Download a PDF of this Backgrounder.

Steven A. Camarota is the director of research at the Center for Immigration Studies.

The findings of this analysis show that the average cost of a deportation is much smaller than the net fiscal drain created by the average illegal immigrant. Immigration and Customs Enforcement (ICE) reported the average deportation cost as $10,854 in FY 2016. In FY 2012, ICE removed 71 percent more aliens with a similar budget, creating an average inflation-adjusted cost of $5,915. This compares to an average lifetime net fiscal drain (taxes paid minus services used) of $65,292 for each illegal immigrant, excluding their descendants. This net figure is based on fiscal estimates of immigrants by education level from the National Academies of Sciences, Engineering, and Medicine (NAS).1 The total fiscal drain for the entire illegal population is estimated at $746.3 billion. Of course, simply because deportation is much less costly than allowing illegal immigrants to stay does not settle the policy questions surrounding illegal immigration as there are many factors to consider.

Deportation costs:

- In April of this year, ICE reported that the average cost of a deportation, also referred to as a removal, was $10,854 in FY 2016, including apprehension, detention, and processing.

- Partly due to policies adopted in the second term of the Obama administration, ICE removed nearly 170,000 fewer aliens in 2016 than in 2012, even though it actually spent 8 percent more in 2016 in inflation-adjusted dollars. The removal of so many more illegal immigrants in FY 2012 means that the average cost per removal in that year was $5,915, adjusted for inflation.

- If the average cost of a deportation was what it had been in FY 2012, then the larger enforcement budget in FY 2016 would have allowed for 200,000 more removals without spending additional money.

Costs of illegal immigrants:

- Researchers agree that illegal immigrants overwhelmingly have modest levels of education — most have not completed high school or have only a high school education. There is also agreement that immigrants with this level of education are a significant net fiscal drain, creating more in costs for government than they pay in taxes.

- The NAS estimated the lifetime fiscal impact (taxes paid minus services used) of immigrants based on their educational attainment. Averaging those estimates and applying them to the education level of illegal immigrants shows a net fiscal drain of $65,292 per illegal — excluding any costs for their children.2

- Based on this estimate, there is a total lifetime fiscal drain of $746.3 billion. This assumes 11.43 million illegal immigrants are in the country based on the U.S. government's most recent estimate.

- The fiscal cost created by illegal immigrants of $746.3 billion compares to total a cost of deportation of $124.1 billion, assuming a FY 2016 cost per deportation, or $67.6 billion using FY 2012 deportation costs.

Important caveats about these estimates:

- The NAS projects future fiscal impacts. A significant share of the current illegal population are not recent arrivals, so some of the net burden they create has already been incurred. We estimate that one-fifth ($13,058) of the average fiscal deficit the current population of illegal immigrants creates has already been incurred by taxpayers.

- The above cost estimates are only for the original illegal immigrant, and exclude descendants. Using the NAS net cost estimates for the descendants adds $16,998 to the net fiscal drain.

- ICE's estimate for deportation costs does not include the costs of the immigration courts run by the Department of Justice. Dividing the court's budget in 2016 by the number deportations adds $1,749 to the average cost of a removal and $770 to the 2012 cost, in 2016 dollars.

- To create its long-term fiscal estimates, the NAS uses the concept of "net present value" (NPV), which is commonly used by economists. This approach has the effect of reducing the size of the net fiscal drain that unskilled immigrants create because costs or benefits years from now are valued less relative to more immediate costs. If the NPV concept is not used, the actual net lifetime fiscal cost of illegal immigrants is likely $120,000 to $130,000 per illegal alien, or between $1.4 and $1.5 trillion for the entire illegal alien population, excluding descendants.

Introduction

One argument made by opponents of immigration enforcement is that it would be prohibitively expensive to deport all illegal immigrants, so we have to amnesty them.3 Advocates of enforcement argue this is a false choice as it is not necessary to deport all or even most illegal immigrants. Rather, actually enforcing immigration laws would cause many illegal immigrants to return to their home countries on their own.4 It would also discourage new illegal immigrants from coming. Nonetheless, the cost of deportations vs. allowing illegal immigrants to stay is still an important question.

To answer that question, this analysis takes the cost that Immigration and Custom Enforcement (ICE) estimates for the average deportation and compares it to the lifetime fiscal impact of the average illegal immigrant. We estimate two different deportation costs because ICE's immigration enforcement budgets have been relatively stable in recent years, but the number of deportations has varied considerably, creating very different average deportation costs. To calculate the net fiscal impact of the average illegal immigrant, we take their likely education levels and apply fiscal estimates (taxes paid minus costs) developed by the NAS for immigrants by education level. Our findings show that deportation is much less costly than allowing illegal immigrants to stay. Of course, fiscal impacts are not the only consideration when weighting the various policy options.

Methodology

The Costs of Alien Removal

ICE's Costs per Removal. Determining how much it costs to deport, or more accurately formally remove, a non-citizen from the United States is not as straightforward a question as it might seem because ICE has multiple missions and legal responsibilities. Much of what ICE does has nothing to do with immigration, such as countering the smuggling of drugs and contraband across the border; stopping the illegal export of sensitive technology; stopping weapons trafficking; preventing the production and sale of child pornography via the internet; and intercepting stolen art and antiques. In short, the budget of ICE is not a budget solely for immigration enforcement.

In April 2017, ICE estimated that the average cost per deportation was $10,854 in FY 2016. This figure includes "all costs necessary to identify, apprehend, detain, process through immigration court, and remove an alien."5 Based on this description, the estimate seems comprehensive, including the costs for both Enforcement and Removal Operations (ERO), which does most of the immigration removal work, and the legal division, which provides the trial attorneys who prosecute removal cases via the Office of the Professional Legal Advisor (OPLA). These two entities comprise the overwhelming share of spending on removals.

One complicating factor when considering enforcement costs is the number of removals. ICE removed only 240,255 aliens in FY 2016 compared to 409,849 in FY 2012.6 However, the ICE enforcement budget in 2016 was actually 7.62 percent larger than in 2012, adjusted for inflation. Yet they removed about 70.59 percent more people in 2012 than in 2016.7 Based on these numbers, the average cost of a deportation in 2012 was equal to only 54.5 percent of the per-removal cost in 2016.8 Using ICE's per-removal cost figure for 2016 gives an inflation-adjusted cost per removal in 2012 of $5,915 ($10,854 * 54.5 percent).9 If costs were what they had been in 2012, adjusted for inflation, then about 200,000 more aliens could have been removed for the same amount of money in 2016.

The Immigration Courts. Based on the description provided by ICE, the estimated removal costs do not include expenditures for the Executive Office for Immigration Review (EOIR), which is part of the Department of Justice.10 Though it has a few other responsibilities, the overwhelming share of EOIR's workload is for removals. In FY 2016, EOIR's budget was $420.3 million and there were 240,255 removals in that year, which would mean that EOIR's cost per removal was $1,749.11 In 2012, EIOR's budget was $315,389,590 (in 2016 dollars). If we divide this by the number of deportations in 2012, the per-capita court costs were $770.

Declining Number of Removals. It is certainly possible to remove significantly more people with the current budget. The government actually did so in 2012. If enforcement was stepped up it seems almost certain that the lower cost per removal would continue, provided that policies continue to encourage enforcement operations rather than discourage them. During the second term of the Obama administration, policies prohibiting agents from arresting aliens became increasingly stringent. A recent GAO report found that the backlog of pending cases that are carried over from the prior year in immigration court more than doubled between 2006 and 2015.12

In his analysis of the GAO report, former immigration judge Andrew R. Arthur explains that several factors have caused the pace of deportations to slow.13 In addition to ICE arresting fewer aliens, the number of continuances granted by the courts has ballooned and, as a consequence, the number of cases completed by the courts has declined. One of the biggest reasons for the recent slowdown in removals is the priorities of the Obama administration, including the decision to admit so many unaccompanied minors at the border and the burden on the courts resulting from the Deferred Action for Childhood Arrivals (DACA) program.

The Trump administration has curtailed some of these policies. Moreover, the number of arrests by ICE has increased substantially in the first few months of the new administration even though the administration has yet to implement the president's directive to increase the ERO agent corps.14 The increase in arrests certainly demonstrates that the enforcement capacity of ICE, given its current staffing levels, allows for a much greater level of activity than was seen in Obama's second term. It remains to be seen if the number of removals returns to the same level as 2012. However, if the costs of deportation were what they had been in 2012 then the somewhat larger enforcement budget in 2016 would have allowed for the removal of at least 200,000 more aliens with the same budget.

The Cost of Illegal Immigration

Estimating the Costs of Illegal Immigrants. There is a good deal of agreement among researchers that the education level of immigrants is a key factor in determining their net fiscal impact. As a recent study by the NAS states, the education level of arriving immigrants is one of the "important determinants" of their fiscal impact.15 This finding is similar to a 1997 study by NAS that also examined the fiscal impact of immigrants.16 This conclusion also is mirrored by a 2013 study from the Heritage Foundation.17 Referring to the education level of household heads, Heritage concluded that, "Well-educated households tend to be net tax contributors." But at the same time, "Poorly educated households, whether immigrant or U.S.-born, receive far more in government benefits than they pay in taxes." My own research has come to the same conclusion.18 The reason for this is straightforward: Those with modest levels of education tend to earn low wages in the modern American economy, and as a result tend to make low tax payments and often qualify for means-tested programs. The less-educated are a net fiscal drain, on average, regardless of legal status or if they were born in the United States or a foreign country.

Education Levels of Illegal Immigrants. In terms of the educational attainment of illegal immigrants, there is a good deal of evidence that they have modest levels of education, much lower than native-born Americans or legal immigrants. The Heritage Foundation study cited above estimated that, on average, illegal immigrants have 10 years of schooling. In an earlier analysis by the Center for Immigration Studies of illegal immigrants based on 2011 Census Bureau data, we found that 54 percent of adults have not completed high school, 25 percent have only a high school degree, and 21 percent have education beyond high school.19 The Pew Research Center estimated that 47 percent of all illegal immigrants have not completed high school, 27 percent have only a high school education, 10 percent have some college, and 15 percent have a bachelor's or more.20

We have updated our prior estimate from 2011 for adult illegal immigrants using a combined sample from the 2014 and 2015 Current Population Surveys. We find that adult illegal immigrants have become somewhat more educated since 2011, but the vast majority still have very modest levels of education. Our best estimate is that 49 percent have not graduated high school, 28 percent have only a high school education, 11 percent have some college, 9 percent a bachelor's degree, and 3 percent have a graduate degree.

It is also worth noting that illegal immigrants overall are significantly more educated than we reported in an earlier analysis, which focused only on illegal border-crossers.21 Illegal crossers tend to be the least-educated component of illegal immigration because more educated foreign nationals wishing to come to the United States can often qualify for temporary visas, which they can then overstay.22 The focus of this analysis is the overall illegal immigrant population, which includes both visa overstayers and illegal border-crossers. Even though illegal immigrants overall are more educated than illegal border-crossers and illegal immigrants have become more educated over time, as a group they remain much less educated than the native-born or legal immigrants.

Fiscal Impact by Education Level. The 2016 NAS study mentioned above projected the lifetime fiscal impact (taxes paid minus services used) of immigrants by education. These estimates are expressed as a net present value (NPV). This is a concept used in fiscal studies, and in other contexts, to express the sum total of costs or benefits over long periods of time — in this case a lifetime. NPV represents the fiscal balance (taxes paid minus costs) if we had to spend the money today. Costs or benefits in the future are discounted or reduced based on how long from now they occur. Later in this report, we discuss in more detail the concept of net present value, both its usefulness and it shortcomings.

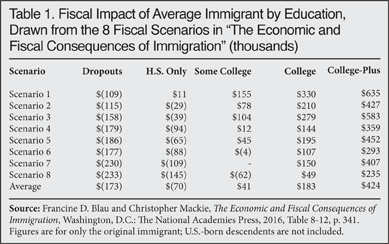

The NAS study does not report separate estimates for illegal and legal immigrants. Rather, it simply estimates tax payments and expenditures on immigrants as they appear in Census Bureau data, primarily the Current Population Survey Annual Social and Economic Supplement. As a result, the estimates from the NAS are for both legal and illegal immigrants by education. The NAS fiscal projections include eight different scenarios, each with different assumptions about future spending, tax rates, and the future flow of immigrants. It is not entirely clear what set of fiscal assumptions are best, and the NAS study itself does not identify the one best scenario. In Table 1 we simply take all 8 scenarios and average them together by education level.

It should be pointed out that in every scenario from the NAS, as shown in Table 1, immigrants without a high school education are a significant net fiscal drain during their lifetimes. That is, they pay less in taxes than they use in services. Those with only a high school education are a net fiscal drain in seven of the eight scenarios. In contrast, the most educated immigrants, those with at least a bachelor's degree, are a net fiscal benefit in all eight scenarios. This is very important because the vast majority of adult illegal immigrants in the country lack a high school diploma or have only a high school education.

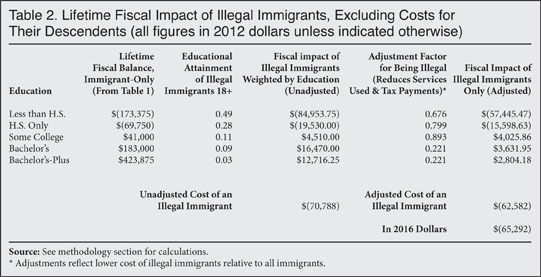

Calculating the Fiscal Impact of Illegal Immigrants. The first column of Table 2 reports the average fiscal effect of immigrants by education level, taken directly from the bottom of Table 1. Column 2 shows the education level of illegal immigrants in the country as discussed above. Column 3 multiplies the average cost by the share of illegal immigrants who fall into that educational category and the bottom of column 3 adds up the costs to give a weighted average. This means that, using the NAS average fiscal costs of immigrants by education and assuming the educational distribution of illegal immigrants shown in the table, the average lifetime fiscal drain is $70,788 per immigrant. However, for reasons discussed below we think this figure overstates the net fiscal costs.

As already mentioned, the NAS fiscal analysis is for immigrants overall — both legal and illegal. Although illegal immigrants do access some welfare programs and create other significant costs, it should still be the case that less-educated illegal immigrants create smaller net fiscal costs than less-educated legal immigrants. Unfortunately, the NAS study has very little discussion of how legal and illegal immigrants differ in their fiscal impact. The study does state on page 280 that, "unauthorized immigrants as a group may have a more positive fiscal impact than authorized immigrants." (Emphasis added.) We agree with their tentative conclusion and so we adjust downward the fiscal drain created by less-educated illegal immigrants relative to illegal immigrants.

To estimate the adjustment factor, we use the Heritage Foundation study mentioned above. That study has estimates for immigrants by education and legal status.23 Adjusting has the effect of reducing the fiscal costs for less-educated illegal immigrants, but it also reduces the fiscal benefits for immigrants who are more educated.24 Since highly educated illegal immigrants make up only a small share of all illegal immigrants, adjusting downward their positive fiscal impact has only a modest impact on the fiscal estimates. The right lower corner of Table 2 shows that the fiscal cost of an illegal immigrant once we include the adjustment is $62,582. Adjusting reduces the fiscal cost by $8,205. There is also the issue of inflation. The NAS fiscal estimates are reported in 2012 dollars. If we convert them to 2016 dollars so that they match the ICE 2016 deportation cost estimate, then the net lifetime fiscal drain of illegal immigrants would be $ $65,292.

One way to think about the above estimates is that for every million illegal immigrants in the country there is a lifetime fiscal drain of $65.3 billion on public coffers. If we assume there are 11.43 million illegal immigrants in the country, then the total fiscal costs they create during their lifetimes using the net present value concept is $746.3 billion.25 In short, the savings associated with removing or causing even a modest fraction of the 11 to 12 million illegal immigrants in the country to return home would be significant.

Costs Already Borne. The NAS fiscal estimates are for newly arrived immigrants during their lifetimes projected forward. Since this analysis is concerned with the existing population of illegal immigrants, some share of the net fiscal costs they create has already been incurred. Based on the age of the illegal population and their time already in the United States, we estimate that one-fifth of their costs have already been incurred. If correct, the remaining fiscal costs of illegal immigrants on average are $52,234 ($65,292 * .80).26 While the full cost of illegal immigrants is important, when considering deportation costs relative to fiscal costs, the remaining fiscal impact of allowing illegal immigrants to remain is also an important comparison.

Do Net Present Values Make Sense? The concept of net present value employed by the NAS study reduces or "discounts" costs or benefits in the future based on how long in the future they take place. Page 325 of the NAS study states that they used a 3 percent annual discount rate, which is common in this kind of analysis. So, for example, the fiscal balance (whether a net drain or benefit) an immigrant creates two years after arrival is reduced by about 6 percent. After 10 years, the amount is reduced by about 26 percent and at 20 years the discount is 45 percent. This means events that occur further in the future have a smaller impact on the total cost or benefit. Comparing the net present value fiscal costs illegal immigrants create to the costs of removal can be seen as reasonable because a removal has to be paid for up front while the fiscal drain accrues over time. By using a NPV it makes the costs of removal comparable to the lifetime costs illegal immigrants create.

The primary disadvantage of using NPV for fiscal estimates is that it masks the actual size of future outlays created by less-educated illegal immigrants. For example, using a 3 percent annual discount rate, as the NAS study does, means that if an illegal immigrant creates a net fiscal burden of $10,000 in the 23rd year of the projection, only about half of this amount will be added to the total NPV. Without discounting, the actual outlays associated with illegal immigrants are much larger. If the NPV concept is not used, the actual net lifetime fiscal cost of illegal immigrants is likely $120,000 to $130,000 per illegal alien, or between $1.4 and $1.5 trillion for the entire illegal population, again assuming 11.43 million illegal immigrants are in the country.

Making Different Assumptions

Including Descendants. There are four key variables in the above calculations that potentially impact the results. The first is whether to include the children of illegal immigrants. Many of the descendants of less-educated immigrants struggle, often earning low wages themselves and making use of welfare programs and other public services. If we use the NAS study's estimates that include the progeny of immigrants, it adds $16,998 (in 2016 dollars) to the net fiscal drain, raising the total for the average illegal immigrant to $82,290. If we assume 11.43 million illegal immigrants are in the country, then the total cost of illegal immigrants and their descendants would be $940.6 billion. If the concept of net present value is not used, then the costs for illegal immigrants and their children would approach $2 trillion. But the tax payments and costs created by the descendants of immigrants in the NAS study go out 75 years. Projections of this length involve significant uncertainty.

Impact of Different Fiscal Assumptions. The second question is which fiscal scenario from the NAS study to use. (All of the scenarios are shown in Table 1 of this report.) Scenario 1 makes assumptions that are most favorable to the fiscal impact of immigrants. If we use only this scenario, then the net fiscal costs created by the average illegal immigrant drop significantly, to $8,018 in 2016 dollars. This is somewhat less than deportation costs in 2016 and somewhat more than the cost in 2012. But this scenario assumes federal spending will not conform to historical patterns and, instead, that spending will be lower and tax payments higher in the future. Further, this scenario assumes away costs for public goods, interest payments on the national debt, and other expenses. All of this seems extremely optimistic. On the other hand, scenario 8, which makes the most pessimistic assumptions about the future, shows a net fiscal impact for each illegal immigrant of $118,091 in 2016 dollars. Averaging out all the scenarios, as we do, reduces the impact of extreme assumptions and provides a realistic assessment of the likely future fiscal impact of illegal immigrants. The fiscal drain varies significantly depending on which scenario is used, but seven out of eight scenarios show a large negative lifetime fiscal impact for the average illegal immigrant.

Illegal Immigrant Education Level. The third key assumption in our estimates is the education level of illegal immigrants. As already discussed, there is widespread agreement that illegal immigrants are a relatively unskilled population. If we assume that illegal immigrants are as educated as Pew estimated, the average fiscal cost would still be very large — $60,280 in 2016 dollars. This is very similar to our estimate of $65,295. Again, Pew's figures show that about three-quarters of illegal immigrants have less than a high school education or only a high school education, and this makes them a large fiscal drain.

Legal vs. Illegal Immigrants. Finally, there is the question of the difference between the net fiscal impact of all immigrants (legal and illegal) by education level, which is what the NAS estimated, and the fiscal impact of illegal border-crossers. In Table 2 we adjust the fiscal impact of illegal immigrants significantly, reducing the costs of illegal immigrants relative to immigrants of the same education by almost 12 percent, or $8,205. If we instead used a larger discount of 50 percent for all educational categories, the net fiscal costs of illegal immigrants would still be $36,926 in 2016 dollars. Under a 50 percent reduction, every one million illegal immigrants would still create a net fiscal drain of almost $37 billion during their lifetimes.

It is important to keep in mind that, mathematically, any reduction in costs for less-educated illegal immigrants means that the costs of less-educated legal immigrants must be correspondingly higher so that they average out to the NAS estimates for all immigrants. Immigrants in the Census data used by the NAS can only be either legal or illegal. So, for example, we estimate that 47 percent of all immigrants in the United States who lack a high school education are in the country illegally and 53 percent are legal immigrants. The average cost estimate from the NAS study for immigrants with this education level (legal and illegal) is $173,375, as shown in Table 1. Our estimation method, as explained above, reduces this amount by multiplying it by 67.6 percent (a 32.4 percent reduction). As a result, illegal immigrants with this education level create a lifetime fiscal drain of $117,236. This means that legal immigrants who have not graduated high school must create a drain of $223,159 for this to average out to the drain of $173,375 from the NAS study. If we increased the discount for illegal immigrants, thereby lowering their costs, and multiply the NAS estimate by, say, 50 percent, then the costs for illegal immigrants without a high school education would be $86,688, a good deal less than we report. But, the cost for legal immigrants without a high school education would have to grow to $250,249 so that it again averages out to the overall NAS estimate of $173,375 for all immigrants, legal and illegal, with this level of education. This drain for the least-educated legal immigrants seems implausibly large.

It is worth noting that because less-educated legal immigrants create a larger fiscal deficit than less-educated illegal immigrants, amnesty (legalization) for illegal immigrants would almost certainly increase the net fiscal costs to taxpayers, as illegal immigrants would become costly legal immigrants. Of course, this is only true for the less-educated illegal immigrants. The modest share of illegal immigrants who are well educated would be a significant fiscal benefit if legalized.

Conclusion

Overall, different assumptions can affect the results. But because the overwhelming share of illegal immigrants residing in the country have not completed high school or have only a high school education, it would require highly implausible assumptions to avoid a substantial net fiscal drain from this population. In short, illegal immigrants are a large net fiscal drain because of their education levels and this fact drives the results. Deportation, on the other hand, is not that costly relative to the fiscal costs illegal immigrants create. Of course, there are many other factors to consider when deciding on the best course of action than just the fiscal balance between removal and allowing illegal immigrants to remain. That said, deporting a large share of illegal immigrants can be justified from a fiscal point of view.

End Notes

1 Francine D. Blau and Christopher Mackie, eds., The Economic and Fiscal Consequences of Immigration, Washington, D.C.: The National Academies Press, September 22, 2016, p. 286.

2 Please see the methodology section of this report for an explanation of how we adjust downward the NAS fiscal cost estimates, which are for both legal and illegal immigrants, to reflect the costs for illegal immigrants only.

3 Philip E. Wolgin, "What Would It Cost to Deport 11.3 Million Unauthorized Immigrants?", Center for American Progress, August 2015.

4 William W. Chip "Mass Deportations vs. Mass Legalization: A False Choice", Center for Immigration Studies, March 2017.

5 Rafael Carranza, "How much does it cost to deport someone?", USA TODAY, April 28, 2017.

6 "FY 2016 ICE Immigration Removals", Immigration and Customs Enforcement, undated.

7 The 2016 ICE budget, including ERO and OPLA, can be found in this document on page 87. Their combined budgets in 2016 were $3,498,536,000. The FY 2012 budget can be found here. In FY 2012, the combined costs for these entities were $3,115,900,000, or $3,250,818,470 adjusted to 2016 dollars. Using the combined ERO and OPLA budgets and dividing by the number of deportations would produce a higher per-removal estimate than ICE reported to USAToday. However, ICE actually has detailed budget and operations figures that allow them to add up only removal costs excluding expenditures not related to deportation. This allows them to calculate the actual cost of the average deportation.

8 Calculating this percentage can be done simply by multiplying 1/1.7059 by 1/1.0762.

9 The most recent estimate from the U.S. government is that there are 11.43 million illegal immigrants in the country. Multiplying this figure by the deportation costs would create a total cost for deporting all illegal immigrants of $124.1 billion assuming a FY 2016 cost per deportation, or $67.6 billion using FY 2012 deportation costs. See Bryan Baker and Nancy Rytia, "Estimates of the Unauthorized Immigrant Population Residing in the United States: January 2012", Department of Homeland Security, March 2013.

10 In addition to the courts themselves, EOIR also consists of the Board of Immigration Appeals (BIA), an appellate tribunal that reviews orders of removal, denials of relief from removal, and denial of certain immigration benefits applications outside the arena of the deportation process.

11 "FY 2016 ICE Immigration Removals", Immigration and Customs Enforcement, undated.

12 "Immigration Courts: Actions Needed to Reduce Case Backlog and Address Long-Standing Management and Operational Challenges Report to Congressional Requesters", Report GAO-17-438, Government Accountability Office, June 2017.

13 Andrew R. Arthur, "The Massive Increase in the Immigration Court Backlog, Its Causes, and Solutions", Center for Immigration Studies, July 2017.

14 "ICE ERO Immigration Arrests Climb Nearly 40%", Immigration and Customs Enforcement, May 2017.

15 Francine D. Blau and Christopher Mackie, eds., The Economic and Fiscal Consequences of Immigration, Washington, D.C.: The National Academies Press, September 22, 2016, p. 286.

16 James P. Smith and Barry Edmonston, The New Americans: Economic, Demographic, and Fiscal Effects of Immigration,Washington, D.C.: The National Academies Press, 1997.

17 Robert Rector and Jason Richwine, "The Fiscal Cost of Unlawful Immigrants and Amnesty to the U.S. Taxpayer", Heritage Foundation, May 6, 2013, p. v.

18 Steven A. Camarota, "The High Cost of Cheap Labor: Illegal Immigration and the Federal Budget", Center for Immigration Studies, August 2004.

19 Steven A. Camarota, "Immigrants in the United States, 2010, A Profile of America's Foreign-Born Population", Center for Immigration Studies, 2012, p. 69.

20 Jeffrey S. Passel and D'Vera Cohn, "A Portrait of Unauthorized Immigrants in the United States", Pew Hispanic Center, April 14, 2009, Figure 16, p. 11.

21 Steven A. Camarota, "The Cost of a Border Wall vs. the Cost of Illegal Immigration", Center for Immigration Studies, February 2017.

22 In contrast, a person with few years of schooling, a low-paying job, and no property in his or her home country is not likely to qualify for a tourist visa or other temporary visitor visa. Such persons would be seen as "intending immigrants", the terminology of the U.S. consular service; and the visa would be denied. As a result, the overall illegal immigrant population, which includes large numbers of overstayers, is significantly more educated than we previously estimated for new illegal new border-crossers.

23 The Heritage Foundation reports the average fiscal impact for illegal immigrant and legal immigrant households by education level. They also report the number of households by education and legal status. With this information it is a relatively straightforward matter to calculate the average fiscal impact of all immigrant households (legal and illegal) by education. We then divide this amount by the estimated costs for illegal households by education to create an adjustment factor. So, for example, among illegal high school dropout households, the net fiscal impact is -$20,485 a year, and for households headed by a legal immigrant who is a dropout, the drain is a good deal more: -$36,993. In Heritage's estimate, illegal immigrants create a net fiscal cost that is about 55 percent that of the burden created by households headed by high school dropout legal immigrants. But this is not the proper comparison, as the NAS estimates are for all immigrants, not just legal immigrants. Given the number of households Heritage reports, the fiscal impact for all immigrant households (legal and illegal) headed by a dropout must be -$30,294. As this equals .676 of the estimated costs of illegal dropout households reported in the Heritage study, this becomes the adjustment factor. We do the same for the other educational categories. As the Heritage study does not show separate estimates for those with only a bachelor's degree and those with a graduate education, we use the same adjustment factor for both. Taken together, this approach reduces the net fiscal drain of illegal immigrants by almost 12 percent.

24 This reflects the fact that while higher-skilled illegal immigrants are assumed to create a fiscal surplus, they often are unable to find work commensurate with their education level because of their legal status and so have to work at lower-paying jobs. They are also more likely to be paid "under the table" by their employers, reducing their tax contributions relative to their legal counterparts. As a result, they do not have as large a positive impact on public coffers as high-skilled legal immigrants.

25 The most recent government estimate of the illegal immigrant population is 11.43 million. See Bryan Baker and Nancy Rytia, "Estimates of the Unauthorized Immigrant Population Residing in the United States: January 2012", Department of Homeland Security, March 2013.

26 The biggest limitation of this approach is that the NAS report does not include detailed fiscal balances by years in the United States and education making it difficult to know what share of the costs has already been incurred. Table 8-11 on page 338 of the study reports mortality and emigration assumptions. We do not change these.