Suppose that there was a federal program — one never authorized as such by Congress — that did the following:

- Took about $3 billion a year away from America's elderly and infirm;

- Involved more than a third of a million workers;

- Gave the money taken from the aging and the sick to employers — including ultra-prosperous companies such as Amazon and JP Morgan Chase — to reward them for hiring foreign college graduates (of U.S. colleges) rather than American (or permanent-resident) graduates of the same schools.

Do you suppose that if such a program did exist, that it would — at the very least — generate controversy and public attention?

It would bring up images of Grandpa and Grandma on an Appalachian dirt farm, or Aunt Sally and Uncle Jim in the slums, and other elderly by the millions, each handing over small bundles of dollars to firms led by Jeff Bezos and Jamie Dimon. It would be a cartoonist's delight.

Sadly, there is such a program, such corporate subsidies do exist, and they are used to pay employers to discriminate against American college graduates. It is called Optional Practical Training (though precious little training is involved) and its subsidies are virtually a secret, thanks to what might look like a conspiracy.

Big media writes about OPT, eminent scholars study it, the government issues reports about it, but the massive subsides are virtually never mentioned.

I do not engage in conspiracy theories — but if the New York Times, the Wall Street Journal, and the San Francisco Chronicle all write articles about the program, without mentioning the subsidy; and the Pew Research Center and the Niskanen Center do the same in lengthy studies on the subject, as does the very agency that runs the program, an obscure part of Homeland Security called the Student and Exchange Visitor Program (SEVP) — well, I might be tempted to think about a conspiracy.

One of the glories of the OPT program for employers is that there is no numerical ceiling. So OPT serves as a handmaiden to the controversial H-1B program for skilled foreign workers, letting employers hire the alien graduates quickly, as OPTs, while both the bosses and workers wait for the H-1B program, with its numerical limits, to provide that visa.

Let's examine OPT a little more closely.

History. OPT was created during the Bush II administration as a way around the H1-B ceilings, which had been cut back to (a very generous) 85,000 a year. The Obama administration expanded it a bit, and the Trump administration has preserved it.

It provides 12 months of subsidized employment to all alien college graduates of U.S. colleges (while still on their student visas), and then allows those in the STEM (science, technology, engineering, and math) fields an additional 24 months of legal work and subsidies. There is a very nominal training element — supervised by the university, not the government — that is widely ignored.

Mechanism. The Bush people, under heavy lobbying pressure from the high-tech industries, faced a dilemma: How can we expand the alien college graduate workforce without an act of Congress?

Then some clever person had a stroke of genius: Foreign students can work in the United States legally while in college, a fairly minor program at the time, so why don't we just redefine the word "student" so that it covers all first-year alumni and, for those graduated with a degree in a STEM field, second- and third-year alumni too?

It's as if some huge hurricane swept the nation's campuses removing the caps and gowns — of foreigners only — and making (currently) a third of a million of these alien alumni into students again.

There was one little problem, which all three administrations swept under the proverbial rug: This mechanism excuses both the employers and the aliens themselves from their payroll tax obligations. (Not charging students of all kinds payroll taxes has long been part of the system.) That's why, without a word from Congress, these jobs became payroll-tax-free — and billions are lost each year to the Social Security, Medicare, and Federal Unemployment Insurance trust funds. These tax breaks give both the workers and the employers freedom from the 8.25 percent payroll taxes that all citizens, and most aliens, pay routinely.

Suppose an individual employer is looking at two equally qualified job candidates, both equally available at the same salary, and both college graduates. Let's say that both workers have engineering degrees, and both would accept the average pay for those graduates (in 2018) of $65,455 a year .

But there is one major difference between the two potential workers, there is the lack of payroll taxes on the graduate from Argentina as opposed to the full set of taxes on the one from Arizona. The employer will save $16,200 over a three-year period, even if there are no raises, by hiring the Argentinian.

So America's old folks are, unwittingly, giving the employer an extra $16,200 if he picks the alien rather than the American. Every time an employer hires an OPT or a STEM person he is helping his company's bottom line, and hurting a single American worker, and all of America's elderly.

The employer should not be put into that position where he has to make that choice — not that industry objects.

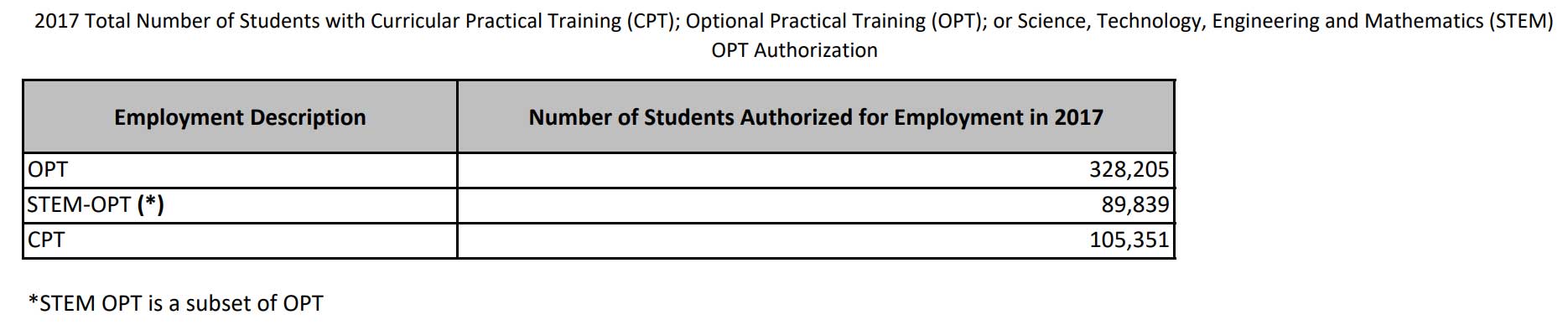

Numbers. The Department of Homeland Security does not treat all of its in-house numbers equally. It will announce, within a day or two of the end of the month, the number of apprehensions at the Southern border, but it will, only from time to time, and much later, release data on the OPT program. The most recent numbers I can get, and these just the broadest counts are available, are for FY 2017, a period that ended on September 30, 2017, nearly two years ago.

|

That's the entire document, and a good example of bare-bones statistical reporting; I assume it is for the fiscal year, 2017, though that is not specified, and I assume that while the STEM total is a subset of OPT, CPT is not. CPT (curricular practical training) is for the employment by industry of real students, a program we are not covering in this posting.

If one multiplies the number of OPT (including STEM) workers by an average annual salary of all 2018 college grads ($51,004) we get an annual OPT/STEM payroll of $16.74 billion (rounded); multiplying that by 16.50 percent for payroll taxes (8.25 percent paid by the worker and an equal share paid by the employer) produces $2.76 billion, which was the annual loss to the trust funds in 2017. By now the number of OPT students has certainly increased, wages have risen a bit, and thus the loss to the funds must be well over $3 billion a year.

Incidentally, using a couple of other USCIS data sources (here and here), again for 2017, we find that Amazon and JP Morgan Chase had these OPT workers, and these bonuses for hiring them:

Company OPT Workers Bonus

|

||

| Amazon | 4,065 | $14,068,649 |

| JP Morgan Chase | 321 | $1,350,713 |

|

|

||

Morgan Stanley tagged along with 214 of these workers. Amazon, by a substantial margin, is the largest user of these workers nationwide, Google and Intel follow.

One hopes that a single vocal member of Congress, or one able investigative reporter, would notice this program and raise some Cain about it, but it has not happened yet.