Today’s news about the EB-5 (immigrant investor) program is that Rep. Mo Brooks (R-Ala.) has introduced an amendment to the Commerce-Justice-Science Appropriations Bill to defund the EB-5 program, on the dual grounds that it is inappropriate to sell a pathway to U.S. citizenship, and that large numbers of Chinese investors have abused the program.

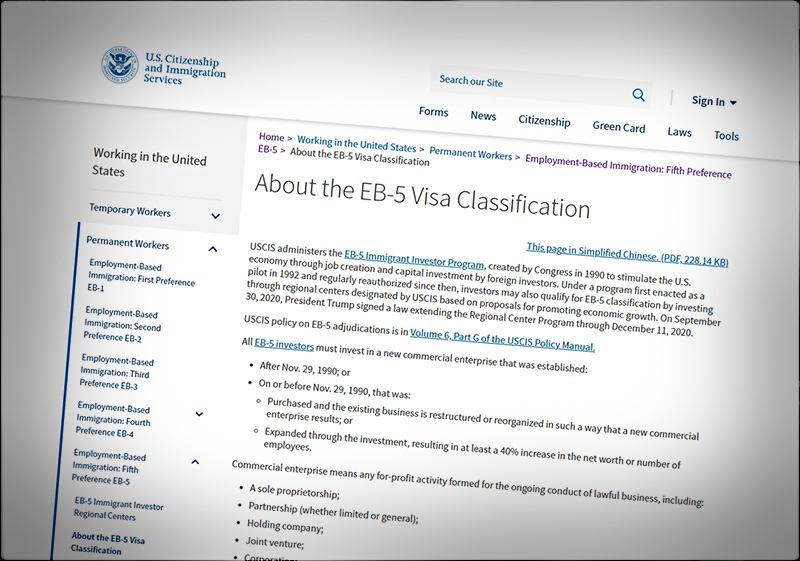

The program had allowed foreign investors to secure a family-sized set of green cards if they help finance Homeland Security-approved but not DHS-guaranteed investments. The minimal amount of the investment had been $500,000 for years; that was increased by the Trump administration to $900,000, but that number was shaved (at least for the time being) by a federal judge in June, back to the $500,000.

Brooks’ proposal – a creative, if long-shot one – is quite different from another problem facing EB-5: that is its congressional authorization ran out on June 30, and has not yet been revived. A federal program needs both funding and authorization to function.

On this issue, and probably no other, the conservative Rep. Brooks stands shoulder to shoulder with ultra-liberal Sen. Dianne Feinstein (D-Calif.); they both want the EB-5 program to die.

Meanwhile, the program’s boosters are whistling past the graveyard as they summon feeble arguments about its future. A blog post this week at eb5investors.com, operated by an EB-5 middleman firm, carries the heading “Mexico’s EB-5 market is primed for growth” and boasts:

The Mexico market is expected to see greater growth in the EB-5 market, industry insiders say. The economic and political conditions make the country ripe for greater interest by Mexican investors in the EB-5 program.

The authors of this are right about one thing: there is room for growth in the Mexican part of the program. They carefully did not offer any statistics on their optimism, and here’s why: visas issued to Mexican investors have never topped one percent of the world total. The program carries a long-established legislative cap of 10,000 visas a year. The State Department shows these EB-5 visas issued in Mexico in three recent years:

2018 66

2019 77

2020 28

Since there are about 2.5 visas per investment, this means that in fiscal year 2020 there were probably about 11 Mexican investments, then worth perhaps $900,000 each, totaling less than $10 million, a tiny droplet, more of a drip, in the multi-trillion-dollar foreign direct investment in the U.S.

The writers are correct that there are some rich Mexicans who are nervous about their country’s leadership and might well want a second passport. But an increase of eleven whole visas (from 2018 to 2019) is hardly a significant sign, and the 2020 data shows an even smaller program.