Immigration’s impact on public coffers has long been at the center of the immigration debate in the United States and other developed countries such as Canada. Until recently, however, we actually had very little reliable data on the subject. While there is still much that is not known, we now have some reasonably good information about immigration’s impact in the United States.

There is a pretty clear consensus that the fiscal impact of immigration depends on the education levels of the immigrants. While other factors also matter, the human capital of immigrants, as economists like to refer to it, is clearly very important. There is no single better predictor of one’s income, tax payments, or use of public services in modern America than one’s education level.

Less-educated immigrants have lower incomes and pay less on average in taxes while at the same time they tend to make heavy demands on social services. Because such a large share of immigrants to the United States have low educational attainment, the few studies that have tried to estimate the total fiscal impact of immigrants have concluded that they pay less in taxes than they use in services. While there has been much less research on these questions as they relate to Canada, the educational level of immigrants is almost certainly a key determinate of the impact of Canadian immigrants on public coffers.

Methodological issues

The fiscal impact of immigration on a receiving society has not been as well studied as one might imagine. This is partly because of limitations in the data and partly because researchers have to deal with a number of difficult methodological questions on which there is not complete agreement. What assumptions one makes can have a significant impact on one’s findings. The methodological questions are important and, when evaluating any study on this topic, it is important to understand the assumptions the authors make about the following issues.

Unit of analysis

The first question that has to be answered when studying immigration’s fiscal impact is whether one will examine only the individual immigrant or the costs associated with their young children born in the receiving country. This is a critically important issue because all industrial democracies spend heavily on young children, particularly in the area of public education. Yet, most children in immigrant families are born in the receiving country and would typically not be considered as immigrants. In the American context, if a study excludes services and costs created by the US-born children of immigrants, it will tend to show lower costs than if they are included.

However, many studies use immigrant households, including the children born in the United States, as the basis of the study of costs. In its landmark study, The New Americans, the National Research Council (NRC) in the United States stated: “Since the household is the primary unit through which public services are consumed and taxes paid, it is the most appropriate unit as a general rule and is recommended for static analysis” (Smith and Edmonston, 1997: 255–56). In their study of New Jersey, Deborah Garvey and Thomas Espenshade also used households as the unit of analysis because, as they state, “households come closer to approximating a functioning socioeconomic unit of mutual exchange and support” (1996: 143).

Looking at households and thereby including the native-born children seems reasonable since the presence of these children in the receiving country is a direct result of their parents having been allowed to enter and remain in the country. If, for example, immigrant parents cannot provide for their US-born children and so qualify for programs like food stamps, it makes little sense to consider this as a cost caused by natives. Children are dependent on parents and thus the use of social services by children reflects the positions of their parent. Therefore, counting services used by these children allows for a full accounting of the costs of immigration.

Marginal versus average costs

In any study of immigrant costs there is also the issue of average costs versus marginal costs: Does an additional person or household using a program or service cost the same as those already using it? In some cases, they will cost more and in others they will cost less.

Consider, for example, the addition of new immigrant students to a public school that is half empty. Since the school in question has plenty of room, the costs of adding new children will be relatively low because the school is already built and no additional funding is needed for school construction. In such a situation, the marginal costs of the new students are much less than the average costs for the students already in the school.

On the other hand, an additional group of students added to an already overcrowded school may require a whole new school to be built, thus making the marginal cost of each additional student much greater than the average cost. The NRC and other researchers assume that marginal costs equal average costs because over time the two tendencies discussed above should balance out.

Public goods

Some goods provided by government are what might be termed pure public goods. That is, everyone living in the country benefits from receiving them but adding people does not raise the costs. The most important example of this type of program is national defense. Having more people in the country does not mean more will be spent on defense. Most studies of the fiscal impact of immigrants have assumed that there are some pure public goods, including defense, government-sponsored research, space exploration, and so on.

In the United States, there are more pure public goods associated with the national government than with state and local governments, which typically play a large role in providing services such as police and fire protection, education, and infrastructure maintenance. For reasons explained above in the context of education, expenditures on these projects are not pure public goods and have to expand as the population grows.

Payment on the national debt

Obviously, immigrants who have just arrived in the country have not contributed at all to past deficits or to the cumulative total of those deficits. On the other hand, if an immigrant household created a net fiscal drain in past years then it would account for a share of the nation’s debt obligations.

The NRC study noted above did not count interest on the national debt as a cost for either immigrant or native households. The NRC study focused only on what it called the “primary” budget, that is, the budget excluding debt-service payments. This makes for an easier analysis but the question of payments on borrowed money remains an area that needs to be addressed in future research.

Direct versus indirect taxes

It is easy to estimate the value of taxes that have been paid by immigrants and natives, such as personal income taxes, sales taxes, and real estate taxes. It is harder to determine who ultimately pays such taxes levied on corporations and landlords. Clearly, some corporate taxes are passed to consumers in the form of higher prices, and landlords will try and recoup property taxes in the form of higher rents. However, not all such taxes can be passed on and corporations and landlords also pay some of these taxes.

In general it can be argued that households pay all of the taxes directly or indirectly because rental property or businesses are ultimately owned by individuals and those individuals pay the taxes that are not passed on to consumers and renters. Nevertheless, most studies attempt to apportion tax payment to individuals and immigrants based on whether they are workers, landlords, or owners of capital. It is also worth noting that the issue of taxes paid by persons living abroad is ignored in most studies.

Impact of immigrants on incomes

One final issue for a study examining the fiscal effects of immigrants is their impact on the level of income of Americans or, more precisely, the aftertax income of the average American household. Most economists believe this effect to be very small since the contributions to the nation’s output made by the immigrants is returned to them in the form of wages. If they bring along capital, its contribution to output is similarly returned to its owners through dividend payments. For this reason, the National Research Council’s study mentioned above (Smith and Edmonston, 1997) simply assumed away the effects of immigration on the incomes of Americans.

However, immigration leaving unchanged average incomes can and often does have effects on the distribution of income between capital and labor on the one hand and between workers with different skill levels on the other. Some business owners who use immigrant labour may benefit while some native workers, particularly those at the bottom of the labor market, might see their incomes decline considerably.

Some results from research on the education levels and economic status of immigrants to the United States

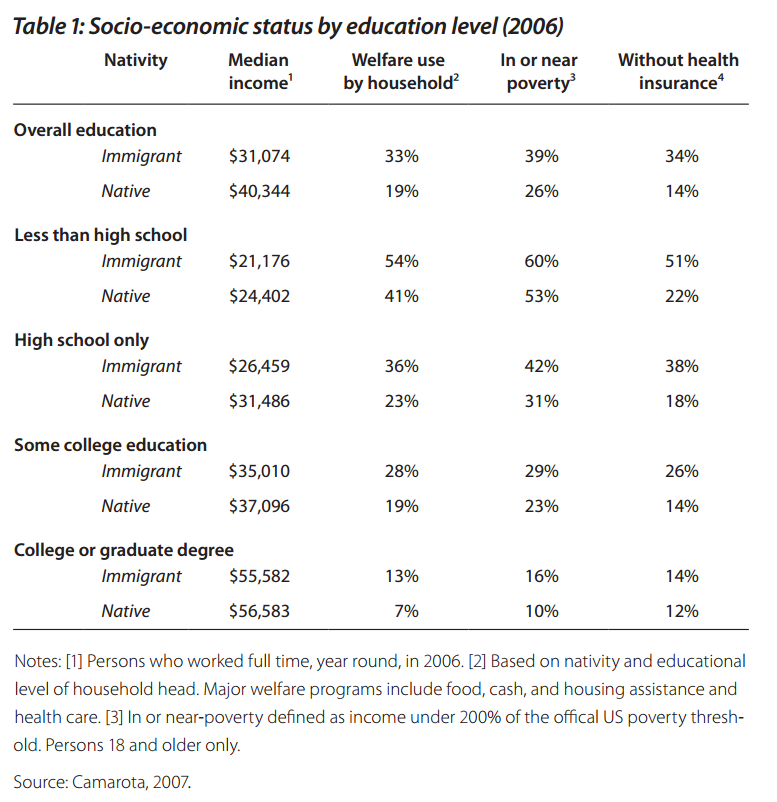

The column, “Median income,” of table 1 shows the average levels of income of immigrants in the United States by educational attainment and compares them with the incomes of native-born Americans with the same educational attainment in the year 2006. The figures under “Overall education” show that, for all persons in the sample, the incomes of native-born Americans exceed the average level of immigrant incomes by $9,000. The rows below show that the difference in income between the two groups decreases with increasing levels of educational attainment: the annual earnings of all immigrant workers is only 77% that of native-born Americans but, once education is controlled for, immigrants earn about 90% of what native-born Americans earn. These data reveal the important fact that most of the difference in the median earnings of natives and immigrants is explained by the low educational attainment of many immigrants in the United States. Most notable is the fact that the median earnings of immigrants with a college degree is about the same as natives with a college degree.

Table 1 also shows that immigrants use welfare more, are more subject to poverty, and more often lack of health insurance coverage than the native-born, though these differences are smaller, the higher the education of both groups. Canadians may find it surprising to learn that one third of those without health insurance in the United States are immigrants or the young children of immigrants. Moreover, immigrants who have arrived since 1990 and their US-born children account for three fourths of the growth in the population lacking insurance in the United States. To a very significant extent, America’s health insurance crisis is being driven by its immigration polices.1

The current American immigration system allows most legal immigrants into the country based on whether they have a relative in the United States rather than whether they have the skills to compete in the modern American economy. This fact, coupled with widespread toleration of illegal immigration, means the foreign-born population in the United States as a whole is much less educated than the native-born population; and less educated than it would be if selection were based on educational attainment rather than family ties.

Given the nature of the modern American economy, as well as the existence of a well-developed welfare state, it seems unavoidable that less-educated immigrants will tend to have lower incomes, make heavier use of means-tested programs, and be more likely to lack health insurance than natives.

Review of research on fiscal impact of immigrants

The true fiscal impact of immigration can only be determined by examining both tax payments made by the immigrants and the costs they impose on services provided by the government. Relatively few studies have tried to calculate this total fiscal balance between tax payments and costs. However, those that have done so found that the size of the fiscal imbalance is different for immigrants with different levels of education and the higher the education of immigrants, the smaller the fiscal imbalance.

The National Research Council study The study by the National Research Council (Smith and Edmonston, 1997) is probably the most sophisticated report ever to examine the impact of immigration on public coffers in the United States. While that report did not consider the legal status of immigrants, it did divide immigrants by education. The report found that, during his lifetime, an immigrant without a high-school education imposed a net fiscal drain (taxes paid minus services used) of $89,000. For those with only a high-school degree, the net fiscal drain was $31,000. On the other hand, the study found that, for those immigrants with more than a high-school degree, the immigrants provided a fiscal benefit worth $105,000 because they paid more in taxes than they consumed in government services.

These figures are only for individual immigrants and exclude the costs imposed on government through their US-born children. When the study included such children and examined households, it found that each year the net fiscal drain for the country as a whole from immigrant households was $20 billion. The study concluded that the primary reason for the net drain was the low education and incomes of immigrants relative to those of other Americans.

Study of New Jersey

A study published in 1997 of the state of New Jersey found that immigrant households (legal and illegal) created a net fiscal drain in the state but the drain varied by immigrant group (Garvey and Espenshade, 1996). For households headed by immigrants under the age of 65, the study estimated their annual fiscal drain in 1990 was $1,824 per household. Those with the least education, such as immigrants from Latin America, created a larger drain (−$2,844) than those with more education, such as immigrants from Europe (−$1,101) and Asia (−$1,467) (Garvey and Espenshade, 1996: 159).

It should be noted that the study assumed all businesses in the state paid more taxes than they received in government benefits, which means households in general were a net fiscal drain, with the drain that immigrant households created being larger than that of native households.

Heritage Foundation study A 2007 study by the Heritage Foundation focused on immigrant households (legal and illegal) headed by a person without a high-school diploma (Rector, 2007). It concluded that in 2005, on average, low-skilled immigrant households in the United States created $30,160 in costs each year and paid only $10,573 in taxes for a net fiscal drain of $19,587. The study also concluded that the lifetime net fiscal drain of each unskilled immigrant household would be $1.2 million. Of course, non-immigrant lowskilled households incur costs similar to those of immigrant low-skilled households. The focus on the costs caused by the immigrant households is that they are avoidable by the use of government policies that prevent them from settling in the country.

Center for Immigration Studies

My own research considered the fiscal cost for the US federal budget imposed by illegal immigrant households (Camarota, 2004). I found that the fiscal costs stem primarily from the educational level of illegal immigrants and resulting low incomes and tax payments, not their legal status. An estimated three fourths of illegal immigrants had either failed to graduate high school or had just a high-school degree

I found that the illegal immigrants paid in federal taxes $10.3 billion less than they cost the federal taxpayers. The net fiscal drain at the state and local level is almost certainly much larger than this sum. If currently illegal immigrants obtained legal status, the fiscal drain at the federal level would almost triple, since the previously illegal immigrants would begin to pay taxes but also begin to use government services to which they were previously not entitled.

The study highlights the fact that it was the educational level of the illegal immigrants rather than their legal status that created the net fiscal drain. In fact, being illegal tended to hold down the drain less-educated immigrants create. Immigrants with little education who are legally in the country were found to be much more costly than illegal immigrants with little education.

Other studies

Several studies by the Urban Institute have examined only tax payments by immigrants without looking at any of the costs they create. The most recent study examined the Washington DC metropolitan area (Capps, Henderson, Passel, and Fix, 2006). Among the study’s findings was that the tax payments vary by immigrant group. The study concluded that those groups that had the highest average levels of education make the highest tax payments and the least educated immigrant groups make the lowest payment.

A 1994 study of the New York State also done by the Urban Institute came to the same conclusion (Passel and Clark, 1994). Several recent Fraser Institute d www.fraserinstitute.org 38 d The effects of mass immigration on Canadian living standards and society studies have tried to look only at illegal immigrants in the United States, an issue that is not particularly relevant to Canada.2

These studies have generally not included the costs associated with the US-born children of illegal immigrants and have also generally avoided including any figures for what might be called population-based costs, such as increased expenditures on roads, bridges, police, and fire protection associated with a larger population. The conclusions of these studies have varied.

Conclusion

The fiscal impact of immigrants is only one issue to consider when deciding on immigration policy. The available evidence in the United States strongly indicates that if fiscal costs are a concern, then immigrants must be selected based on their education rather than other criteria such as whether they have relatives in the United States. The evidence is clear that less-educated immigrants create significant fiscal costs, which can be avoided by the use of proper immigrant selection procedures or reductions in the number of immigrants admitted.

It is worth noting that many native-born Americans observe that their ancestors came to America and did not place great demands on government services. This view is also sometimes expressed in Canada. Perhaps these sentiments are correct, but the size and scope of government was dramatically smaller 100 years ago when both the United States and Canada experienced large-scale immigration. Thus, the arrival of immigrants with little education in the past did not have the same negative fiscal implications that it does today. Moreover, the American and Canadian economies have changed profoundly in recent decades, with education now the key determinant of economic success. The costs that unskilled immigrants impose simply reflect the nature of a modern economy and welfare state. These costs should not be interpreted as a kind of moral defect on the part of immigrants. But, if fiscal costs are to be avoided, then immigration policy must reflect the realities of a modern post-industrial society with a well developed administrative state.

End Notes

1 Calculating the impact of recent immigrants on the growth of the uninsured is relatively simple. The March Current Population Survey (CPS) collected by the US

2 See Siskin, 2007, which examines several recent studies that attempted to examine the costs of illegal immigrants in the United States in particular parts of the country. CRS reports are difficult for the general public to obtain.

References

Camarota, Steven (2004). The High Cost of Cheap Labor: Illegal Immigration and the Federal Budget. Center for Immigration Studies.

Camarota, Steven (2007). Immigrants in the United States, 2007: A Profile of America’s Foreign-Born Population. Backgrounder (November). Center for Immigration Studies. .

Capps, Randolph, Everett Henderson, Jeffrey S. Passel, and Michael E. Fix (2006). Civic Contributions: Taxes Paid by Immigrants in the Washington, DC, Metropolitan Area. Urban Institute. .

Garvey, Deborah L., and Thomas J. Espenshade (1996). State and Local Fiscal Impacts of New Jersey’s Immigrant and Native Households. In Thomas Espenshade, ed., Keys to Successful Immigration: Implications of the New Jersey Experience (Urban Institute Press): 139–72.

Passel, Jeffrey S., and Rebecca L. Clark (1994). Immigrants in New York: Their Legal Status, Incomes, and Taxes. Urban Institute. .

Rector, Robert (2007). The Fiscal Cost of Low-Skill Immigrants to the U.S. Taxpayer. Heritage Foundation. .

Siskon, Alison (2007). Cost Estimates of Unauthorized (Illegal) Immigration. Congressional Research Services (CRS).

Smith, James P., and Barry Edmonston (1997). The New Americans: Economic, Demographic, and Fiscal Effects of Immigration. National Academies Press.