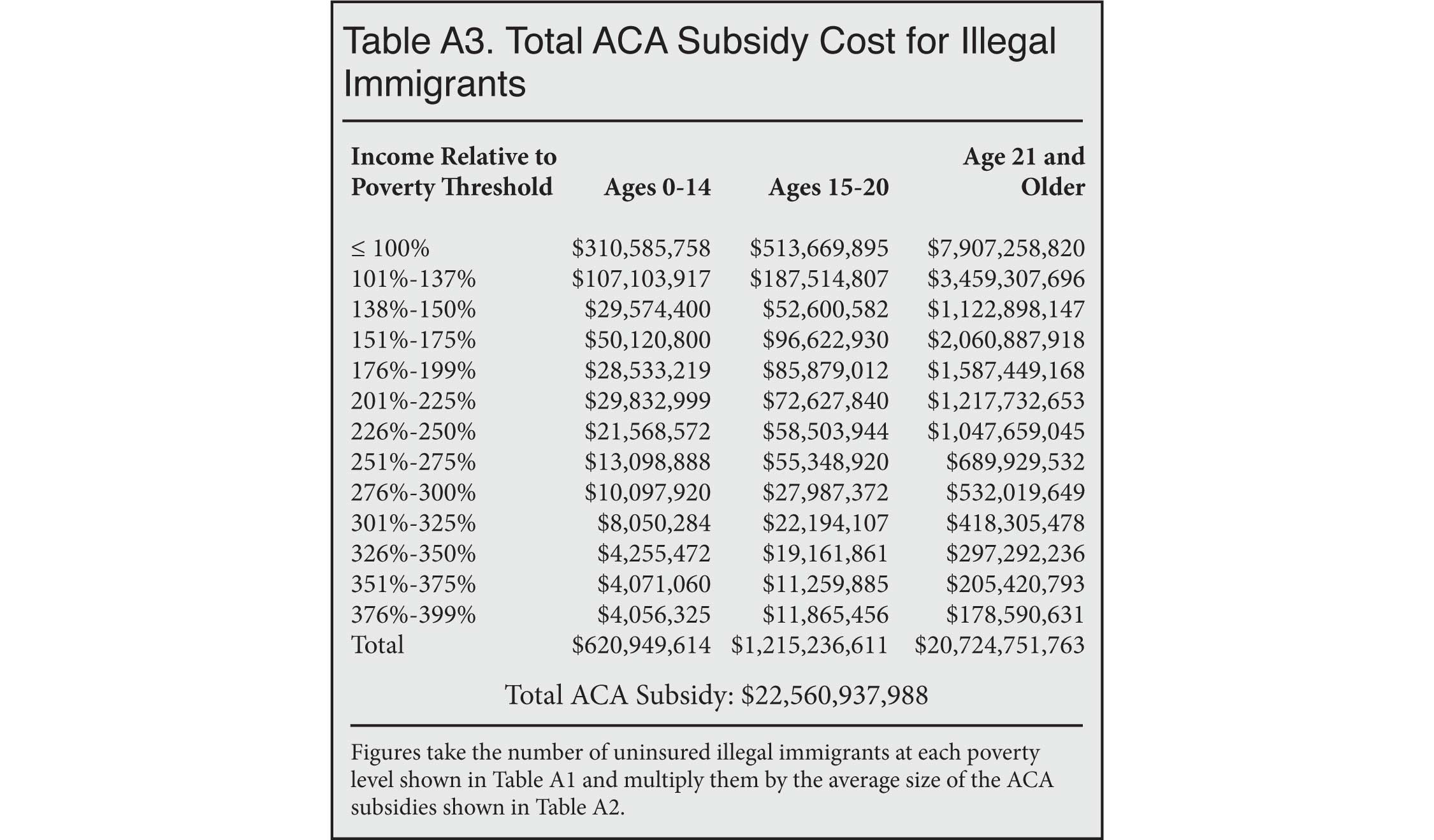

ACA Subsidies for Illegal Immigrants. Table A1 in the Appendix reports the distribution of uninsured illegal immigrants by their age and income relative to the poverty threshold. We calculate an ACA subsidy for low-income uninsured illegal immigrants based on their age and poverty status. Table A2 shows the subsidy paid by the government at each poverty level for younger children (0 to 14), older children and young adults (15 to 20), and adults (21 and over) by their poverty levels. Each payment shown in the table represents the dollar value of the subsidy for a person who has the average age at each poverty level.12 Given their income and age, the average payment received by an illegal immigrant would be $4,637. This figure represents the cost for 2019. While this cost is certainly substantial, the average ACA credit paid to insurance companies for those who buy insurance on the exchanges is $7,210 per year, according to the Congressional Budget Office.13 Therefore, our analysis indicates that illegal immigrants would actually cost less to insure than the average adult receiving a credit. The relatively young average age of adult illegal immigrants is the primary reason. Low-income, illegal immigrant adults have an average age of 39. By contrast, the average age of uninsured citizen adults with incomes below 400 percent of poverty is 49.

In general, age and income are what matters when it comes to the size of the subsidy. A beneficiary's overall health does not impact the premium the insured person pays or the subsidy paid to the insurance company by the federal government to make the premium affordable. Immigrants do consume somewhat less in healthcare than the native-born with similar characteristics, but this does not affect how the subsidy is calculated.14 Differences in health costs between immigrants and natives do come into play when we estimate Medicaid costs because in that case the government would be providing insurance directly.

The ACA Coverage Gap. Because the ACA was originally designed to provide all persons with incomes below 138 percent of poverty with Medicaid, no provision was made to give ACA subsidies to those with the lowest incomes. But since some states have not expanded Medicaid, the so-called "coverage gap" was created. In non-expansion states, some people below 100 percent (not 138 percent) of poverty (mostly childless adults) are also unable to access ACA subsidies.15 Our 100-percent ACA enrollment scenario assumes that if the law is changed to allow illegal immigrants to receive ACA subsidies, the change would include a provision giving the lowest-income illegal immigrants access to ACA subsidies, even those with incomes below 100 percent of poverty. There is certainly precedent for this kind of provision. Aware of the fact that new legal immigrants would not be able to access Medicaid as a result of the 1996 immigration reform, the ACA's architects carved out an exception allowing new permanent residents (green card holders) to receive ACA subsidies even if their income was below 100 percent of poverty.16

Assuming 100 Percent Enrollment in ACA. To estimate the total cost of providing subsidies, we multiply each payment shown in Table A2 by the number of people at each age and poverty level shown in Table A1. Table A3 shows the results of these calculations for each age group and poverty level, and then sums the total at the bottom. We estimate that the total cost to taxpayers of providing ACA subsidies to all 4.9 million lower-income illegal immigrants would be $22.6 billion annually, assuming all those eligible actually enrolled. No Medicaid costs are assumed yet.

Likely ACA Enrollment. The above estimate is the cost of providing ACA credits to all 4.9 million uninsured illegal immigrants with incomes below 400 percent of poverty. However, as is the case with all government programs, some of the people eligible will not enroll. For 2018, Kaiser has estimated that 46 percent of those with incomes low enough to qualify for the Advanced Premium Tax Credits actually purchased insurance through one of the healthcare exchanges.17 Some may be unaware of the program, while others are simply not interested in it. Further, the Commonwealth Fund found in 2017 that among uninsured adults who were aware of the ACA, but had not visited the website, 59 percent felt they still could not afford health insurance. Of those who had visited the site, but did not enroll, 74 percent also cited costs.18 Whatever the reason, a significant share of newly eligible illegal immigrants will not take advantage of ACA subsidies. Assuming 46 percent enrollment would create a total cost of $10.4 billion to taxpayers.19

Calculating the Cost of Medicaid. The ACA was designed so that all of those with incomes under 138 percent of poverty would be enrolled in an expanded Medicaid program, but some states have chosen not to expand Medicaid. In the analysis that follows, we assume that adult uninsured illegal immigrants with incomes under 138 percent of poverty would receive Medicaid, while those with incomes above this threshold would receive ACA subsidies. Since virtually every state provides Medicaid coverage to children with incomes under 200 percent of poverty, we also assume that uninsured illegal immigrant children in this income group would be covered by the program. Later in this analysis we provide an estimate that takes into account the differing Medicaid enrollment rates in non-expansion states.

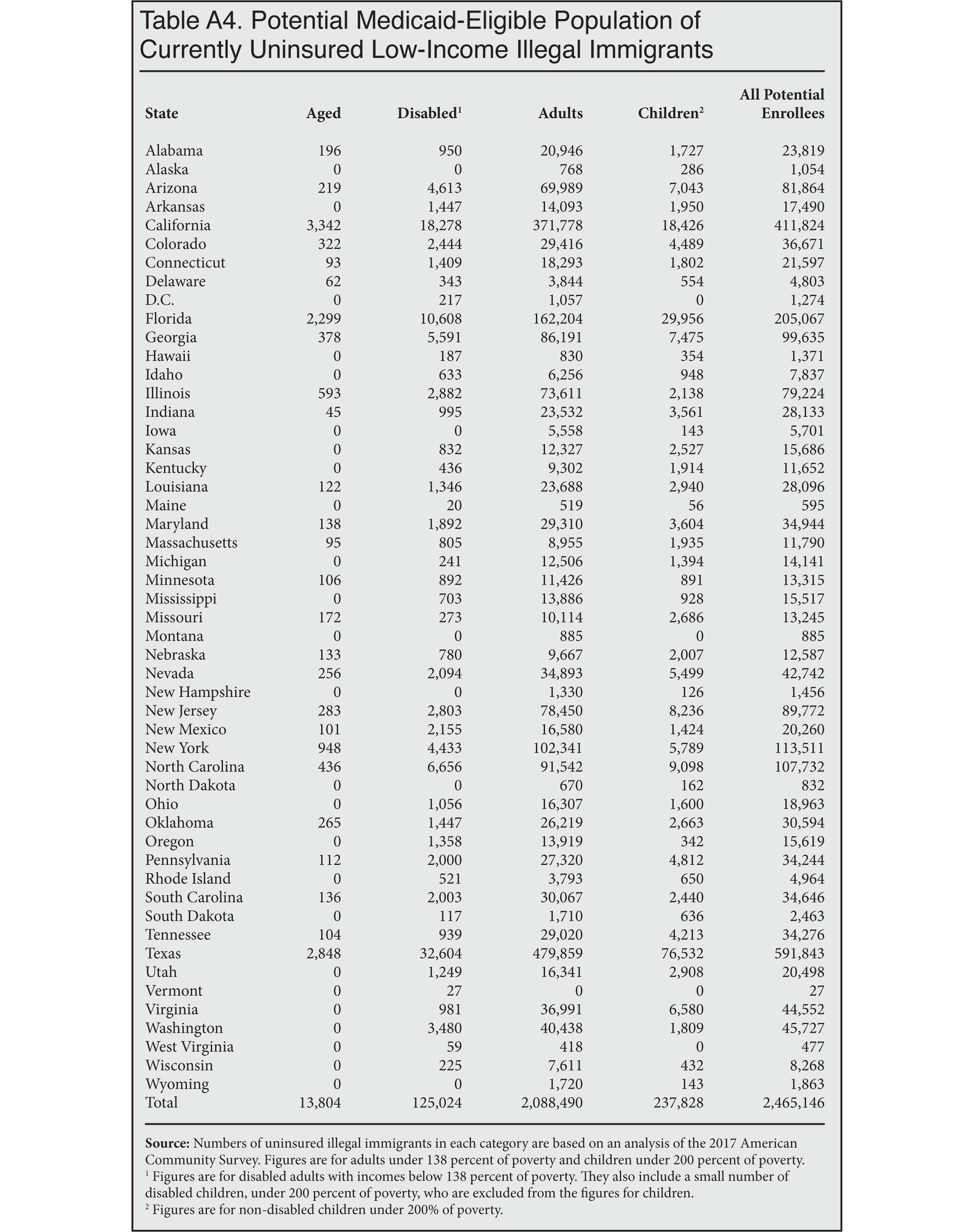

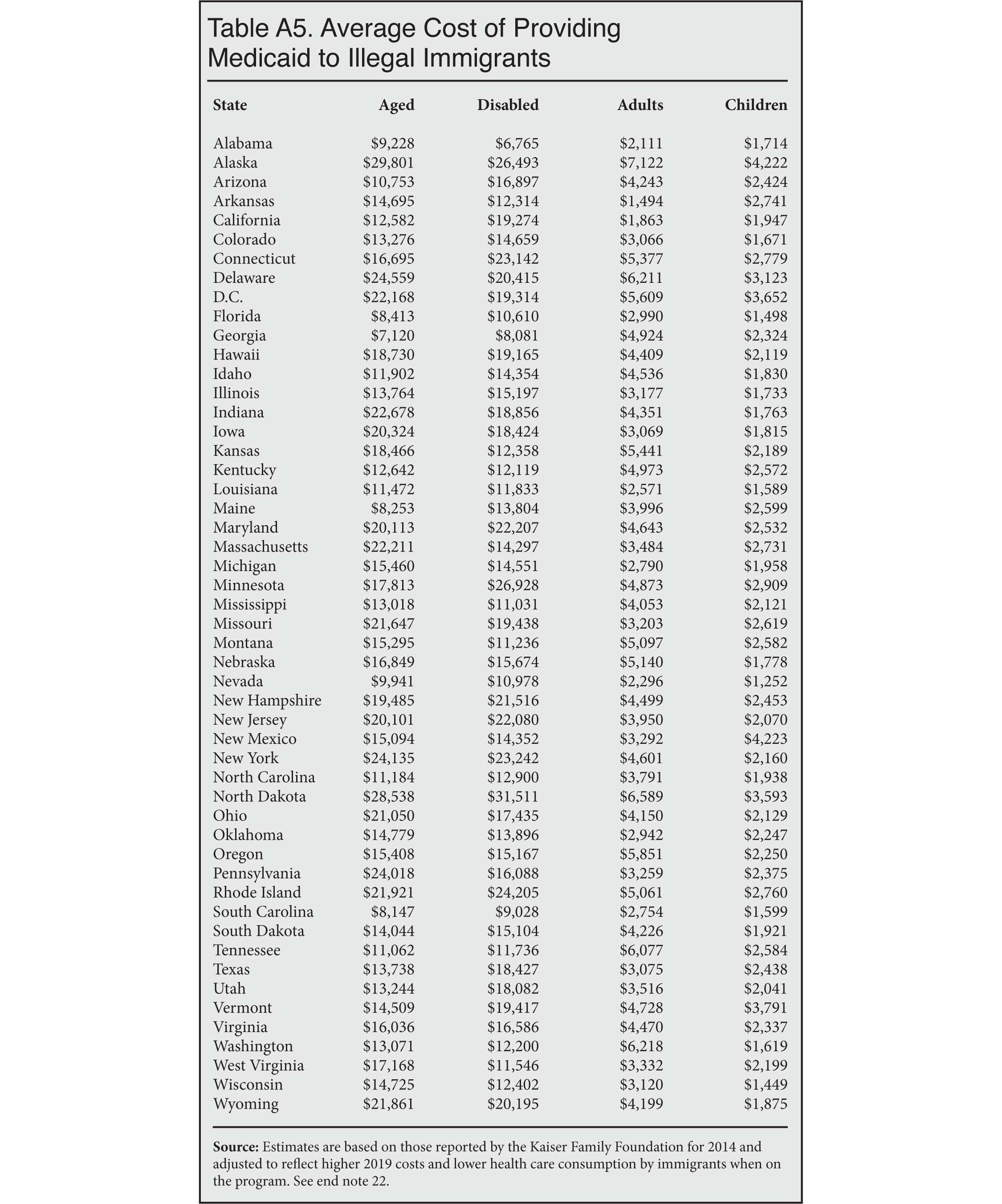

Medicaid by State. To estimate the Medicaid cost, we divide the lowest-income, uninsured illegal immigrants (adults under 138 percent of poverty and children under 200 percent) into four expenditure groups based on their age and disability status using the 2017 ACS — elderly (65 and over), disabled (including disabled children), adults (18 to 64), and children.20 Table A4 reports the number of uninsured illegal immigrants with incomes low enough to receive Medicaid in each category by state. Table A5 reports the estimated per enrollee costs for Medicaid in 2019 in each state.21 The cost figures in Table A5 are adjusted to reflect the tendency of immigrants to use somewhat less in healthcare when on Medicaid than the average person does.22

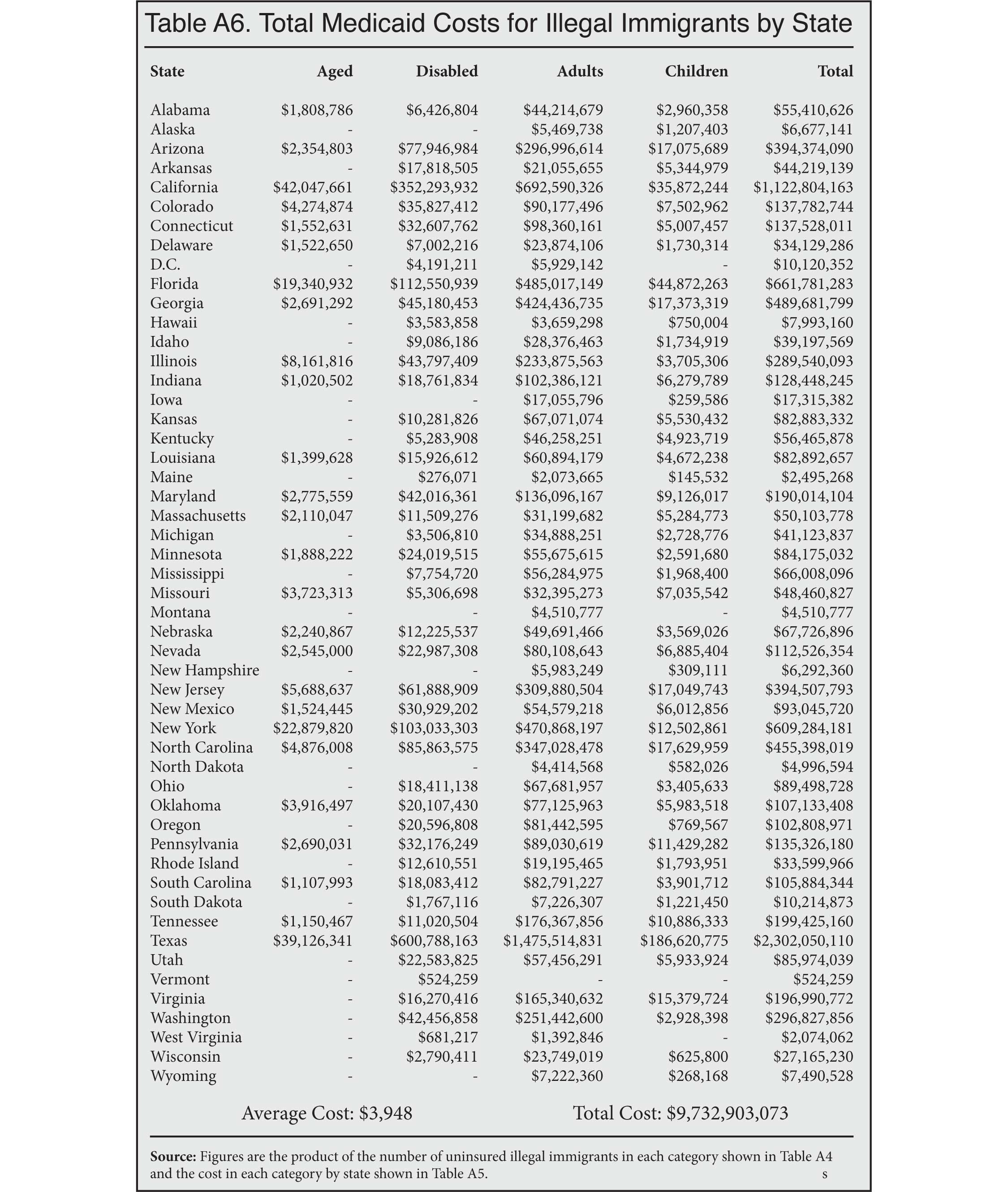

Table A6 takes the number of illegal immigrants in each state that would receive Medicaid by age and expenditure category shown in Table A4 and multiplies it by the average costs in Table A5 for a total cost of $9.7 billion. This would be the cost if all eligible illegal immigrants were enrolled in Medicaid. This compares to an estimated cost of $12.7 billion to provide ACA subsidies to this same population of uninsured illegal immigrants.

The lower Medicaid cost compared to ACA credits partly reflects our assumption that immigrants on Medicaid consume somewhat less in healthcare than the average person in the program. By contrast, ACA subsidies are paid to insurance companies and mostly reflect a person's age and income, not their actual consumption of healthcare. It also may be less burdensome on public coffers to provide Medicaid to the lowest-income illegal immigrants because Medicaid is able to hold down costs by making lower payments to healthcare providers than do private insurers who offer coverage through the exchanges. In fact, the latest analysis by the Congressional Budget Office shows the gap between Medicaid and ACA subsidies is likely to grow.23 However, as we will see, Medicaid is likely to be less costly than ACA credits for the lowest-income illegal immigrants only if we assume 100 percent enrollment rates for both programs.

Cost of Providing Medicaid and ACA Credits Together. The cost of providing ACA subsidies for all illegal immigrants with incomes above the Medicaid eligibility threshold would be an additional $9.9 billion. Adding this to the cost of providing Medicaid ($9.7 billion) creates a total cost of about $19.6 billion annually. Again, this is assuming 100 percent enrollment. This is nearly $3 billion less than the $22.6 billion reported in Table A3 (also Table 1 and Figure 1) as the total cost if all illegal immigrants received ACA subsidies only. The reason for the lower total cost stems entirely from the lower Medicaid cost discussed above.

Likely Use of Medicaid and ACA Subsidies. The rate of Medicaid enrollment differs significantly by state. We use the ACS to estimate enrollment for a surrogate population of low-income Hispanic citizens. We use citizens because we can be assured that they are eligible for Medicaid. Ideally, we would like to use only naturalized Hispanic citizens; however, the sample in the ACA for this population is too small in many states to provide reliable Medicaid use rates. While Medicaid enrollment is quite low in some states, we find that, nationally, 93 percent of children in our surrogate population who live in families with incomes less than 200 percent of poverty are enrolled in the program, as are 70 percent of adults with incomes below 138 percent of poverty.

We apply state Medicaid enrollment rates in each state to the estimated number of illegal immigrants in these age and income groups who would likely use the program. This produces an estimate of the likely share of illegal immigrants in the lowest-income group who would enroll in Medicaid if they were allowed to access the program. Using "likely" enrollment rather than 100 percent enrollment significantly lowers the overall cost of Medicaid from the $9.7 billion reported above (shown in Table A6) to $6.1 billion. Applying the likely ACA enrollment rate of 46 percent to illegal immigrant adults above 138 percent of poverty and children above 200 percent of poverty produces a cost of $4.6 billion for higher-income illegal immigrants who receive ACA subsidies. This creates a total estimated cost of $10.7 billion when assuming likely enrollment rates in the ACA and Medicaid.

Miscellaneous Issues. Although our Medicaid estimates do take into account differences across states, our ACA estimates reflect national averages only. It is possible that illegal immigrants are concentrated in higher- or lower-cost areas.

In Scenario 2, when we calculate the likely usage rates of Medicaid and ACA credits, we do not include any estimated cost for people who are eligible for Medicaid but who instead purchase insurance on one of the exchanges and receive a premium subsidy. We think this number would be quite small, as Medicaid is free, while insurance purchased on the exchanges would require some money from the purchaser.

We do not include any subsidies currently associated with employment-based coverage of illegal immigrants because we are focused on uninsured illegal immigrants.

ACA cost-sharing subsidies are designed to reduce the out-of-pocket (deductibles and co-payments) expenses of those who have incomes below 250 percent of poverty. Insurance companies appear to be charging higher premiums on the exchanges to recoup these costs, which results in larger subsidies.24 Our estimated ACA payments reflect these higher premiums for 2019 and therefore should capture the cost to taxpayers of providing this subsidy.

Finally, we do not take into account possible indirect or second-level effects of providing health insurance to illegal immigrants. The new benefit may, of course, spur additional illegal immigration, which would increase costs, but by how much we cannot say. On the other side of the ledger, adding relatively healthy illegal immigrants to the risk pool might eventually lower the average premium and the corresponding subsidy. But since the sickest illegal immigrants are the most likely to enroll, how illegal immigrants would affect the risk pool in the long run is unknown.

Appendix

|

|

|

|

|

End Notes

1 Ronald Brownstein, "The Democrats' Gamble on Health Care for the Undocumented", The Atlantic, July 11, 2019.

2 Jason Richwine, "The Cost of Immigrant Medicaid Coverage Under Current Policy", Center for Immigration Studies Backgrounder, October 2019.

3 We do not estimate any costs associated with changes in coverage for new legal immigrants, but if illegal immigrants were given access to Medicaid, then the current bar on new legal immigrants using that program would almost certainly be ended.

4 In some cases, a person's income during the year changes significantly, necessitating an adjustment on that year's tax return that increases or decreases the subsidy. This is why the subsidy is referred to as a "credit", even though it typically takes the form of a payment to an insurance company from the federal government.

5 Anyone can use the exchanges to buy insurance and may receive a subsidy if his or her income is low enough. However, if one's employer offers health insurance, that will typically be the cheaper option. Subsidies for low-income buyers on the exchanges are available only if the insurance offered by an employer is not considered affordable based on criteria established by the federal government. Large companies that provide insurance work to make their insurance affordable so that they are not penalized by the government if their workers buy insurance on the exchange. This means that the vast majority of low-income people using the exchange will not have an employer option.

6 See the Methods section for a discussion of the "coverage gap", which at present prevents some of the lowest income individuals from signing up for the ACA when Medicaid is not available.

7 See the bottom of Table 2 in "Federal Subsidies for Health Insurance Coverage for People Under Age 65: Tables from CBO's Spring 2018 Projections", Congressional Budget Office, 2018.

8 "Marketplace Enrollees Receiving Financial Assistance as a Share of the Subsidy-Eligible Population", Henry J. Kaiser Family Foundation, 2019.

9 See the Methods section for a discussion of the "coverage gap", which prevents some people below 100 percent of poverty from signing up for the ACA when Medicaid is not available. Our scenario assumes that if the law is changed to allow illegal immigrants to receive ACA subsidies, it would also eliminate the restriction on access for people below 100 percent of poverty.

10 About half of the illegal population lives in Medicaid expansion states. While Medicaid covers children with incomes below 200 percent of poverty in virtually every state, some states go beyond this threshold and have additional criteria for children. Many also provide extensive coverage to children with incomes above 200 percent of poverty using the SCHIP program. Because SCHIP is a block grant, states would have to be willing to take funding from citizens to extend coverage to illegal immigrants, and this seems unlikely. To simplify our analysis, we assume a 200 percent of poverty threshold for Medicaid eligibility for every state, though this assumption may tend to slightly reduce the Medicaid population. As less than 10 percent of illegal immigrants are children, this assumption has only a small impact on the estimates.

11 "State-Level Unauthorized Population and Eligible-to-Naturalize Estimates", Center for Migration Studies, undated.

12 To calculate these payments, we assume the middle poverty level for each poverty range and apply the average age in each cell of the table. (We found that alternative age groupings did not significantly change our findings.) We then rely on the average ACA subsidy as shown in the Health Insurance Marketplace Calculator provided by the Kaiser Family Foundation. Kaiser states that its calculated premiums are "obtained through data published by HHS, data received from Massachusetts Health Connector, and data published by HIX Compare from the Robert Wood Johnson Foundation." The figures are based on the second-lowest cost silver plan premium, which is the benchmark used to determine the size of the subsidy. While we believe this estimate provides a good picture of the likely size of the ACA subsidies illegal immigrants would receive, the primary weakness of this approach is that it is not adjusted for local differences in the cost of insurance.

13 See the bottom of Table 2 in "Federal Subsidies for Health Insurance Coverage for People Under Age 65: Tables from CBO's Spring 2018 Projections", Congressional Budget Office, 2018.

14 Steven Ross Johnson, "Study finds immigrants use fewer U.S. healthcare resources", Modern Healthcare, August 8, 2018.

15 The Kaiser Family Foundation has estimated this issue impacts some 2.5 million individuals. See Rachel Garfield, Kendal Orgera, and Anthony Damico, "The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand Medicaid", Kaiser Family Foundation, March 21, 2019.

16 This means that, unlike other U.S. residents, the coverage gap does not impact new legal immigrants. This is a rare example of immigrants being eligible for a public benefit that citizens are denied. See 42 U.S.C. § 18051(e)(1)(B).

17 "Marketplace Enrollees Receiving Financial Assistance as a Share of the Subsidy-Eligible Population", Henry J. Kaiser Family Foundation, 2019.

18 Sara R. Collins, Munira Z. Gunja, and Michelle M. Doty, "Following the ACA Repeal-and-Replace Effort, Where Does the U.S. Stand on Insurance Coverage?", Commonwealth Fund, September 2017.

19 ACA enrollment rates tend to vary significantly between Medicaid expansion vs. non-expansion states. Since uninsured illegal immigrants are split roughly evenly between expansion and non-expansion states, using a single figure of 46 percent should provide a reasonable estimate of likely ACA enrollment.

20 The American Community Survey includes a person's age and asks six questions to determine if someone is disabled. We estimate there are only about 125,000 disabled illegal immigrants uninsured with incomes below 138 percent of poverty or (if disabled children) under 200 percent of poverty. The disabled represent just 5 percent of all low-income uninsured illegal immigrants. We also estimate that less than 1 percent of low-income uninsured illegal immigrants are age 65 or older.

21 To create these estimates we use the 2014 costs reported by the Kaiser Family Foundation for each category by state. More recent state data by category is not available. We adjust the 2014 value up by 11.1 percent to reflect increases in Medicaid expenditures per enrollee through 2019. See "Medicaid per Person Spending: Historical and Projected Trends Compared to Growth Factors in per Capita Cap Proposals", Medicaid and CHIP Payment and Access Commission, June 2017.

22 We use Hispanic immigrants in the 2016 Medical Expenditure Panel Survey (MEPS) who report they are on Medicaid as a proxy for illegal immigrants who might enroll in the program. Hispanic immigrants 65 and older use 104 percent more than the average person of that age on Medicaid; however, disabled Hispanic immigrants use only 84 percent of the average disabled Medicaid recipient; adults (18 to 64) use 93 percent as much as the average person in that group; and children 74 percent as much. Since the vast majority of illegal immigrants are non-disabled adults between the ages of 18 and 64, these adjustments reduce the average cost of providing Medicaid to low-income illegal immigrants. Less than 6 percent of uninsured illegal immigrants who would be eligible for Medicaid based on their income are either disabled or elderly, which are the two most costly groups. This further reduces the cost of providing healthcare to illegal immigrants compared to the general Medicaid population. Less than 1 percent of Medicaid income-eligible illegal immigrants are 65 or older. Some fraction of this small population might receive Medicare instead of Medicaid, but we do not have a way to estimate this.

23 See "Federal Subsidies for Health Insurance Coverage for People Under Age 65: Tables from CBO's Spring 2018 Projections", Congressional Budget Office, 2018; and Susannah Luthi, "ACA subsidies cost more per person than Medicaid. Is that sustainable?", Modern Healthcare, August 8, 2018.

24 This is the so-called practice of "silver loading", which means that insurance companies charge more for the benchmark plans that determine their payment from the federal government. See Stan Dorn, "Silver Linings For Silver Loading", Health Affairs, June 3, 2019.