The battered EB-5 program took another hit last week when a court ordered settlement failed to be paid.

The factors included the expected set of alien Chinese investors, their $50 million, an unbuilt office tower overlooking Lake Michigan, the U.S. development firm, a U.S. law firm once associated with Jack Abramoff, and a Middle Eastern, near week-long “religious feast holiday.”

The religious holiday allegedly prevented somebody from paying the $50 million debt. It was the eighth time that the promoters missed a payment deadline.

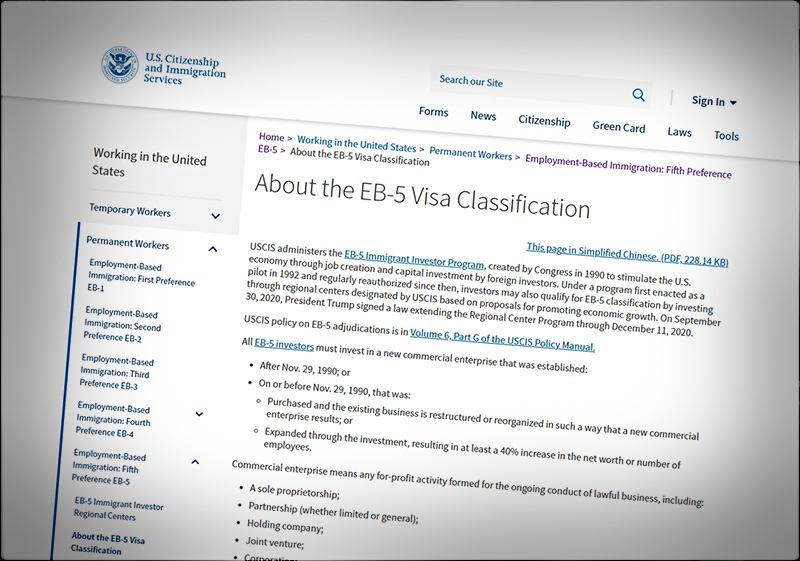

It was just another indication of the extent of corruption and double-dealing in the immigrant investor program which is supposed to provide a family-sized set of green cards to those investors who buy into a project identified by Homeland Security but not guaranteed by the agency.

The minimum level of investment was $500,000 when the Chicago project was put together, but the ante, by a change in regulations, was later increased to $900,000. Earlier this summer Congress did not act to renew the temporary authorization of the pooled investment (and main) part of the EB-5 program. The program's initials come from "Employment-Based", as it is the fifth category in the employment-based segment of the immigration system. It has a limit of 10,000 visas a year, and once attracted much interest from wealthy, but nervous Chinese.

According to the detailed report at Law360, the investors asked federal district court judge Charles Kocoras to invite the U.S. Justice Department to join the case saying: “non-performance is one thing, however, perpetuating a fraud directly on the court is contempt.”

The Law 360 article continued: “The project owners’ latest status report [said] their lender sent them a record of an international wire order for the first part of their loan proceeds on Monday but then notified them on Tuesday that a “significant religious feast holiday... will keep banks closed through the rest of the week.”

How the money got from China to Chicago to somewhere in the Middle East was not explained, but such multi-transfers are not new to EB-5.

The law firm representing the project owners is Greenberg Traurig LLP.