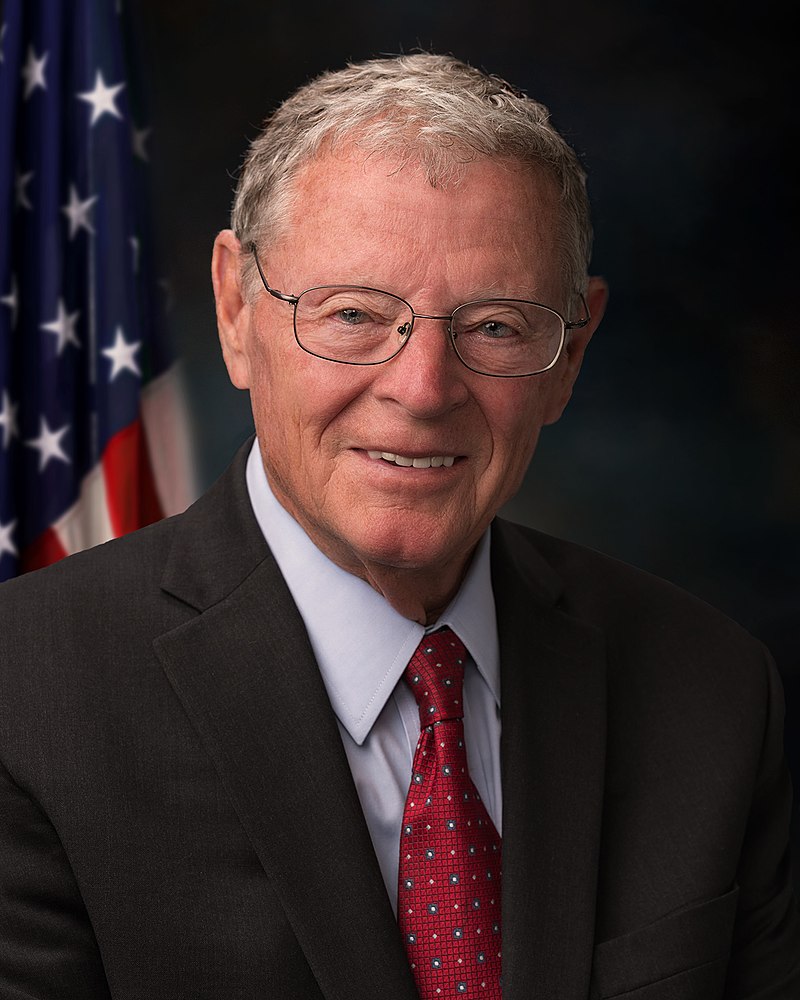

Sen. Jim Inhofe (R-Okla.) and three colleagues have finally done something that should have been done years ago; they have introduced legislation that will:

- Stop sending illegal aliens billions a year for staying in this country; and

- Use those savings of some $33.5 billion, over a 10-year-period, for building a wall along the southern border.

Sen. Inhofe was joined in the introduction of S.3713, "the WALL Act" by Sens. Ted Cruz (R-Texas), John Kennedy (R-La.), and Mike Rounds (R-S.D.).

Congress' Joint Committee on Taxation has certified the estimate of the net level of savings, dealing with both the gross amount of savings, and the costs of administration.

My colleague Jan Ting and I have suggested in the past different ways of adjusting existing government benefit and refund programs to provide funding for the wall and other migration enforcement operations.

The senators have cut through the smog enveloping Social Security numbers, and have crafted a bill that will prevent most — if not all — of the little-understood but widespread misuse of SSNs by illegal aliens.

What the senators have figured out, something that too many decision-makers and voters do not know, is that all SSNs are not equal, and only some of them should be used when someone wants something from Uncle Sam. Here's the situation:

- Most SSNs are issued to those who may work legally; others are issued for non-work purposes; some of the work-related ones issued to aliens are time-limited.

- SSN's are issued to a given individual, and are not to be transferred to others.

- Some potential SSNs are, to use the insider's term, "impossible numbers" in that they have the xxx - xx - xxxx sequence, but they have never been issued. Their use is relatively rare.

- There are also Individual Tax Identification Numbers (ITINs), which are issued to those not entitled to work legally, but may be used by aliens to report stock dividends, for example.

- Government benefits should be issued only to possible SSNs that were issued for work purposes and can still be used for work, and that were issued to the individuals claiming the benefits. No income tax-related benefits should go to people with ITINs, which are routinely issued to those who cannot work legally.

- Many illegal aliens lie to the government, in that they are offering someone else's SSN, sometimes a relative's, when seeking tax benefits.

What is shown above is how SSNs should be used, but often are not. Sometimes current law or its interpretations allow other uses of the SSNs and the ITINs. Often, though not always admitted, income tax agencies will look at the number on the employer's W-2 form, and if that matches the 1040 or the state income tax form, they accept the SSN as legitimate, look no further, and issue the refund.

Inhofe's bill, broadly speaking, demands that benefits be handled as in bullet No. 5 above. It deals with a variety of tax programs, such as Earned Income Tax Credits (EITC), Child Tax Credits and Additional Child Tax Credits (ACTC), and welfare programs such as food stamps, Medicaid, and public housing. Also, to quote its summary, it "requires IRS to verify SSNs with the Social Security System to ensure filer's SSNs are valid and match the identity of the filer."

While I am all for spending substantial sums for the wall, it would also be useful to use some of those savings to do some serious nation-building in the Northern Triangle of Central America. Further, IRS should be given enough funding to do all the extra work specified.

Comment. In addition to the commendable provisions about the misuse of SSNs, the bill also contains a provision calling for the imposition of an automatic fine of $300 on every apprehended illegal migrant. I worry about this provision for these reasons:

- Collecting $300 each from presumably millions of illegal aliens, most of whom are low-income individuals, will be an expensive process for the government. While many will be bearing cash, it is pretty clear that most do not have credit cards or U.S. checking accounts.

- Taking money out of the pockets of individuals, moneys that may have been obtained legally in their home countries, has a rather different, and less attractive, flavor, than denying someone illicit public-sector benefits, which is what will be done regarding the misuse of SSNs.

- I am not sure that, even over 10 years, very much money can be collected this way, at least as compared to the non-issuance of illicit tax refunds. If there were one million illegal aliens identified each year, and if the $300 could be obtained from every single one of them (two rather generous expectations) and we did this for 10 years, it would produce $3 billion, or less than 10 percent of the $33.5 billion expected.

But the excellent approach to the misuse of Social Security numbers, notably in the tax system, is a much more important aspect of this bill than the caveat noted above.