Analysis by the Center for Immigration Studies of the latest data (2018) from the Census Bureau's Survey of Income and Program Participation (SIPP) shows that welfare use by households headed by immigrants remains high relative to the native-born. The desire to reduce welfare among future immigrants was the primary justification for “public charge” rules issued by the Trump administration that have now been abandoned by the Biden administration. Immigrant advocacy groups were right that many immigrants make heavy use of the welfare system, and the proposed rules might have impacted the ability of some prospective immigrants to receive green cards. The latest SIPP data from 2018 shows immigrant households continue to use welfare at higher rates than native households, though use rates for both groups were lower in 2018 than when we last looked at the data using the 2014 data. In this blog, we use the term “immigrant” to mean the “foreign-born”, which includes all those currently in the country who were not U.S. citizens at birth.

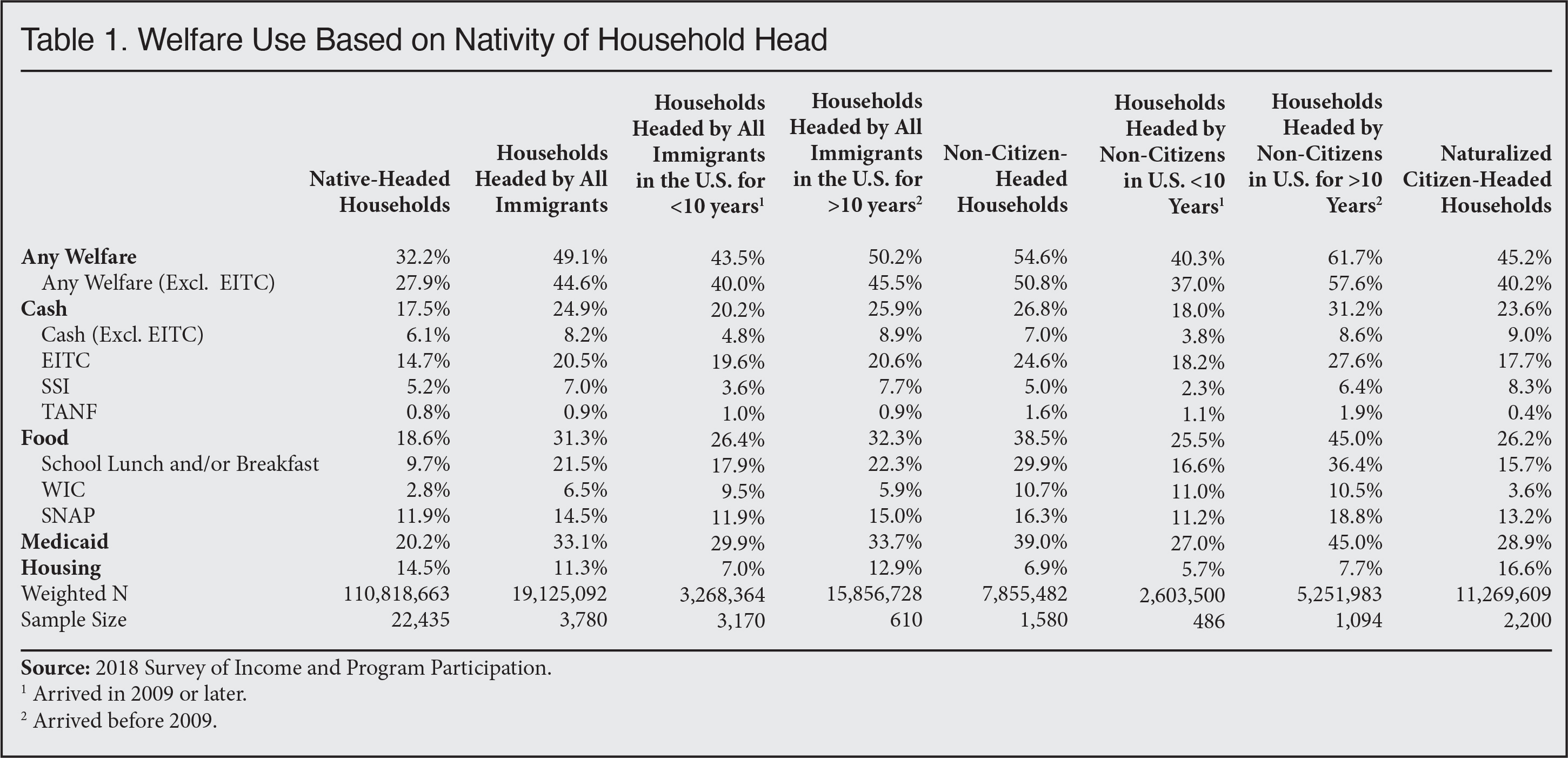

- In 2018, 49 percent of households headed by all immigrants — naturalized citizens, legal residents, and illegal immigrants — used at least one major welfare program, compared to 32 percent of households headed by the native-born.

- Among households headed by non-citizens, 55 percent used at least one welfare program. Non-citizens in the SIPP include those in the country legally (e.g. green card holders) and those in the country illegally.

- Welfare use dropped somewhat to 45 percent for all immigrant households and to 51 percent for non-citizen households if cash payments from the Earned Income Tax Credit (EITC) are not counted as welfare. This compares to 28 percent for native households excluding the EITC. EITC recipients pay no federal income tax and, like other welfare, it is a means-tested, anti-poverty program, but unlike other programs one has to work to receive it.

- Compared to native households, immigrant-headed households had especially high use of Medicaid (33 percent vs. 20 percent for natives) and food programs (31 percent vs. 19 percent for natives).

- At 39 percent, non-citizen households’ receipt of both Medicaid and food programs was even higher than for all immigrants and much higher than for the native-born.

- Including the EITC, 25 percent of all immigrant-headed households and 27 percent of non-citizen-headed households received cash welfare, compared to 18 percent of native households. If the EITC is not included, then cash receipt by all immigrant and non-citizen households was only slightly higher than that of the native-born.

- Welfare use is high for both newly arrived immigrants and long-time U.S. residents. Of households headed by an immigrant who had lived in the United States for 10 years or less, 44 percent used at least one program. Of those in the country more than 10 years, 50 percent accessed one or more programs.

- Among households headed by a non-citizen who had lived in the United States for 10 years or less, 40 percent used at least one major program and for those in the country more than 10 years it was 62 percent.

- While most new legal immigrants (green card holders) are barred from most welfare programs, as are illegal immigrants and temporary visitors, these restrictions have only a modest impact on immigrant household use rates primarily because non-citizens (including illegal immigrants) can receive benefits on behalf of their U.S.-born children who are awarded U.S. citizenship and full welfare eligibility at birth.

- Other factors that tend to lessen the effectiveness of restrictions on immigrant welfare use include: 1) the bar does not apply to all programs, nor does it always apply to non-citizen children; 2) most legal immigrants have been in the country long enough to qualify for most programs; 3) naturalized citizens have the same welfare eligibility as the native-born; and 4) some states provide welfare to otherwise ineligible immigrants on their own.

- Trying to bar immigrants once they are in the country from accessing welfare is unlikely to be effective. If we wish to avoid high use of welfare by future immigrants, then moving away from the current family-based system to one that selects immigrants who are less likely to use such programs would be more effective. For example, welfare use by immigrants varies significantly by educational attainment, so placing more emphasis on education and skills as selection criteria for prospective immigrants would almost certainly reduce future immigrant welfare use.

- As we made clear in our prior analyses (here and here), most households (immigrant- or native-headed) accessing the welfare system have at least one worker present. But, often because of their lower levels of education, immigrants tend to earn lower wages, making a large share eligible to receive means-tested programs.

Methods

Programs Examined. The major welfare programs examined in this report are Supplemental Security Income (SSI), Temporary Assistance to Needy Families (TANF), the Earned Income Tax Credit (EITC), the Women, Infants, and Children (WIC) food program, free or subsidized school breakfast and lunch, food stamps (officially called the Supplemental Nutrition Assistance Program or SNAP), Medicaid, public housing, and rent subsidies. Relatively modest general assistance programs run by states are also included in the overall welfare use rates and when all cash assistance is examined, but are not reported separately.

Data Source. Data for this analysis comes from the public-use file of the 2018 Survey of Income and Program Participation (SIPP), which is the newest SIPP data available. The SIPP is a longitudinal dataset consisting of a series of "panels". Each panel is a nationally representative sample of U.S. households that is followed over several years. Like all Census surveys of this kind, welfare use is based on self-reporting, and as such there is some misreporting in the survey. All means and percentages are calculated using weights provided by the Census Bureau.

Why Use the SIPP? The SIPP is ideally suited for studying welfare programs because, unlike other Census surveys that measure welfare, the SIPP was specifically designed for this purpose. As the Census Bureau states on its website, the purpose of the SIPP is to "provide accurate and comprehensive information about the income and program participation of individuals and households." While there are other government surveys that ask about welfare use, the SIPP is only survey that is specifically designed to measure program use and it includes as many programs as were discussed in our prior analysis. The survey is thought to better capture welfare use. There is no question that the SIPP does capture a large share of illegal immigrants. Other researchers and analysts have used the data as a basis to estimate the illegal population in the United States.

Examining Welfare Use by Household. A large body of prior research has examined welfare use and the fiscal impact of immigrants by looking at households because it makes the most sense. The National Research Council did so in its fiscal estimates in 1997 because it argued that "the household is the primary unit through which public services are consumed." In their fiscal study of New Jersey, Deborah Garvey and Thomas Espenshade also used households as the unit of analysis because "households come closer to approximating a functioning socioeconomic unit of mutual exchange and support." Other analyses of welfare use and programs, including one by the U.S. Census Bureau, have also used the household as the basis for studying welfare use. The late Julian Simon of the Cato Institute, a strong immigration advocate, pointed out that, "One important reason for not focusing on individuals is that it is on the basis of family needs that public welfare, Aid to Families with Dependent Children (AFDC), and similar transfers are received."

The primary reason researchers have not looked at individuals is that, as Simon pointed out, eligibility for welfare programs is typically based on the income of all family or household members. Moreover, welfare benefits can often be consumed by all members of the household, such as food purchased with food stamps. Also, if the government provides food or health insurance to children, it creates a clear benefit to adult members of the household who will not have to spend money on these things. In addition, some of the welfare use variables in the SIPP are reported at the household level, not the individual level.

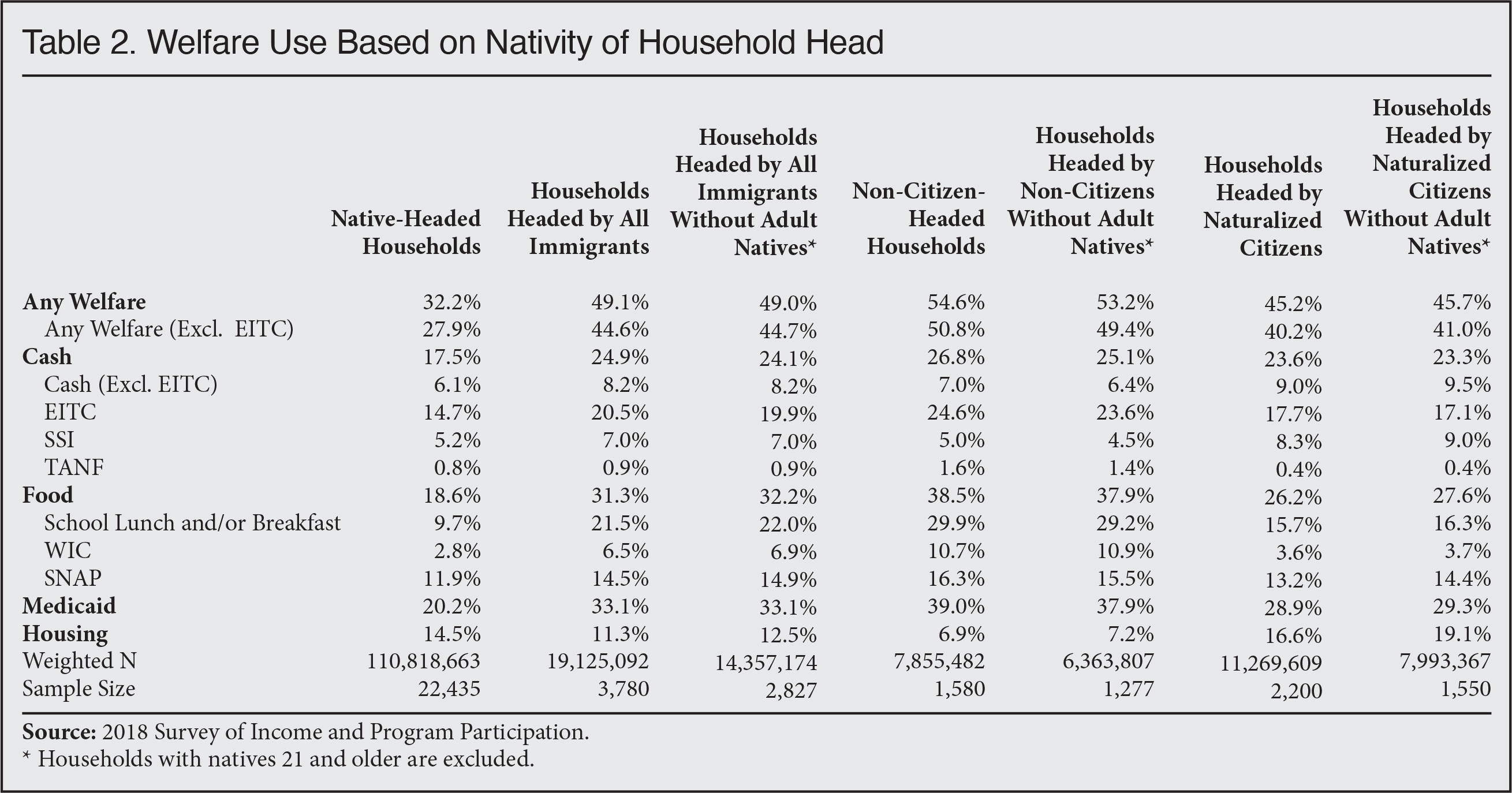

Some advocates for expansive immigration argue that household comparisons are unfair or biased against immigrants because someday children who receive welfare may possibly pay back the costs of these programs in taxes as adults. Of course, the same argument could be made for the children of natives to whom immigrants are compared in this analysis. Moreover, excluding children obscures the fundamental issue that a very large share of immigrants are unable to support their own children and turn to taxpayer-funded means-tested programs. In terms of the policy debate over immigration and the implications for public coffers, this is the central concern. It is also sometimes suggested that a significant share of welfare use by immigrant households reflects the presence of adult natives, typically spouses of immigrants. But as Table 2 shows, when adult natives are excluded from immigrant households, it has very little impact on the welfare use rates of households headed by immigrants.

|

|