Download a pdf of this Backgrounder

David North is a CIS fellow who has studied the interaction of immigration and the U.S. economy for more than 30 years.

Suppose you had gritted your teeth and decided to sell your soul, brain, body, or whatever, and virtually no one wanted to buy? Suppose you gritted your teeth again, and decided, in effect, to lower your price by half, and still there was not much response? Pretty depressing, right?

Well, that is exactly the government’s posture as it has tried to sell life-long green cards to aliens, who otherwise would have no right to migrate to the United States, in exchange for relatively short-term cash investments. I am not at all sure that the government should be doing anything like this.

What I am describing is the EB-5 program for immigrant investors. (The initials relate to its being the fifth class of Employment-Based immigration programs, as spelled out in the Immigration and Nationality Act.) And despite repeated and almost frantic efforts by the Department of Homeland Security to sell the program, the numerical limit of 10,000 green cards a year for investors has yet to be reached; in fact only a small fraction of that number are awarded annually. However, when FY 2011 data become available it is likely that the numbers will be somewhat higher than in the past.

This examination of the EB-5 program shows, that despite massive promotional efforts:

- There are comparatively few takers, and only a fraction of them complete the process and get green cards;

- No one, citizens or aliens, middlemen or workers, or the economy generally, seems to be getting much out of the program;

- Many of the investments turn out to be bad ones, some scandalous; and

- Other immigrant-receiving nations run much more rational programs than we do, while securing more significant investments, proportionately, from aliens.

Foreign investment comes to the United States routinely, in large volume, with minuscule help from EB-5. In 2010, total foreign investment in the United States increased by $1.9 trillion, according to the U.S. Department of Commerce.1 My estimate (based on the investors’ green card applications filed two years after the first investment) is that EB-5 investment that year was about $191 million,2 and that was a well-above-average year for the program. So, for every $100 of increased foreign investment that year, the EB-5 program contributed about one penny.

I have heard that using a much more wobbly statistical base (the initial applications of would-be immigrant investors), USCIS is telling journalists that the level of investment in the recently concluded fiscal year (2011) was at the $1.2 billion level. For the sake of argument let us accept that estimate, but even this (probably inflated) number would bring the amount of increased foreign investment due to EB-5 up to the level of only six cents for every $100.

EB-5 is a program that is failing, and richly deserves to fail.

In the pages that follow we will examine the history of the program, its extremely generous (to aliens) terms and conditions, the efforts by the government to promote the program, its migration and economic consequences, and finally we will look at rival migrant investor programs, both overseas and within the United States.

Program Design

Legislative History. The EB-5 program was created as part of a comprehensive re-write of the existing immigration law, the Immigration Act of 1990, a piece of legislation that substantially increased the number of employment-based visas. One of its many provisions, according to the immigration bar’s trade paper, Interpreter Releases,3 was described at the time in this way:

“The fifth employment-based preference category sets aside 10,000 visas each year for foreign investors … . The investment must create at least ten full-time jobs for U.S. citizens [or] permanent resident aliens … . The amount of capital required for most investments is $1 million, although that can be increased by INS regulation. The United States can require an investment of up to $3 million for designated “high employment areas … . Conversely, to encourage investment in areas where jobs are needed, the 1990 Act allows the investment to be as low as $500,000 for enterprises in a ‘targeted employment area.’”4

That publication, as is its wont, was correctly reflecting the then-current view of the immigration establishment regarding the new provisions; but change came quickly, both in the law and in its administration, as the watering-down process took hold. For example, during the course of this research I never saw the $3 million figure repeated in later years, and currently it is estimated that some 90-95 percent of the EB-5 grants go at the half million level.

In 1993 Congress created the concept of government-approved EB-5 regional centers to channel the half-million-dollar investments as a pilot program, which now operates as a temporary program that needs congressional re-enactment every three years. The current enactment expires on September 30, 2012, and will, in all likelihood, be renewed by Congress.5

A further legislative easing came in 2000 when an earlier statutory provision requiring an increase in exports was dropped; and, a few years later, the pilot program, which had first operated in a handful of states, was replaced by a nationwide provision for the EB-5 regional centers.

Perhaps the most significant legislative relaxation of the program arrived in 2003 when the previous demand for a hard count of 10 new jobs was replaced by a mandate for the calculation of indirect job “creation using any ‘reasonable methodologies,’”6 Middlemen organizations that promote this program often promise that their own economists will help investors — for a price — calculate the indirect creation of jobs.

The Obama administration and its new USCIS director, Alejandro Mayorkas, an assertive California lawyer,7 decided that the legislative relaxations described above had not sufficiently expanded the program, and so they have launched a series of efforts to modify the program’s administration to encourage greater utilization, with some success. These efforts will be described more fully below.

Terms and Conditions. The basic deal is that the alien invests in the United States and gets green cards for everyone in the immediate family. Perhaps this is a matter of taste, but I find the basic concept less than attractive.

Needless to say, tasteful or not, it is rather more complicated than a simple exchange of cash for the green cards.8 There are two sets of variables, the investment ones and the immigration ones.

For something like 90 percent of the applicants, the amount of investment is $500,000, and the period of investment need be no more than 24 months as far as the government is concerned, though sometimes investors have trouble, in fact, withdrawing their investment that quickly.

The investment must be just that, not a loan. It must be an at-risk arrangement, and it must be made in the private sector. It must be made by the investor, and not by a corporation, for instance, owned or controlled by the investor. The money must also be legally acquired; it cannot be the loot of a drug lord. It must create or save (no matter how calculated) 10 jobs for legal resident workers other than members of the investor’s family.

All the above stipulations apply no matter whether the investment is made at the $1 million level (as it occasionally is) or at half that level. But the smaller investments can only be made in financial vehicles selected by the USCIS-approved regional centers, which substantially limits the choices open to investors.

On the other hand, the program does not demand anything but an investment; there is no need for the migrant to actually start, or even operate a business. A passive investment is perfectly OK, and appears to be the norm.

As to the migration variables, they are numerous, too. Ignoring the rare $1 million-level investors for a moment, the EB-5 regional centers — there are currently 211 of them — must first be approved by USCIS.

In the next step, the investor must seek USCIS approval for both the investment and for a conditional visa, or a set of conditional visas for the investor’s family. The investment must appear to be a genuine one, as noted above, and each member of the family must be otherwise admissible to the United States (in other words, have a clean police record, not be a terrorist, and so on).

The conditional visas — much like those of newly married alien spouses of U.S. citizens (USCs hereafter) — lets the family come to the United States and work here for two years; after that the family must, through another immigration process, ask that the “conditions be removed” and that their status be converted to full green card, or permanent resident alien, status. The conditions will be removed only after USCIS is satisfied that the investment lingered for at least two years, and that enough jobs were created or preserved to meet the requirements.

So it is not just a cash-for-a-card arrangement; the program design is very complex.

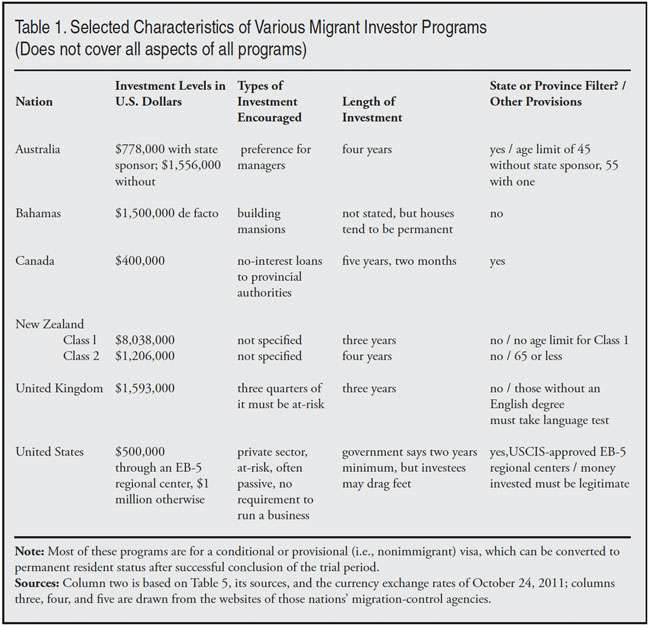

On the other hand, as Table 1 shows, the half-million-dollar investment that routinely works in the United States is a relatively small sum of money compared to the demands made of immigrant-investors in Australia, the Bahamas, New Zealand, and the United Kingdom. Canada, alone of these immigrant investor nations, asks for a smaller investment, but wants it for a longer time and it calls for it to be a non-interest loan to a Canadian province.

Some of these other nations not only ask for a larger investment, they make other demands of the would-be immigrant investors as well. The UK wants, in addition to an investment of £1,000,000, three-quarters at risk, that the investor speaks English. Australia and New Zealand, for some of their programs, demand that the investor be under a certain age, with 45, 55, and 65 being cut-off points for different programs. In Australia there is also a sensible requirement that the investor, or the investor and spouse, have at least 50 percent more in net assets than the minimal investments of either Au$750,000 or Au$1,500,000.9

The U.S. makes no similar demands, and with lower required investment levels than all but Canada, that would seem to suggest that the EB-5 program would attract more customers than these other nations, but, as we show later, this is distinctly not the case.

Dramatis Personae. The EB-5 program is a little like a full-blown Wagnerian opera production, with a huge cast and crew, soloists and musicians, scenery designers and managers, costumers and box office staff, all working valiantly and long hours to please an audience of … about a dozen.

My sense is that one of the reasons that the EB-5 program is so unsuccessful is that there are both too many processes, as well as too many cooks (i.e., expensive middlemen) all demanding a piece of the action. A mere listing of some of the players, at the half-million level, standing between the investor, at one end, and the investee (or developer) at the other end, may be instructive:

- Investor, provides (some) capital

- Migration agents, private sector people, in the home country10

- EB-5 Regional Center executives, in the United States, and supporting them: immigration lawyers, economists, a trade association of such centers,11 and information-sharing systems for EB-5 professionals12

- USCIS officials who decide on the petitions, their managers, their lawyers, and their outreach people, and that agency’s appeals body, the Administrative Appeals Office

- If an appeal is deployed, immigration lawyers, this time for both the investor and USCIS

- Consular officials who actually issue the visas

- Investees or developers, who use the capital, which is supposed to provide jobs. The investee could be, but rarely is, the investor.

Program Operations

The Application Processes. USCIS handles directly three key elements in the EB-5 process. These are:

1) The filings for the recognition of an EB-5 regional center; these serve as the middle-man agency for 90-95 percent of the individual investments. Most of these are private, for-profit organizations, although the one in Vermont is an arm of the state government.

2) Once an investor has decided on an investment, he files an I-526 form for himself and any dependents with one of the four Regional Service Centers of USCIS (which are not to be confused with the far more numerous USCIS-recognized Regional Centers for EB-5 purposes). The current instructions for the I-526 form tell the applicant to send the form to one of two lockboxes (mail handling facilities) in Texas, from which they are forwarded to the USCIS Service Centers.13 The one in Vermont seems to be handling all of these applications currently, though other Service Centers were also involved in the past.

The approval of an I-526 grants the investor and his family conditional and temporary legal status in the United States, which allows them to cross the border freely and to work in the United States legally. There is no requirement that they settle anywhere near the site of the approved investment.

The next step, if the alien getting I-526 approval is overseas, is for the alien to seek a visa to enter the United States from a State Department consular official. If the alien is already in the United States in some other (presumably nonimmigrant) capacity, he needs to obtain USCIS approval for an adjustment of status. (Neither of these steps is likely to be troublesome for the investor.)

3) After the passage of at least two years, if the family remains interested in permanent U.S. residence, and if the investor has met the government requirements about the investment, and if there have been no serious run-ins with the law, then there is the filing of the I-829 form to “remove the conditions” previously imposed by USCIS. Should this form be approved, the family then moves onto permanent resident alien, or green card, status.

Since there are a substantial, but not government-measured, number of drop-outs in the program, there are noticeably fewer filings of the I-829 than of the initial form, the I-526.

Low Investor Interest and High (for USCIS) Denial Rates. Although the government generally, and this administration particularly, is enthusiastic about this program, some of the key players are not.

These key players include overseas investors who have shown little interest in the program, and decision-makers (all civil servants) who deny applications in this program at a far higher rate than they do other USCIS applications, presumably because they detect (appropriately) large problems within the program. Meanwhile, the leadership of USCIS and all the middlemen listed above want the program to expand.

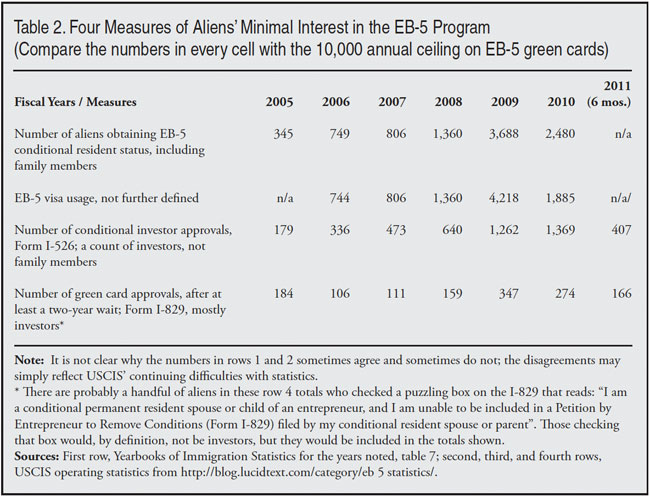

Bearing in mind that Congress set an upper limit of 10,000 investor green cards a year, examine Table 2, which shows four different statistical measures of the popularity of the program from 2005 through the first six months of FY 2011. No number in that table comes close to 10,000. In earlier years, interest was even lower.

Later in the report we will look at some of the reasons for this lack of interest.

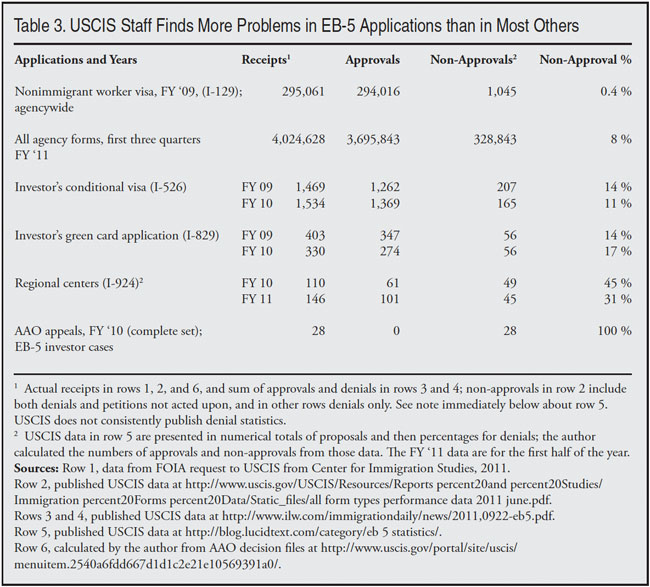

As to the level of denials, it is useful to consult Table 3, which shows that while USCIS usually says no to applications in general only rarely — that happens from less than 1 percent to 8 percent of the time — the denial rates on various aspects of the EB-5 program are shown at 11 percent, 14 percent, 17 percent, 31 percent, and 45 percent. In one specialized and atypical measurement, the denials reached 100 percent during one year.

How appropriate are these EB-5 denials? One must resort to a bureaucratic version of examining tea leaves to get an answer, as the basic applications and the resulting decision papers are kept secret. The two proxy measures that we are using are: 1) the comparison between these decisions and USCIS decisions generally, and 2) what does the in-house appeals process do with the minority of denials that are brought to its attention? The one with the 100 percent disapproval rate came from the USCIS in-house appeals unit, the Administrative Appeals Office (AAO).

Neither measure suggests a flow of high-quality applications.

Bear in mind — and this is subjective but based on many years of observations — that USCIS, in general, loves to say “yes” to applications of all kinds. It sees itself as a benefit-granting agency, not an impartial court that happens to have migrants among those it must judge.

One of the reasons why any judgment about the EB-5 decisions is difficult is because USCIS is not only not very skilled with numbers,14 it is reluctant to publish the kind of impartial data that Major League Baseball, for example, is perfectly happy to provide in great detail. USCIS is much more likely to publish upbeat numbers, like benefits approved, but it is often leery of publishing data on its denials. It is as if MLB kept excellent accounts of hits and runs but never counted strikeouts. But within these limits it is possible to make some observations about the way the agency staff regards the EB-5 program, as is reflected in Table 3.

Having known the agency and its predecessor, INS, for decades, I have a sense of how its people think about their jobs, and how careful most of them are to try to do the right thing. If this group of faceless bureaucrats thinks that a group of benefit applications are more than usually troublesome, and if their decisions reflect that, I suspect it is because the applications are more flawed than the average.

On the other hand, the 100 percent disapproval rate at the bottom of Table 3 requires a little explanation. At the appeals level, where the numbers are much smaller, the review staff agreed with the field staffs’ denials — in a collection of 28 cases — fully 100 percent of the time. The appeals people were looking only at denials, and what the 100 percent indicates is that someone else, looking at staff denials, found all of those 28 denials to be appropriate.

These cases seen by the USCIS’ own appeals unit may not be numerous but the texts of the individual decisions shed a lot of light on the program.

During FYs ‘09 and ‘10 there were on average 242 I-526 and I-829 denials each year and, in comparison, there were 28 appeals decided by the AAO in FY’10, so about 12 percent of the denials were appealed. I would suspect that the quality of the applications whose denials were appealed would be higher, on average, than the denials that were not appealed, but there is no proof of that. Nevertheless, in those 28 cases, there were 26 negative decisions and two withdrawals.

AAO’s posture about reporting the texts of its decisions is both useful to close observers, and extremely frustrating. It does publish the texts of the decisions, and that is helpful. On the other hand, no statistics are offered. To learn how AAO reacted to its 28 appeals of investor cases that year, I had to read the full texts of each of those decisions.15

Further, reading the decisions is complicated by that agency’s bizarre ideas on privacy; not only are the aliens’ names blacked out, so are the names of the corporations involved in the cases, their lawyers, and even the names of the decision makers. Sometimes sloppy clerks in the office forget to redact something and one learns something about who is involved in the cases.16

But despite these problems, the multi-page decisions of the AAO do shed some light on some of the EB-5 cases that are rejected by agency staff.

While I expected that there would be many problems with aliens claiming the creation of 10 or more jobs when the facts did not support such claims — and there was a lot of that in these decisions — there was also a series of financial wrinkles that I had not imagined.

For example, many a case was rejected because the “investor” had not made an “at-risk” investment; it was a camouflaged loan, for example. Or the full required sum had not been invested. Or the alien himself had not really invested in the project, the money coming from a corporation, rather than an individual, as is required. Or the project was in a million-dollar area, and the investment was for half of it. Or the amount of money claimed to be invested included fees to middlemen, so that the full amount needed would never get to the project. Or, sometimes, AAO sensed other kinds of out-and-out fraud in the applications.

My favorite financial scam exposed in these otherwise drab AAO decisions was among the dozen or so that related to a complex effort to get EB-5 money to refurbish the “former Watergate Hotel” as the AAO decision-writers always described it.17 One of the requirements of the EB-5 program is that one has to show that the investment money was legally obtained. In this case the alien had obtained the money he wanted to invest from a financial organization in Iran that had been blacklisted by our State Department. (This was just one of the reasons why this appeal failed.)18 The other Watergate cases were rejected on appeal because of a combination of the kind of financial problems described above and a lack of plausible evidence about the jobs to be created.

The Watergate cases also shed light on another aspect of the EB-5 program, which is supposed to bring the half-million-dollar investments to depressed areas. The city government in Washington, D.C., in order to bring money to this project, gerrymandered the lines of the economic development district in question to link the hotel, in a plush part of town, to distant depressed areas. The AAO did not rely on this gimmick in its decision-making, but it wrote about it and commented sharply on it.

When the same kind of economic gerrymandering was attempted for a Wall Street-area real estate project, also using EB-5 funds, it made the front page of the December 19, 2011, New York Times, a newspaper that is routinely supportive of more relaxed immigration policies.19 That long and detailed article included a map showing the convoluted boundaries of an EB-5 economic district that included both the proposed construction site in the highly prosperous lower tip of Manhattan, and a distant public housing project where unemployment is common.

Unless my map-reading skills have failed me, I cannot see how one could walk or drive from the Manhattan site to the Brooklyn slum area without going through other census tracts. The only way to get from one to the other without venturing into other tracts would be to take a boat from the building site, cross the East River, tie it up at the Brooklyn Navy Yard, and then hike or drive to the poverty-stricken Farragut Houses development.

Without the use of such mapping, the project could only accept million-dollar investments, and that would put it at a major disadvantage vis-a-vis other EB-5 districts where only half that figure is needed. The Farragut Houses provide the middlemen with such attractive numbers that, according to the Times, that Census tract has been jiggered in to two other EB-5 proposals as well.

To return to the earlier, more general, question: “how appropriate were these EB-5 denials?” I think what scant evidence has been made available suggests that, as a rule, they were appropriate. (We have no way to judge the validity of the approvals, of course, because those documents are locked away; and it is among the approved projects that one finds most of the EB-5 scandals described later.)

Promoting and Modifying, but Not Researching the Program. A government agency with a failing program on its hands, one that it wants to save, can devote its fungible resources to such a challenge in at least three different ways:

- It could conduct research to find out what works and what does not in the program;

- It could promote it as it stands, without doing anything else; or

- It could modify its management and its rules to make the program more popular.

One or more of these are approaches can be taken without changing the underlying legislation, which, of course, is another option, but one involving the Congress.

If USCIS has done much research on the program, it has kept the results hidden. In fact, its officials may learn some things about the program by reading this report, particularly how the program compares with its more successful rivals abroad.

USCIS, on the other hand, has been vigorous in its promotion of the program, and in the easing of the rules to benefit aliens seeking green cards, and to help the projects — some of which are questionable — that use the (modest) investment funds that are produced.

As to research, I heard, while attending one of the frequent “stakeholders’ meetings” conducted by USCIS on this subject, that the agency did not keep track of the private fees that were charged to the investors; “all we want to do is to make sure that the full investment is made in the project,” the staffer declared. I then asked, given the two-year stipulation as to the minimum length of the investment, “does USCIS have any idea what percentage of those two-year investments are still there, say, three or four years after they were made?”

The answer was no, and there was no indication that the agency had any curiosity on the subject.

The lack of internal research on the program was confirmed in a recent Los Angeles Times article, which stated: “The USCIS, by its own admission, has failed to closely track the flow of EB-5 money, how the projects are being sold to investors or whether the projects were successful. Instead, its focus has been on making sure jobs are created — but not that the jobs will last.”20

These “stakeholders’ meetings,” by the way, are smooth, well-managed productions held quarterly in a large conference room on Massachusetts Ave., NW, in Washington, D.C.21 They are announced on the Internet in advance, one is urged to RSVP, and in addition to the in-person session, usually involving 50 or more people, there is a simultaneous teleconference. People in the room, and on the phone, can ask questions, and that part of the USCIS leadership involved in the program is present. They are part of a series of the sessions on various subjects, all managed by the fully staffed Office of Public Engagement, which appears to be separate from the USCIS press operation.

The questions at the meetings tend to be quite narrow, but cannot be case-specific. The EB-5 audience (with the exception of the odd interloper, such as the author) is 99 percent pre-sold on the program and absorbs the detailed information offered with enthusiasm.

It is through these meetings, press releases,22 “informational summits with industry leaders,” and other means, that USCIS promotes the program and announces its program modifications, which have been extensive and are described below.

“Streamlining” the Program. The modifications that USCIS has been making to the EB-5 program recently are centered on these moves:

- Hiring more and (by definition) different decision-makers;

- Setting new processing schedules and making quicker decisions for those paying more;

- Giving some EB-5 players direct access to decision makers, a bold move; and

- Changing the command structure within the bureaucracy.

As Table 3 showed, applications from would-be EB-5 regional centers (Forms I-924) are often viewed dimly by the staff, with 45 percent of the applications being denied in FY 2010 and 31 percent in the first half of FY 2011. So it should be no surprise that the USCIS leadership has focused on this part of the process as it seeks to change the system. The changes summarized above were first spelled out in an agency proposal for comment on May 19, 2011.23 According to that document:

“Proposals submitted under the EB-5 program are often complex … . The proposed steps outlined below respond to concerns stakeholders and petitioners have raised about the often-complex EB-5 proposal process and reflect USCIS’s long-term commitment to realizing the EB-5 program’s fullest job-creation potential and to address stakeholder concerns about process challenges.”

In other words, management wants the staff to say “yes” more often and more quickly.

Hiring. Adding, or reassigning, more staff to this program obviously will make the work go more quickly, and that’s the surface part of the proposal. But when new people are put in a job, it gives management the (undiscussed) power to decide who will be making the decisions on the applications, and management may well choose personnel who will be more amenable to questionable cases than the current staff is.

Putting more staff to work on the EB-5 program presumably means fewer staff members are available for other duties, an aspect of these changes not mentioned by USCIS.

Processing the Cases. In addition to setting some new and faster “target processing times” USCIS has made two moves in this field, one of which makes good sense, and the other (as far as I am concerned) is troubling.

The agency is making a distinction between projects that are “shovel-ready” and those that are not, and are termed “exemplar,” providing faster decisions on the former, which is probably harmless.

On the other hand it has adopted the non-egalitarian principal of premium processing, giving faster decisions to those paying a special fee ($1,225). In fact, with the combination of a “shovel-ready” project and the premium processing payment, decisions are to be made in as little as 15 days on both I-924 and I-526 applications (for centers and for individuals, respectively).

All of this is in the time-honored Third World principle of letting the rich go to the head of the line.

Direct Contact with Decision Makers. The recent tradition in USCIS is that there rarely is direct personal contact between a decision maker and an applicant. There are face-to-face interviews in asylum cases, in naturalization cases (or there used to be), and in suspected marriage fraud cases, but otherwise USCIS prefers to make its decisions on paper applications. This is faster, cheaper, and saves the agency from having to notice, in the odd case, that the lady claiming to be a farm worker arrives in a mink coat.24

Further, in recent years, individual decisions have been removed to remote decision factories, the previously mentioned Regional Service Centers, rather than in the district offices where interviews are at least possible. It is within this framework that USCIS is giving some would-be EB-5 regional center operators a chance to talk to the decision makers.

The prevailing USCIS dim view of direct contact between an applicant and an adjudicator is not just an informal tradition, though it is that, too. Such activities are seen as serious breaches of protocol, regulations, and the law. This was expressed in alarmed tones in this 2008 AAO decision supporting a staff denial of approval of a regional center:

“As stated above, the appellant expresses concern that other promoters were able to meet with [USCIS] Service Center Operations staff. While Citizenship and Immigration Services regulations have a provision for oral argument under certain circumstances at the appellate level (8 C.F.R. § 103.3(b)), there is no regulatory provision for oral argument during the adjudication of a proposal for designation as a regional center. Further, if the appellant is suggesting that USCIS staff should have informally discussed the merits off the record, the AAO notes that ex parte communications are prohibited by the Administrative Procedure Act (APA), 5 U.S.C. § 706.”25

I like the term “promoters” used above. While AAO reviewed 28 cases involving individual would-be immigrant investors during FY 2010, as noted earlier (and denied all 28 appeals), it has ruled in only two cases that I know of26 involving staff decisions on regional EB-5 centers, supporting staff denials in both instances.27

But despite such thoughts (and the agency’s recent history) those who want to set up regional centers are being given the right to direct contact, under certain, admittedly narrow circumstances as described below.

As I pointed out in a recent blog28 if you are a U.S. citizen, and your nearest and dearest alien relative is dying from cancer in a place with few health resources, you cannot have direct contact with a USCIS decision maker, but if you are a promoter with an itch to get your hands on some alien’s money, or some aliens’ moneys, you have at least a partial open sesame.

Let me digress for a moment about the way that the agency twists the language in connection with the EB-5 regional centers. It routinely says: “Regional Centers are public or private entities that promote economic growth ... .”

In fact, according to the State of Vermont — it alone has a public regional center29 — all the rest are private, mostly if not all, for-profit entities. So why say “public and private” when public is the odd exception? Presumably because the more accurate “private and public” would not sound quite as appetizing.

The Command Structure. Perhaps the boldest, most creative, and most troublesome innovation in the process is the insertion of a totally new entity, the newly created “Expert I-924 Decision Board,” between the line staff decision makers, on one hand, and the Administrative Appeals Office, on the other.

I had thought, at first, that this was an attempt to reduce the powers of the AAO, but then I learned that decisions on EB-5 regional centers rarely go to the AAO, but these I-924 applications (see Table 3) are frequently rejected at the staff level. Here’s what the USCIS document has to say about this new entity:

“[T]he Board will be composed of a USCIS economist and two USCIS adjudicators, and will be supported by legal counsel. The Board will receive a case for disposition from the Specialized Intake Team, and the Board’s first step in each case will be to approve the I-924, to route the I-924 back to the intake team for a Request for Evidence (RFE), or to issue the applicant a Notice of Intent to Deny (NOID).”30

The board would not seem to have the power to reject an application immediately; initially at least, it could only issue the NOID. Similarly, staff members could not, apparently, send out the RFE notices, as they did in the past. In, short, the whole process will be tipped further toward saying “yes.” Given these new rules, the denial rate, last seen at 31 percent for the first half of FY 2011, will surely drop — which is the point.

If the board does, in fact, issue an NOID “it will offer the applicant the opportunity to have an in-person or a telephonic interview with the Board to inform its final decision ... . The Board will audiotape or otherwise memorialize the interviews for the record.”

Presumably, if even after all these careful arrangements have been made, the board still says no, the promoters would continue to have the option of appealing to the AAO.

Program Results

What has been the ultimate product of all this activity? We will look at this from a macro-economic view, a micro-economic view, and from the point of view of human migration.

Economic Results, Macro — the Early Years. A strange thing happened to many of the earlier EB-5 investments; in many cases very little — sometimes as little as $10,000 — actually got to the project, with the rest of the money being siphoned off by middlemen. Working under arrangements subsequently revoked, a small and bipartisan group of former government officials, including a former INS commissioner, a former assistant secretary of state, a former general counsel to INS, and former members of the House of Representatives, all allied with immigration middlemen, variously arranged for substantial fees to be taken out of the million or half-million investments.

The Baltimore Sun ran a powerful exposé of these practices: “INS insiders profit on immigrant dreams”, written by reporters Walter F. Roche, Jr,. and Gary Cohn on February 20, 2000.31

To the extent that these practices prevailed, and there is no statistical data on that point, the EB-5 program would have had no significant impact on the economy generally, but would have had useful impacts on the pocketbooks of the former officials. In recent years the results have become more complicated.

Economic Results, Macro — Current Situation. One might think that a mature government program aimed at stimulating investment in the United States, which describes EB-5 on both counts, would publish data on how much investment it had raised. This has not occurred.

There would seem to be two explanations: 1) USCIS has the data but has not released it, a fairly common practice of that agency, or 2) fearing truly tiny numbers, it decided not to find out the total level of investments. Neither practice would shed an attractive light on the agency or its leadership.

Given the centrality of the question, and the lack of hard numbers, we looked around for estimates, and found one in the program-friendly environs of one of the well-established regional EB-5 centers, CMB Export LLC, in Rock Island, Ill. Its website said that about $1 billion had been raised by the end of 2003, and since then that number has probably doubled.32

I remember seeing another estimate for the entire 20-year life of the program at $1.5 billion, but cannot find the citation, but it must be more than a year old. Each of these estimates, of $1 billion, $1.5 billion, and $2 billion, respectively, divided by the 20 years, would produce modest annual estimates of EB-5 investments of $50 million, $75 million, and $100 million, respectively.

Can data released by USCIS on other measures be used to get some idea of how much money EB-5 has raised from overseas? Maybe, but to paraphrase the former secretary of defense, you go into program analysis with the data you have, not the data you want. Some statistical straws in the wind may be helpful.

One of the problems is: what are we trying to measure? One possibility would be the plans and promises of the would-be alien investors as reflected in approved I-526 petitions, whose instructions carry the weasel words “Evidence that you have invested or are actively in the process of investing” (emphasis added).

Another one is the historical record, more than two years later when the agency actually concludes that the required investments have been made, as it approves the I-829 forms. These data reflect the situation several years later than the I-526 numbers do.

Looking back to Table 2, we see that there is a very large discrepancy between the two sets of numbers; during the 6.5 years covered there were 4,666 I-526 forms approved and only 1,347 I-829s. Lagging the comparison narrows the gap a bit, with 1,628 I-526 forms approved from 2005 through 2008 compared to 891 for the I-829s in the years 2007 through 2010.

Even with the lagging, it looks like about half the once-approved investors dropped out of the system before it concluded, for them, by their obtaining green cards.

Incidentally, if you honestly invest, say, half a million in an approved EB-5 scheme, and all the money is lost you still can get your green card, so bad investments alone are not the reason for the much smaller numbers of approvals of the second form (I-829). Maybe a lot of would-be investors in the United States have lost interest in America, a possibility that is probably too awkward for a government agency to want to contemplate, or at least to talk about.

There are several other reasons for the drop-off, besides a voluntary decision not to move to, or stay in, America:

- Some did not fulfill their investment obligations;

- Some of the investors probably found other ways to legalize their status in the United States during the investment period;

- Some with approved I-526s turned out to have filed fraudulent applications, and were turned down at the I-829 level;

- Others finding interior immigration enforcement to be generally slack — certainly among the well-to-do — probably just eased into illegal status; and

- A handful must have died.

Whatever the reason, the I-829 approvals are both fewer than, and a much better measure of, enduring investments in the United States than the I-526 approvals.

So, how much was, in fact invested? Using the I-829 approvals for the years 2005 through the first half of 2011 (from Table 2) and assuming that 90 percent of the visas were issued at the half-million level, and only 10 percent at the full million, it appears that there was a total of about $743 million invested in these, the program’s best 6.5 years to date.33 Since there were far more investors per year in those years than in the previous 12.5 years, this suggests that the $1.5 billion investment total estimate is close to the mark, for that time period, as is the annual estimate of a little more than $100 million a year in the last few years.

I worry that in the future USCIS might try to build an estimate on I-526 approvals rather than the I-829s, thus inflating the totals considerably; such estimates have been leaked to the press this year, but I have yet to see a USCIS document using this estimation technique.

But what does $1.5 billion for the life of the program, or a recent average of about $100 million a year, compare to?

As we noted earlier, this is a proverbial fraction of a drop in the bucket, literally a penny for every $100 in additional foreign investment during 2010. And these sums of money are being raised in such laborious ways it makes one wonder if it is at all worthwhile.

Economic Results, Micro. Having been a government publicist in the past (at the U.S. Department of the Interior), I have often wondered about something glaringly missing in the EB-5 program — and that’s the glowing government press releases on success stories.34

If you run a program for 20 years, involving presumably hundreds of investment situations, one of them, by sheer laws of chance, must have become a howling success.

Somewhere, somebody has turned these investments into something outstanding, maybe a factory that turns kudzu into cloth or energy; an investment in a medical device that not only saves lives generally, but has saved the life of a famous opera star or a prominent football player; or investment money that has turned a dying textile or coal mining town into a prosperous crafts center.

I suspect that nothing of the kind has happened, or else we would have heard about it.

There is a truly basic, underlying reason for this.

There is, as in everything else in life, a range of possibilities, in this case, a spectrum of investment opportunities.

There are the top-notch ones, which are known to only the innermost of the insiders. Then there are those more publicized good deals in which major Wall Street outfits jostle each other to get a fraction of the play. Further down the ladder, there are other opportunities that can find the needed financing without going beyond familiar sources of capital. And then there are truly marginal opportunities in which the promoters have to struggle to get any money at all, and are willing to go to the extremes, in this case the extreme of accepting a complex government program and limiting their take to half a million per investor.

It is these bottom-of-the-barrel investment opportunities that predominate in the EB-5 program. If you cannot get money for your new business, except by offering a green card to every member of the investor’s family, maybe it’s not a very attractive business.

I have a bit of an insight into the venture capital world, because I have a relative who is a success in it. With a Harvard MBA, a PhD in chemical engineering, and years in the business, etc., he would laugh at the notion of raising venture capital in half million dollar tranches, which is the only way to do it in the EB-5 program.

So there are few, if any, success stories in the EB-5 field.

On the other hand if you keep your eyes open in a specialized way, as I have, one sees lots of newspaper articles about real or thwarted scandals, disasters and failures among the EB-5 programs.

Let me offer a partial list of such troublesome investment schemes, all of which secured negative press attention in the past year, and some of which have been mentioned earlier in this report:

- What turned out to be a bankrupt dairy farm in South Dakota, where 16 of the 17 jobs created, albeit briefly, turned out to be held by illegal aliens;35

- A convoluted effort, eventually rejected by USCIS, to use some legitimate money and some questionable (Iranian) funds to revive the old Watergate Hotel in Washington;36

- A scheme that was so lacking in integrity, in the Mojave Dessert in California, that the sponsoring EB-5 regional center itself was terminated;37

- Similarly, a mixed-use real-estate development in El Monte, Calif., with a highly controversial set of developers, has collapsed taking down another EB-5 regional center;38

- An artificial sweetener factory project in central Missouri that was to be supported by $8 million in EB-5 money, $39 million in municipal funds, and $17 million in state money that collapsed;39 and

- A would-be gambling casino near Baltimore that would require careful gerrymandering of economic districts to allow for the desired half-million dollar investments.40

Noted above are just some of the investment schemes that went badly or were deeply controversial; in addition, there are strong indications that the middlemen entities, who along with USCIS promote these schemes, are not, as a group, doing very well either.

I am thinking of the EB-5 regional centers. As of January 13, 2012, there were 211 of them41 and with a cumulative investment in the program of $1.5 billion, that’s about $7.1 million each, and much of that investment has been withdrawn after the mandatory two years. Some of the older ones, of course, have much more than the average, but an average portfolio of some portion of $7.1 million is not much.

The best year to date, according to our previously noted estimate, brought $191 million in new investments to the nation in FY 2009; that number divided by 211 would produce less than $1 million in new investments, on average, for each of the EB-5 regional centers. There were, of course, fewer such centers in being that year, but again, it shows the slimness of the program.

The EB-5 regional centers make what money they do from fees laid on the investors, and perhaps on the investees as well. To the best of my knowledge they receive no direct income from USCIS, and, in fact, must pay a one-time fee of $6,230 to that agency.

Further, as immigration lawyer and Cornell Law School professor Stephen Yale-Loehr said on a radio interview program, it costs at least $100,000 in legal and consultants’ fees to start one of these programs.42 He should know — he founded the EB-5 regional center national trade association. It all sounds like slim pickings in a crowded field except for a small minority of these entities.

So, if there are at the micro level no visible EB-5 success stories, if the job-creation data is inconclusive, if there are flurries of scandals and failures, if even the EB-5 middlemen and promoters are not doing very well, and if, on a macro level, the addition to foreign investment is minuscule, why continue the program?

Migration Results. The EB-5 program, like most portions of the immigration system, is written in worldwide terms; theoretically, rich investors from Haiti as well as from Switzerland can qualify for it, but many specific immigration programs are, in fact, dominated by people from a given area.

Think about refugee programs, for instance, that have from time to time been primarily Cuban or Vietnamese; or the temporary farm worker programs that once had been almost completely staffed by Mexicans. Currently the Visa Lottery, once created for the Irish, has 49 percent of its admissions from Africa.43 Similarly, people from India were far more numerous among the H-1B admissions in FY 2009, 48 percent, than anyone else.44

The EB-5 program, not surprisingly, is dominated by Mainland Chinese, who occupied 51 percent of its slots in FY 2010. Indeed, fully 78 percent of the places that year were taken by Asians. The top 10 nations, as reported by the annual report of the Visa Office that year, were:45

| Nation | EB-5 Preference Visas Issued FY 2010 |

| China | 581 |

| South Korea | 172 |

| Great Britain | 86 |

| Taiwan | 45 |

| Iran | 35 |

| South Africa | 31 |

| Russia | 29 |

| India | 15 |

| Mexico | 14 |

| Vietnam | 13 |

| All others | 118 |

| Total | 1,139 |

New Zealand, a country mentioned later in this report as one seeking to attract immigrant investors, also sent some our way. It just missed the cut above with 10 incoming EB-5 visas in FY 2010. Each and every family member is counted by the Visa Office, so we cannot know how many investments are represented by 1,139 people, but I would estimate some 400-500 of them. It should be noted that these visas were issued at the I-526 level, and do not reflect the smaller totals of those granted green cards through the program that year.

The dominance of the Asian investors has persisted in recent years, though the percentages have dropped a little bit recently. In FY 2007 the Asian percentage was 89 percent, 82.3 percent in FY 2008, 83.4 percent in FY 2009, and 78 percent in FY 2010.46 Incidentally, there are websites, created by U.S. promoters, in Mandarin pushing the program.47

The data shown above relate only to EB-5 visas granted overseas, and not to adjustments of status here in the States. Presumably the distribution by nation of origin among the adjustees is roughly similar to that of those applying overseas.

How many people come to the United States on a green card basis because of this program? This is hard to pin down because the Office of Immigration Statistics of DHS, a consistently reliable source regarding immigration data, counts the admissions and adjustments of people with conditional visas, and does not subtract out the ones who fail to stay in the country.48 We do know, however, that in the 6.5 years covered by Table 2 that members of 1,347 investor families were granted green cards, or a little more than 200 families a year, on average.

Competing Immigrant Investor Programs

The American EB-5 program does not exist in a vacuum. There are many competing programs, all linking visas of various kinds to investments of various kinds and sizes.

One of the reasons why the number of success stories, and of visa-carrying EB-5 investors, is so small is because of the relative attractiveness of these other programs.

This is shown clearly in Table 4, which compares use of the EB-5 program to those of the roughly comparable programs in Australia, Canada, and New Zealand. There is also a similar program in the United Kingdom, but I was unable to untangle useful data on the extent to which it is used.

Note that in some years tiny New Zealand, whose economy is less than 1 percent of ours, attracted more immigrant investors than the United States. In many years the smaller-than-the-U.S.-economies of Australia and Canada also had attracted more immigrant investors than we did in the EB-5 program. (Comparing immigration data across nations often involves some definitional matters so it is not an exact procedure, but the raw numbers in the lower half of Table 4 are remarkable, contrasted to the EB-5 numbers, considering the sizes of the various economies.)

What is even more remarkable, however, is the competition within the United States with the State Department’s rarely discussed non-immigrant investors’ program for Treaty Investors (E-2). In 2005 the E-2 program issued almost 100 times as many visas as EB-5; and by 2010, the ratio was still about 10 visas for the State program to one in the USCIS program.

We are not dealing with apples and oranges here, more like oranges and tangerines, and that needs a little explanation. There are four major differences between the two programs.

First, EB-5 (the smaller of the two programs) is worldwide in scope, while the larger E-2 program is limited to nations with whom we have investment treaties.49 China is not on the list, so all would-be Chinese immigrant investors are forced into the EB-5 program.

Second, the State program is a nonimmigrant program, while the USCIS program grants both conditional and later (and less often) permanent resident cards. That difference is vitiated, however, by the fact that E-2 visas can be extended indefinitely, year after year. Similarly, both the E-2 investor and the spouse can work in the United States, but not the children. The investor can work full-time with the business, and the spouse can get an Employment Authorization Document for other work.50

Third, the State Department program, although formally called the Treaty Investor program, is for entrepreneurs, while the USCIS program, which often refers to its clients as “entrepreneurs,” is really designed for investors, including passive ones.

Fourth, and crucially, as we explain below, the State program requires much less money than the USCIS program.

The State Department’s rules call for a “substantial investment” in the United States, one that must be managed by the investor. How large is “substantial”? The rules do not say, but when I checked the program on Google, the first three references all said, in effect, as little as $50,000.51 That’s only one-tenth of the minimum investment of $500,000 in the EB-5 program. Further, another attraction of the E-2 visa is that the investor can — and must — make the investment on his or her own, and does not need to work with any fee-collecting middlemen. Though I do not bow deeply to the concept of the free market, I must say that the design of the E-2 program is much more market-oriented than the design of the EB-5 program, and this clearly pleases some alien investors.

The attractions of the E-2 program are, thus, obvious and the much greater participation in that program, as compared to the EB-5, is totally predictable. What I find curious is that there has not been more media attention paid to the treaty investors.

Thinking about that a little, I concluded that there are a whole raft of reasons why there has been so little notice given to the E-2 program. They are, in no particular order:

- Each project is a small and self-standing one, and thus largely invisible;

- Each project has been approved quietly at some distant place, such as Tokyo or Mexico City;

- There are no local institutions in America, like the EB-5 regional centers, to generate news;

- While some immigration lawyers promote the program, there is nothing like the middleman-stuffed infrastructure that is associated with the EB-5 program;

- To my knowledge, the State Department is not actively promoting the program;

- Program denials do not lead to court-like appeals and thus published decisions;

- It is a quiet, one-step process, involving a single agency, the State Department;

- Since it nominally grants only temporary visas, there can be no controversy about the “sale of green cards;”

- I hate to think it, but there are no wealthy Chinese to stir journalistic juices; and

- In Washington, at least, this is a permanent program and requires no legislative extensions.

Given these factors, there is not much media coverage of the program, so its inevitable frauds and failures do not attract the attention that similar problems in the EB-5 program do. I also think we know a lot less about E-2 than we do about EB-5.

I must admit that, despite decades of watching various parts of the immigration system, before I started writing this piece I had not paid much attention to the Treaty Investor program52 or thought much about how, with one-tenth the financial demands, it gets 10 times the response of the more widely discussed EB-5 program.

As to who uses the E-2 program the most, it is the Japanese who predominate. Looking back to the listing of the 10 nations most likely to use the EB-5 program, Japan is not even mentioned there.

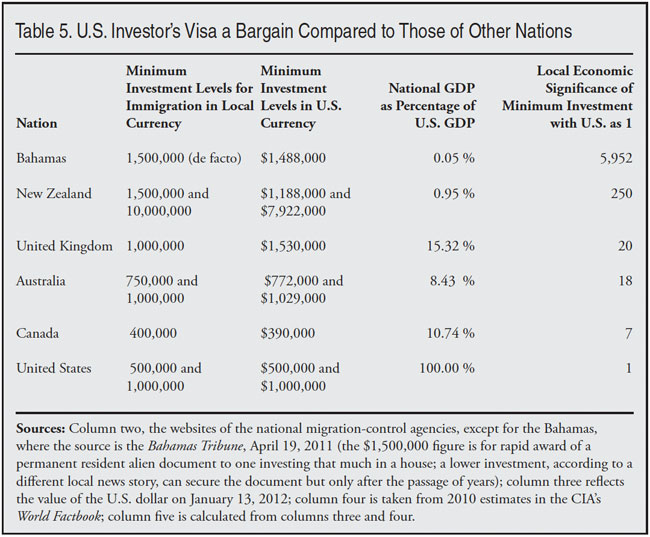

The Relative Price of an EB-5 Green Card. There’s another factor — an international comparison — that is a further indicator that the United States has priced its investor green card too cheaply. This is the comparative size of the minimum investment needed for a migration benefit as that relates to the size of the overall economy of the nation receiving such an investment.

To take a dramatic example (perhaps an overly dramatic one), it is obvious that the placement of a given amount of overseas money in the Bahamas, for example, is more important to its overall economy than investing the same amount in the United States. As a matter of fact, as Table 5 shows, the Bahamas insists on three times the U.S. minimum for immigrant investors, and since the U.S. economy is 2,000 times as large as that of its island neighbor, the minimal investment in the Bahamas, at $1.5 million, has nearly 6,000 times the impact on that nation’s economy as a half-million dollar investment does here.

Table 5 shows that the other nations seeking to import investors all get much more for the minimum investment than we do, using that measure, by margins of from seven-to-one to 250-to-one.

Incidentally, just because these other nations are getting a much larger financial boost than we are for each minimal investment does not mean that their programs are less popular than ours; far from it, as Table 4 shows.

I do not like the idea of selling our visas at all, but if we do, we might as well get more for them. Here are some domestic statistics that suggest the current investment levels are too low.

First, the dollar is not what it used to be; it would take only $290,000 in 1990 dollars to equal $500,000 today. Just to keep pace with inflation, we should increase minimum dollar amounts by 74 percent — better that we round that up to a 100 percent increase.

Second, the sum of half a million dollars is not really an impressive amount of money when you compare it to the average (mean) net worth of American families generally. That figure in 2007 according to the Census was $556,300, with the median number, of course, being a lot less.53

Should we offer visas to aliens with money, because they have money, and then make that offer to families investing less than the mean net worth of American families? It’s like deliberately recruiting teenagers who are five feet, six inches tall to make the high school basketball team, on average, taller.

Concluding Comments and Recommendations

Denied much of the basic data, as the public is, it is still possible to offer some comments about the objectives, structure, operations, and results of the EB-5 immigrant investor program.

One: The program is based on the wrong set of values. Immigration visas should be regarded as precious. Clearly the United States, with its fraying infrastructure and its massive unemployment, does not need additional people. Visas should be saved for spouses of citizens, truly talented and well-educated aliens, and genuine refugees fleeing real dictatorships who have no other options. Selling our visas to unimpressive people (who cannot be admitted otherwise, or else they would not be applying to EB-5) with unimpressive amounts of money, for too low a price, is a terrible waste of a valuable resource.

Two: The program is badly designed. It is too complicated as it tries to do too many things with inadequate resources. I am no foe of government intervention to make America a better place to live (such as the existing Social Security system or the proposed Canadian-style health insurance program), but there are good designs and bad ones. EB-5 is a bad one.

In this case, the government is trying to force a tiny resource — immigrants bearing small tranches of investment funds — into locally acceptable investments in low-income areas while preserving the free market. Further, this adventure in economic development is being managed by an agency that, historically, has had absolutely no experience with this sort of thing.

Three: Because of the problems noted above, the response in terms of investment funds, and people with these funds securing green cards, has been minimal, though it has increased in the last couple of years. The tiny size of the program is obvious when the amount of money raised in it is compared to the huge flow of foreign investment coming to the United States each year through other channels.

The lackluster response by aliens to this frankly difficult program has been perfectly rational, and it may also reflect that many aliens with small pots of money are no longer as enamored with the United States as we would like. That would be a truth that is hard to swallow.

Four: The tepid response to the EB-5 program is particularly remarkable when compared to the much more enthusiastic response to other nations’ immigrant investor programs, and the rarely discussed E-2 (Treaty Investor) program run much more casually by the State Department. That program, incidentally, is for entrepreneurs who actually run businesses, while the EB-5 program is mostly for passive investors. State has that part right.

Five: So EB-5 should be allowed to die.

These comments are confined to the EB-5 program; the larger, looser, and more popular Treaty Investor (E-2) program of the State Department is worrisome, but I have too little knowledge of it to make further comments.

A Replacement for EB-5? If a replacement program is thought to be needed — and I would rather phase out the current one — let it be both simpler and more demanding. I could see a formula that demands that visas be given only to entrepreneurs with proven track records and substantial amounts of cash, and no visas be given to passive investors.

The formula might well be at least $1 million to be invested in the right kind of job-producing new business — no real estate developers, for example — another million to be lent to the U.S. government or to one of the states at zero interest for four years (to bring some distinctly public benefits into the program), and yet another million as a cushion against the possible failure of the investment. There would be a four-year conditional visa, and the commercial decisions should be made by an agency other than USCIS, perhaps the Commerce Department.

Finally, if there is to be such a program, it should be totally transparent and the kind of nuts- and-bolts-information, now quite secret, should be open to all.

End Notes

1 U.S. Commerce Department data as quoted in a recent Bureau of Economic Analysis press release, http://www.bea.gov/newsreleases/international/intinv/2011/pdf/intinv10.pdf.

2 The $191 million investment total estimate is based on the number of investors in 2009 who successfully filed I-829 petitions (there were 347 of them that year, the peak in the program’s history). Approvals of these documents confirmed that their investment obligations had been met, and granted the investors and all members of their immediate families green cards for life. For the number of such approvals, over the years, see the bottom row of Table 2. The dollar total estimate is based on the (frankly generous) assumption that as many as 10 percent of the investments were at the $1 million level, and the rest at $.5 million. The math is:

(312 x $.5 million = $156 million) + (35 x $1 million = $35 million) = $191 million.

Unfortunately, USCIS has never published data on the amounts of money invested through these programs.

3 Interpreter Releases, December 21, 1990, p. 1474.

4 INS (the Immigration and Naturalization Service) was subsequently broken up and the new agency that wound up handling immigration benefits, including the EB-5 program, was named U.S. Immigration and Citizenship Services (USCIS).

5 See http://www.eb5vermont.com/blog/blogpost.php?blog_post_id=36, the website of Vermont’s EB-5 regional center, the only in the nation, it says, to be sponsored by a state government. The balance of the EB-5 regional centers are private, for-profit entities.

6 See http://www.cmbeb5visa.com/EB5_InDepth.aspx, the website of another EB-5 regional center, CMB Export LLC, in Rock Island, Ill.

7 Mayorkas is a presidential appointee. He has solid California Democratic connections and during the Clinton administration became the nation’s youngest U.S. Attorney. He has shown himself to be devoted to “streamlining” USCIS operations generally. He is, however, in charge of an agency that is almost totally staffed with career civil servants, many of whom had served with INS in the past.

8 In contrast, until about a dozen years ago there used to be a very straightforward exchange offered by the Kingdom of Tonga in the South Pacific, largely designed for wealthy residents of what was then the British Colony of Hong Kong; quite simply, you could buy a Tongan passport for cash. The whole scheme came a cropper when other governments noticed that holders of this kind of passport, though allegedly citizens of the kingdom, were not allowed to enter Tonga. Consequently, other nations, including the United States, decided not to honor the document, and sales evaporated.

9 Through these various provisions Australia apparently is seeking to tilt the balance of incoming investors to younger people, and to people with sizeable enough assets to stay financially viable even if they lose every penny of their migration-creating investment. Australia also demands some serious business management experience of its would-be investor immigrants. (Many years ago, on an assignment from the Australian Embassy in Washington, I conducted an evaluation of that nation’s migrant entrepreneur program.)

10 A good example is American Life of London; it specializes in EB-5 real estate investments in a sagging part of Seattle (my description, not theirs). See their website at http://www.amlife.us/.

11 See the website for The Association to Invest in USA, at https://iiusa.org/.

12 See the website for EB5 Info, at http://eb5info.com/.

13 See http://www.uscis.gov/files/form/i526instr.pdf.

14 The wealth of tiny type at the bottom of Table 3 illustrates some of the problems with USCIS statistical data on this and other programs. Numbers, when they are not missing completely or partly missing, are inconsistent in format; they rarely are in one or two easy-to-find locations, and they often are difficult to follow when available. Hence the notes to the table have to explain that sometimes, for example, total receipts of a given application are available, and in other instances we have to construct a proxy of total receipts by adding the approvals and denials, which may not be accurate because of other outcomes or non-outcomes.

15 To read these appeals decisions, see http://www.uscis.gov/portal/site/uscis/menuitem.2540a6fdd667d1d1c2e21e10....

16 For a comment on AAO, and the fumbling would-be secrecy associated with an EB-5 case involving a dairy farm that went bankrupt in South Dakota, see this blog: “Case Study: Alien Investor Program Has a Spectacular Failure in S. Dakota”, http://www.cis.org/north/investor-visa-spectacular-failure.

17 Sometimes the AAO clerk would redact the word “Watergate” but leave the rest of the phrase intact, sometimes the whole phrase would survive.

18 For more on this see my CIS blog, “Another Watergate Mystery”, http://www.cis.org/north/watergate-eb5-scheme.

19 See “Rules Stretched as Green Cards Go to Investors”, by Patrick McGeehan and Kirk Semple, The New York Times, December 19, 2011, http://www.nytimes.com/2011/12/19/nyregion/new-york-developers-take-adva....

20 P.J. Huffstutter, “In U.S. visa program, money talks”, Los Angeles Times, September 3, 2011, http://articles.latimes.com/print/2011/sep/03/business/la-fi-easy-visa-2....

21 For information on a typical gathering of this kind, the one on June 30, 2011, see http://www.uscis.gov/portal/site/uscis/menuitem.5af9bb95919f35e66f614176....

22 See, for example, this one headed “USCIS Announces ‘Entrepreneurs in Residence’ Initiative”, http://www.uscis.gov/portal/site/uscis/menuitem.5af9bb95919f35e66f614176.... The headline is more than a bit misleading, as the EB-5 program deals mostly with passive investors, not entrepreneurs.

23 See http://www.uscis.gov/USCIS/Outreach/Feedback%20Opportunities/Operartiona....

24 There were certainly stories about such appearances, and other outlandish claims of farmworker status filed by urban types, recounted by INS staff members during the IRCA legalization of 25 years ago, which I studied for the Ford Foundation. There were special, low-barrier amnesty rules for farmworkers in that program, and this attracted literally thousands of “farmworkers” to apply for legal status in New York City.

25 This West Coast application was denied for a host of reasons. The AAO decision opened this way: “The bases of denial included: (1) the appellant’s failure to demonstrate that it existed....” (The would-be center had identified itself as having an “Inc.” in its name, but AAO found that it had not been incorporated.) For the full text, see http://www.uscis.gov/err/K1%20%20Request%20for%20Participation%20as%20Re....

26 I make the caveat “that I know of” in this instance because it is perfectly possible, given the general ineptitude of the AAO’s clerical staff, that there may well be other cases regarding EB-5 regional center certifications that have simply have been misfiled electronically. To support this statement one only needs to examine the AAO’s collection of FY 2009 appeals of I-526 and I-829 decisions filed in this the agency’s B-7 category at http://www.uscis.gov/portal/site/uscis/menuitem.2540a6fdd667d1d1c2e21e10....

There are 35 cases in this file, but seven of them belong in other categories (such as fiancés of U.S. citizens) and only 28 of them are appropriately filed. Similarly, in the K-1 category, of appeals regarding regional centers, two cases are listed for 2009, but they are duplicates of each other. This is the same staff that, as noted in End Note 16, routinely mishandles the AAO’s silly attempts at secrecy.

27 The other of the two known AAO decisions on regional centers, this one in 2009 regarding a center linked to a proposed casino near Baltimore, can be seen at http://www.uscis.gov/err/K1%20-%20Request%20for%20Participation%20as%20R....

28 See http://www.cis.org/north/EB5-little-fat-cats.

29 See http://www.eb5greencard.com/.

30 For the source of this quotation, see End Note 22.

31 See http://articles.baltimoresun.com/2000-02-20/news/0002220371_1_investor-v... INS general counsel at the time, David Martin, played a major role in correcting the problem.

32 See http://www.cmbeb5visa.com/EB5_InDepth.aspx.

33 The $743 million investment estimate stems from calculations based on row 4 of Table 2.

34 Immigration and Customs Enforcement publicists, for example, run weekly roundups of “ICE’s top 5 news stories of the week”, i.e., their success stories, one of which can be seen at http://www.ice.gov/news/releases/1201/120106washingtondc2.htm.

35 See End Note 16.

36 See my blog “Another Watergate Mystery”, https://cis.org/North/Another-Watergate-Mystery.

37 See my blog “USCIS Does the Right Thing on Immigrant Investor Scheme in the Mojave”, http://www.cis.org/north/mojaveinvestorvisascam.

38 See my blog “Total Crash of Calif. EB-5 Project Makes USCIS Look Careless”, http://www.cis.org/north/totalcrashofcaliforniaeb5program.

39 See Associated Press, “Missouri AG investigates Mamtek project”, http://news.yahoo.com/missouri-ag-investigates-mamtek-project-004608864.....

40 See End Note 27 and my blog “Dubious Casino Investment Linked to Dubious Immigration Program”, http://www.cis.org/north/dubiouscasinoinvestmentEB5.

41 For the full, official USCIS list, see http://www.uscis.gov/eb-5centers.

42 Heard on the WAMU’s radio talk program, “The Kojo Nnamdi Show”, September 28, 2011, http://thekojonnamdishow.org/shows/20110928/investmentimmigration/transc.... As one might expect, the “balance” on the program was displayed by having two speakers, one, Yale Loehr, an immigration lawyer, and the other, Demetrios Papademetriou, head of the nation’s leading pro-migration think tank, the Migration Policy Institute.

43 2009 Yearbook of Immigration Statistics, Table 11.

44 See Characteristics of H-1B Specialty Occupation Workers/ Fiscal 2009 Annual Report, p. ii, http://www.uscis.gov/USCIS/Resources/Reports%20and%20Studies/H-1B/h1b-fy.... Sadly DHS publishes nothing as comprehensive as this volume on the EB-5s.

45 Table V, http://www.travel.state.gov/pdf/FY10AnnualReport-TableV-PartIII.pdf.

46 Ibid.

47 See http://www.yiminchaoshi.com/index.php/archives/2667.

48 Telephone conversation with Michael Hoefer, Director, Office of Immigration Statistics, DHS, October 2011. This Office, by the way, is not part of USCIS, and publishes statistics regarding all the immigration agencies in DHS.

49 For the full list of E-1 (Treaty Trader) and E-2 (Treaty Investor) nations see http://travel.state.gov/visa/fees/fees_3726.html; I counted 80 nations on the E-2 list, including Taiwan, but not Mainland China.

50 For the State Department’s rules on the E-2 program, see http://travel.state.gov/visa/temp/types/types_1273.html#14.

51 See, for example, this article in the Los Angeles Times on May 16, 2011: “E-2 visa helps many non-U.S. citizens start small firms”, http://articles.latimes.com/2011/may/16/business/la-fi-smallbiz-visa-201....

52 The State Department also operates a Treaty Trader (E-1) program that has substantially different rules than the E-2 program, and is not really comparable to the EB-5 program.

53 See http://www.census.gov/compendia/statab/2012/tables/12s0721.pdf.