Today's collection of items on the immigrant investor (EB-5) program contains news from London, Washington, Houston, and Los Angeles — including yet another addition to the long list of multi-million-dollar mis-directions of EB-5 funds on this side of the pond, and an indication that the Brits place a price on a two-years-to-permanent-residence-alien-investment visa that is 25 times larger than ours.

That's £10 million (about US$12.6 million) for them, as opposed to $500,000 for us.

I happen to think that selling migration visas, like selling your sister into slavery, is a bad idea, but if you are going to do so you might as well make some serious money out of the deal. The Brits apparently agree with the last part of the prior sentence.

London. Whereas in our immigrant investor (EB-5) program a major perceived problem is the swindling of alien investors by U.S.-based middlemen, the major concern in the UK is that some to many of the incoming migrant investors may have secured their funds in inappropriate ways.

Apparently as a result of such worries, according to the New York Times, the Home Office announced the suspension of its Tier One visa, for investors, and then a few days later reversed the suspension.

What caught my eye in this story was not so much the wobble in policy, but the high price of the Tier One visas, and the stark simplicity of the program itself. Looking a little further (see here and here), I found that there are three flavors of what is known in Britain as the Golden Visa.

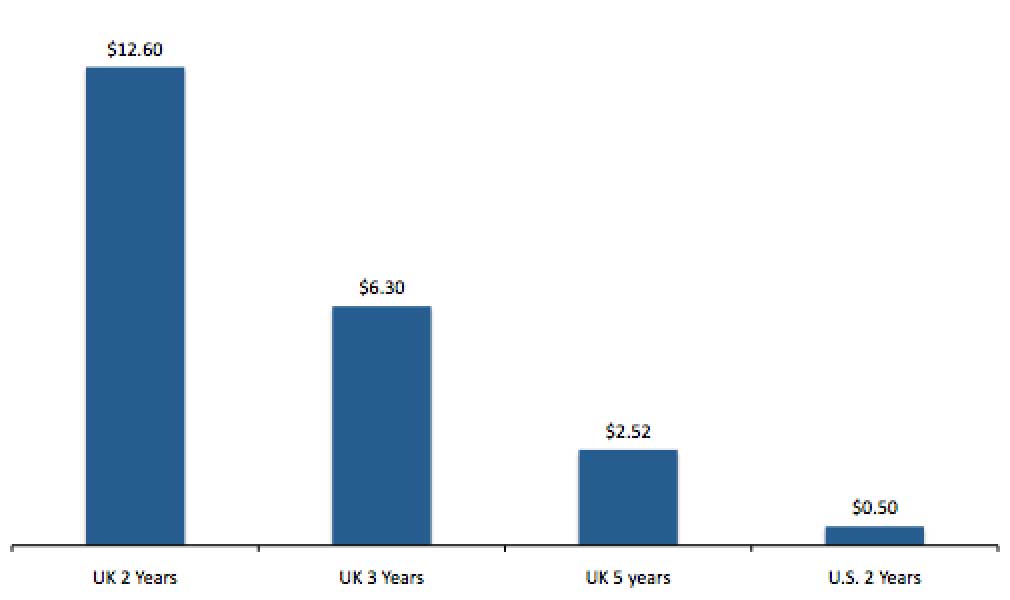

If an alien invests £10 million, the investor and spouse and children under 18 can apply, after two years, for indefinite leave to remain (i.e., a British green card); this is the equivalent deal to our EB-5 program. If the investment is £5 million, the indefinite leave to remain comes into play after three years, and for an investment of £2 million, it takes five years. These three levels work out to $12.6 million, $6.3 million, and $2.52 million. We have a fixed price of $500,000 and have had it for more than a quarter of a century.

Waiting Times & Minimum Investment, UK Tier One Visa vs. U.S. EB-5 (in millions of US$) |

|

While the price is higher in the UK, the program is much simpler. There are no regional centers, as we have; there is no concentration in urban real estate, as we have; and, most importantly, the investor is operating in the free market, as our EB-5 investors are not. Tier One visas are available when the investor shows investments, at the appropriate level, in such things as government bonds or shares of stock. Our investors must invest in projects that have been both approved by DHS and designed by U.S. middlemen, and which tend to pay no more than 1 percent or 2 percent in interest.

Further, the fees there are fewer and lower; I saw an internet ad for a Tier One legal fees at £10,000 ($12,600), the government's own fee is about $2,000, and there is a cost (not known to me) for mandatory medical insurance.

Washington. At the moment, the heart of the American EB-5 program is due, yet again, to expire, this time on December 21. A program with only temporary authorization, it has been extended again and again through language in the continuing resolutions that keep the government funded. I have lost track of how many times it has been re-authorized this way.

What is interesting this time is that the president says he wants to shut down the government unless he gets at least $5 billion for a border wall. While a number of things are possible in this scenario, one of them is that the EB-5 program, which has been so useful to his in-laws, the Kushners, might be shut down at the same time. This is my own speculation and I have seen nothing in writing on this matter.

Houston. This is the location of a semi-happy ending to a story about the mishandling of EB-5 funds.

There were 90 investors, each of whom put up $550,000 (including a $50,000 fee) for the construction of an EB-5-funded senior housing project in Houston. The project was never built and the middlemen siphoned off $20.5 million for other purposes.

Often, when EB-5 funds are diverted they wind up being spent on yachts, houses, and cars for the middlemen here in the States. This apparently did not happen in this case, which came to light last week when the Securities and Exchange Commission published a civil agreement between the developers and the SEC, which routinely plays the role of cop on this beat.

In this case, all the moneys invested by the 90 were returned to them, along with a little interest, and there was an $800,000 civil fine. The three named respondents, American Modern Green Senior (Houston) LLC, and two other similarly named outfits, were all "100% owned by a master developer that is an indirectly owned subsidiary of a foreign real estate company", which remained nameless.

The foreign real estate company paid up, and kept its name, and those of its executives, out of the public record. The alien investors got their money back (as many in similar situations do not), and a little interest, but no visas. SEC collected the fine. No one was indicted, and thus here we have a semi-happy ending to another EB-5 case.

Los Angeles. While the following item probably should not be news — that an EB-5 project was completed and its 250 investors were repaid their original investments — it was the subject of a press release from Can-Am Enterprises, a user of EB-5 financing. It said it was its 36th such project.

The project itself was unusual in two different ways; first, it was not in real estate; and second, it was,

a $125 million loan ... [a] cash infusion ... used to fund film and television productions in a targeted area located in Los Angeles County. A significant amount of California-based productions relocate to other states, or to Canada, where there are greater finance incentives, including film tax credits that California historically has not offered.

Reading between the lines, I assume that the rock-bottom interest rates endemic to the EB-5 program were used to counter the tax breaks offered by many non-California filming locations, an interesting maneuver. The press release did not spell out that rate. I assume, although this was not mentioned in the release, that the 250 investors got, or are getting, their green cards.