The answer to the title question is "when the government says so," at least in a recent case involving 99 violations of the employer sanctions law.

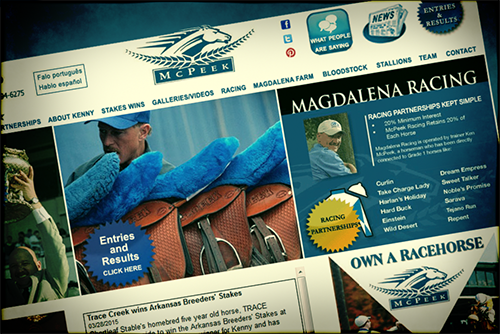

If you look up the website of Kenny McPeek's Racing, a race horse training operation, you will find these evidences of prosperity and success:

Shortleaf Stable's homebred five year old horse, TRACE CREEK swung wide to win the Arkansas Breeders' Stakes at Oaklawn. He is the 160th stakes winner for Kenny and has bankrolled $261,659 for his connections.

MGSW millionaire GOLDEN TICKET was far back early and rallied through traffic to get up for third in the G3 Razorback H. at Oaklawn. He is owned by Magic City Thoroughbreds and was bred by WinStar Farm LLC. He has now earned $1,358,090 for his connections.

On the same day KING OF NEW YORK broke his maiden also at Oaklawn. He has been knocking on the door and already has $110,220 in earnings.

"Connections" are the horse's owners and trainers. "Breaking his maiden", though it may sound like some kind of barnyard violence, means that the horse in question has won his or her first race. The sum of the dollar figures for just the three horses quoted above is $1,729,969.

McPeek is a horse training not a horse ownership entity, but is clearly rubbing elbows with big money and is a successful enterprise.

How does all this relate to immigration? Well, McPeek, like all employers, is supposed to have a complete set of I-9 forms for its employees; it is on this form that the worker verifies to the employer that he or she is in the country legally. Although Immigration and Customs Enforcement found no illegal aliens on the McPeek payroll, it did find that the firm had failed to handle the I-9s in a legal manner on 99 occasions. In 58 cases, it had no I-9s at all in its files.

ICE, using a complex formula, decided to fine the stables $64,795.50. McPeek, while not denying the charges, then exercised its right to appeal the size of the fine to the obscure Justice Department entity that handles these things, the Office of the Chief Administrative Hearing Officer, in the Executive Office for Immigration Review.

The CAHO, as it does too often, then reduced the fine to $35,900, saying that this is a "small business", and the size of the fine would be damaging to the stables. It also reported that McPeek had a gross income of $5,873,408 in 2013 and "ordinary business income" of $248,383. McPeek is an S corporation and the "ordinary business income" is presumably defined by that business-friendly law. The text of the decision can be seen here.

So you can be handling millions and millions of dollars as your firm helps the rich play the "sport of kings" but to this administration, yours is a small business.