There has been a plethora of bad news for the faltering EB-5 program in recent weeks.

Let's start with a hidden factor: While it's too soon to know for sure, Sen. Chuck Schumer (D-N.Y.) does not appear likely to become the majority leader of the Senate; he is the strongest, and wiliest, of the defenders of the immigrant investor program.

But there are also other dark clouds for the program, which gives a family-sized set of green cards to alien investors who put at least $900,000 into Homeland Security-approved investments, usually in big city real estate deals:

- Immigration Daily, an internet publication for immigration lawyers, predicted on November 9 that "SEC [Securities and Exchange Commission] enforcement will dramatically increase on unregistered finders fees for EB-5 investments, so both issuers and finders who have been operating in the gray area will find themselves on the receiving end of SEC scrutiny and possibly fines."

- Law360, another online site, published a long article on October 20 about how Covid-19 and other forces will, in three different ways, cause a downturn in EB-5 because that program has always emphasized investments that run counter to social-distancing rules.

- Our continuing review of government statistics shows that, by a wide variety of measures, the program keeps sinking.

Let's look at each of these developments.

The SEC. This agency has long been the cop on the EB-5 beat, not the Department of Justice, and certainly not the Department of Homeland Security, which, through U.S. Citizenship and Immigration Services, runs the program.

Why it would "dramatically" increase its already assertive level of activities is a puzzle; the agency is run by presidential appointees, and it will take a while before there is a Democratic majority on the Commission. Maybe Immigration Daily has some information the rest of us lack.

The Nature of EB-5 Investments. While the predicted SEC activities would hamper the crooks in the EB-5 program, the factors described by Law360 would do harm to both the crooks and the non-crooks in EB-5. Here are the key quotations from the article entitled "3 Ways COVID-19 Is Reshaping the EB-5 Landscape": "While commercial real estate as a whole has been affected by the pandemic, EB-5 financing is often used to fund high-profile hospitality, retail and office projects, and these asset classes have been the hardest hit by the downturn."

It goes on to quote an immigration lawyer speaking of these projects as having been "envisioned that people would be coming [to them] in person".

A second factor cited in the article, one that does not relate to the virus crisis, is that the new regulations of last year, in a long-overdue reform, prevent the economic gerrymandering of the hand-crafted bits of geography, or Targeted Employment Areas (TEAs), where projects can be built. Law360 describes the reform in this convoluted manner: "big companies are finding it hard to do deals in TEAs amid changes in 2019 [the new regulations] that shifted classification of some areas from TEA to non-TEA."

It sounds as if the reporter viewed all of America as a TEA, while in reality the TEAs are artificial geographical areas specifically drawn for the EB-5 program. Something like 99 percent of America is not in a TEA.

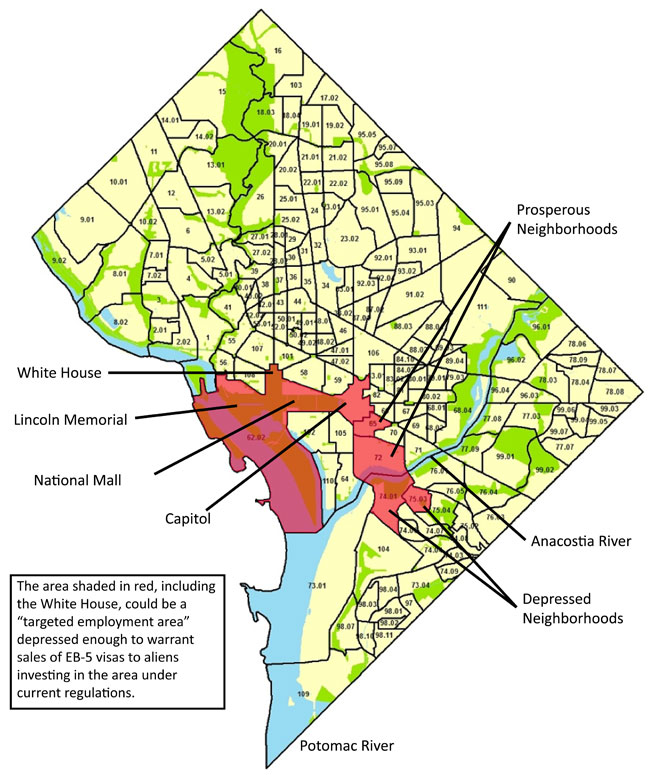

In the past, developers were free to string together large numbers of U.S. census tracts until the new TEA connected the lush downtown location of the project with distant slums where unemployment was high enough so that the whole TEA looked like a depressed area, and thus an appropriate location for an EB-5 project. We demonstrated earlier that one could, using the old rules, put together a TEA that included the White House!

|

The third problem cited by Law360 was described accurately, if incompletely: "The requirement that each [alien] investment create 10 jobs is tricky even in a nonpandemic environment, and the loss of millions of jobs due to COVID-19 is creating headaches for the parties involved."

If one were to present a complete picture, one would note that while the 10 jobs per investment rule was a difficult goal at the old $500,000 level, it is a little easier at the current $900,000 minimum.

The Numbers. One measure of the success of a program is the number of entities that want to play a role in it. EB-5 revolves around the middleman agencies that put together the investors and the projects. These are single-purpose entities called regional centers, which are licensed by DHS, as well as sometimes put out of business by DHS, or deserted by their owners, so the numbers of them are constantly changing. Here are the most recent five running totals:

| December 2018: | 880 |

| September 16, 2019: | 822 |

| January 15, 2020: | 792 |

| July 10, 2020: | 711 |

| October 6, 2020: | 678 |

That is more than a 20 percent decline in less than two years.

How many would-be regional centers are there? These are the numbers for new filings in this fiscal year:

| First quarter, FY 2020: | 1,013 |

| Second quarter, FY 2020: | 604 |

USCIS used to have trouble keeping up with the volume of new regional center applications, but this is a diminishing problem. Here are the sizes of the backlogs recently:

| Second quarter, FY 2018: | 1,598 |

| First quarter, FY 2020: | 149 |

| Second quarter FY 2020: | 137 |

So we see a pattern here; the insiders who run, or who ran, or who want to run regional centers are a dwindling population.

How about the alien investors? We examined State Department data on EB-5 visas issued in the nations that sent us the largest numbers of them:

EB-5 Visas Issued in Selected Nations,

|

|||

| Nation | FY 2018 | FY 2019 | FY 2020 |

| China | 1,321 | 1,359 | 399 |

| India | 134 | 191 | 126 |

| Vietnam | 170 | 168 | 125 |

| Totals | 1,625 | 1,718 | 650 |

|

Source: "Monthly Immigrant Visa Issuance Statistics", |

|||

So these totals are down, too, but Covid-19 is surely a factor for the 2019-2020 trend.

One final measure: At one point recently, all three nations had backlogged immigrant visas because of the operation of our country-of-origin ceilings. Now, only the Chinese visas are backlogged.

The author is grateful to CIS intern Kevin Berghuis for his research assistance.