Download a PDF of this Backgrounder.

Steven A. Camarota is the director of research and Karen Zeigler is a demographer at the Center.

The nation’s two largest cash assistance programs for low-income workers are the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC). Despite their names, both programs are cash payments, not tax refunds. Millions of illegal immigrants have Social Security numbers (SSNs), potentially allowing them to receive cash payments from the EITC and ACTC. Illegals without SSNs who have U.S.-born children are also allowed to receive the ACTC by using an Individual Taxpayer Identification Number (ITIN). Based on their income and number of U.S.-born children, we estimate that illegal immigrants may receive between $3.8 and $4.5 billion from the two programs. This is in addition to the $4.4 billion we have previously estimated illegals likely received in stimulus checks this year.

- About two million illegal immigrants have been issued Social Security numbers, including those with Deferred Action for Childhood Arrivals (DACA), Temporary Protected Status (TPS), and applicants for adjustment of status, suspension of deportation, and asylum, as well as parolees and those granted withholding of removal.

- All of the above individuals are in the country illegally and could be required to leave. Yet, under the current system, they are still given work authorization and Social Security numbers, allowing them to receive the EITC and ACTC.

- In addition to the nearly two million illegal immigrants issued Social Security numbers, the Social Security Administration has previously estimated that 700,000 illegal immigrants use stolen identities and SSNs, which would allow them to access the two programs.

- Finally, under current law illegal immigrants without SSNs are still allowed to receive the ACTC, but not the EITC, by using an Individual Taxpayer Identification Number if they have U.S.-born children.

- Reflecting their much lower levels of education on average than the native-born, we estimate that about 19 percent of all illegal immigrants are poor enough to receive the EITC and 15 percent are poor enough to receive the ACTC. This compares to about 6 and 4 percent respectively for the native-born.

- Based on their income and number of dependents, illegal immigrants with SSNs likely receive $2.9 billion in cash payments — $2 billion from the EITC and nearly $890 million from the ACTC. In addition, illegal immigrants using ITINs may receive between $870 million and $1.6 billion from the ACTC. In total, illegal immigrants will receive between $3.8 billion and $4.5 billion in cash from these two programs.

- With the exception of those using stolen identities, illegal immigrants issued SSNs or ITINs are not breaking the law by receiving cash payments from these programs. The decision to issue SSNs and ITINs to illegal immigrants cannot but help to undermine immigration law and encourage more illegal immigration.

- We report the ACTC figures as a range because the IRS has not published the number of people using ITINs to file tax returns in recent years, so we have only a rough idea of how many illegal immigrants are using them to receive the ACTC.

- Both the 2015 PATH Act and the 2017 Tax Cuts and Jobs Act included provisions making it somewhat more difficult for illegal immigrants to receive ACTC payments. These provisions likely have reduced what illegal immigrants are receiving from that program below the $4.3 billion the Inspector General for Tax Administration found they received from it in 2010.

Who May Receive the EITC and ACTC

The Earned Income Tax Credit. The Earned Income Tax Credit or EITC is the nation’s largest cash assistance program for low-income workers. Despite its name, the EITC is not a tax refund. It makes cash payments to workers with no federal income tax liability. To qualify for payments, one must have earned income, and total income from all sources can be no more than about $57,000 in 2020.1 Payments are based on income, filing status (single or married), and number of children. The average EITC payment in 2020 was nearly $2,500.2 The IRS is very clear on its website that to receive the Earned Income Tax Credit, everyone “you claim on your taxes must have a valid Social Security number (SSN).”3 To be considered a valid number, the IRS states that an SSN must be: “valid for employment”. And the IRS goes on to state specifically that this includes “Social Security numbers on a Social Security card that has the words, ‘Valid for work with DHS authorization.’” This is the kind of number that is issued when U.S. Citizenship and Immigration Services (USCIS) gives authorization to work to an alien. This is typically referred to as an employment authorization document (EAD) or “work permit”.

The Additional Child Tax Credit. The Additional Child Tax Credit or ACTC is only for families with children under age 17. The ACTC is related to the Child Tax Credit (ACT) which reduces tax liability by $2,000 for families with a qualifying child. If the value of the ACT is less than the value of their child tax credit, families can receive the “refundable” portion of the credit, which is referred to as the Additional Child Tax Credit. Families receive cash payments equal to 15 percent of their earnings in excess of $2,500, up to $1,400 per qualifying child. Like the EITC, the ACTC is a cash payment, not a refund. The IRS instructions for the ACT and ACTC state that, “each qualifying child must have the required Social Security number.”4 The SSN must be “one that is valid for employment”. If a child does not have an SSN, the tax filer cannot use the child to claim the credit. However, in its instructions for aliens (publication 5195) the IRS states that for a parent to receive the ACTC he or she needs either an SSN or an Individual Taxpayer Identification Number (ITIN). This is also stated on the IRS website.6 This means that illegal immigrants without Social Security numbers can receive the ACTC if they have U.S.-born children — all persons born in the United States are issued SSNs.

Estimated Number of Illegal Immigrants with SSNs

In estimating what illegal immigrants received from these programs, our assumption is that illegal immigrants with valid SSNs will get both payments if they have the qualifying income and U.S.-born children. The government publishes data regularly on the number of aliens, including illegal immigrants, who are issued SSNs and work authorizations annually. As we will see, determining what share of illegal immigrants use an ITIN to receive the ACTC is a more difficult question.

Our Prior Analysis. We use a variety of U.S. government sources to estimate the number of people living illegally in the United States who have Social Security numbers. While it may be surprising to some, there is no debate that there are large numbers of illegal immigrants eligible to work in the United States who have been issued Social Security numbers by the government. It may seem incongruous that people living illegally in the United States have explicitly been given work authorization by the government, but that is, in fact, the case.

In this report, we use our prior analysis of illegal immigrants with Social Security numbers who likely received stimulus checks published in February of this year.7 That report found that 652,880 illegal immigrants with DACA have Social Security numbers, as do 411,326 individuals with Temporary Protected Status, 441,943 asylum applicants, and 440,109 other individuals, such as those who have applied for adjustment of status, those given suspension of deportation, withholding of removal, or deferred action (other than DACA), and parolees. The Social Security Administration has also previously estimated that there were 700,000 illegal immigrants working in the United States with stolen Social Security numbers8. In total, we estimate there are 2.65 million illegal immigrants with Social Security numbers that would allow them to potentially receive the EITC and the ACTC if they have qualifying children and their incomes are low enough.

Efforts to Tighten up Use of ITINs. In part because of a 2011 Inspector General for Tax Administration report showing that illegal immigrants received more than $4 billion in refundable (cash) tax credits, Congress included provisions in both the 2015 PATH Act and the 2017 Tax Cuts and Jobs Act designed to curtail illegal receipt of these programs.9 Among other things, the 2015 PATH Act slowed the disbursements of payment for those tax filers who were receiving cash payments from the EITC or ACTC in an effort to reduce fraud. It also included provisions that made some older ITINs invalid and did the same for numbers that had not been used on a return for three years, forcing many illegal immigrants to apply for new numbers.10 Further, a temporary provision of the 2017 Tax Cuts and Jobs Act, which is in effect from 2018 to 2025, requires that all children included on tax returns receiving the ACTC must have “a work-authorized Social Security number”.11 For the children of illegal immigrants this means, with few exceptions, that they must be U.S.-born. But neither the PATH Act nor the Tax Cuts and Jobs Act mandated that parents must have valid Social Security numbers to receive the ACTC. So, as already discussed, illegal immigrants may receive the ACTC, but not the EITC, by using an ITIN if they have U.S.-born children.

Estimating Receipt of the EITC and ACTC

Estimated Illegal Immigrants in the CPS. We estimate the number of illegal immigrants in the Census Bureau’s Current Population Survey Annual Social and Economic Supplement (CPS-ASEC) based on prior research.12 Using our prior methodology to identify illegal immigrants, we further identify those within the illegal population who have DACA or TPS, or are asylum applicants. To identify DACA and TPS applicants in the CPS-ASEC, we use their demographic characteristics, which have been well studied. Asylum applicants are a more challenging population to identify, but based on their characteristics from administrative data, we feel we are able to obtain a reasonable estimate of this population in the CPS. However, we have not developed a methodology for those in the smaller categories of aliens who are temporarily present without status under the Immigration and Nationality Act. This is an eclectic group, making it very difficult to identify them in the CPS. Nor do we have a method for identifying illegal immigrants with stolen identities in the survey. For these two groups, we simply assume they have the same characteristics as the overall illegal alien population in the CPS-ASEC.

EITC and ACTC Payments. The Census Bureau, which collects the CPS-ASEC, includes in the public-use files an estimate of how much each respondent would receive from the EITC and ACTC. These estimates are imputed by the Bureau based on reported income, number of dependents, marital status, and other information in the survey. It is important to note that these payments are not based on self-reporting like other welfare programs. The EITC and ACTC payments shown in the CPS only show what respondents would receive from the programs if they claimed them.

Adjustment for Payment Undercount. The EITC and ACTC payments calculated in the CPS-ASEC undercount the total amount received from the programs, especially for the EITC. The survey for 2020 shows total payments of $37.74 billion from the EITC for 2019 — the survey asks about the prior calendar year. However, the IRS website shows that a total of $62.825 billion was paid out by the program in that year, so we adjust upward payments in the CPS-ASEC to account for this difference.13 Our assumption is that under-reporting of EITC eligibility and payments in the survey is the same across subpopulations. We do the same adjustment for the ACTC. While the 2020 CPS-ASEC shows total payments of $24.373 billion from the ACTC, 2019 budget documents show that $28.898 billion was paid out by the program.14

Other Adjustments. A second set of adjustments has to be made to the EITC and ACTC values in the survey because the imputed payments created by the Census Bureau in the CPS ASEC are based on the assumption that all children in families with qualifying incomes are eligible for the programs. As already discussed, only children with valid Social Security numbers may be used to claim the EITC and ACTC payments. We adjust downward payments for both programs to exclude the modest number of children who are themselves illegal immigrants. For the EITC, we use the payment table for tax year 2019 provided by the IRS.15 For the ACTC, we do a similar adjustment by reducing payments to the program to reflect only the number of U.S.-born children living with adult illegal immigrants. It is worth pointing out that these downward adjustments do not make as much of a difference as it might seem because, as prior research shows, only about 12 percent of children who live with illegal immigrants are illegal themselves, the remainder being U.S.-born.16 Our own analysis of the 2020 CPS-ASEC confirms this finding.

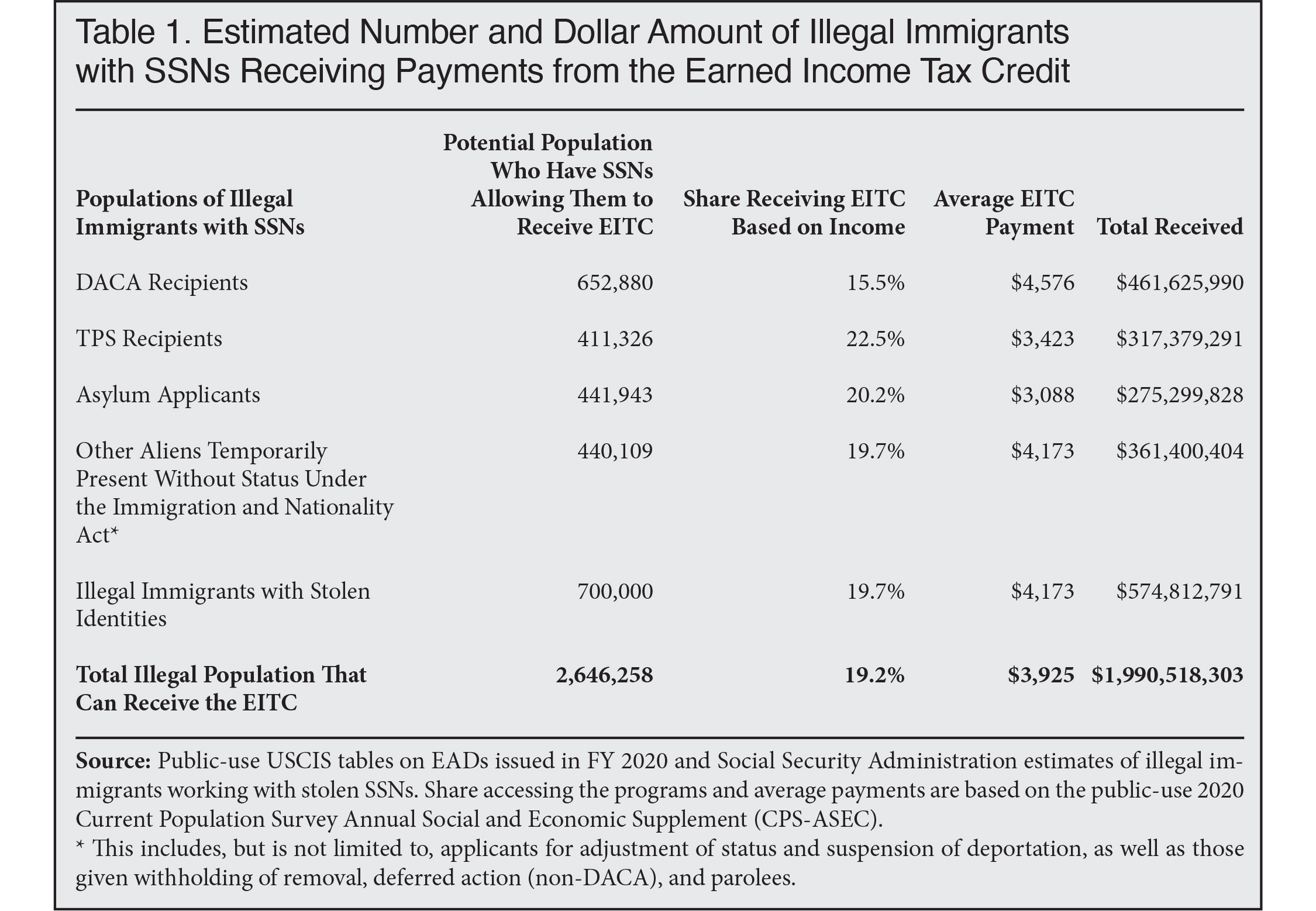

EITC Payments. In this analysis, we assume that only the 2.65 million illegal immigrants who have valid work authorization and Social Security numbers or stolen identities can receive the Earned Income Tax Credit. The total number of such individuals is shown in Table 1.17 We use the adjusted EITC payments from the CPS-ASEC to estimate receipt of the program by DACA, TPS, and asylum applicants separately based on income and number of children. As mentioned above, we do not have a methodology for estimating the specific characteristics of illegal immigrants with stolen IDs or “other aliens temporarily present without status under the INA”. For these populations, we assume that they will receive the average illegal immigrant EITC payment, again based on characteristics. The results in Table 1 show that about one-fifth of illegal immigrants with SSNs likely received the EITC — slightly less than $2 billion.

|

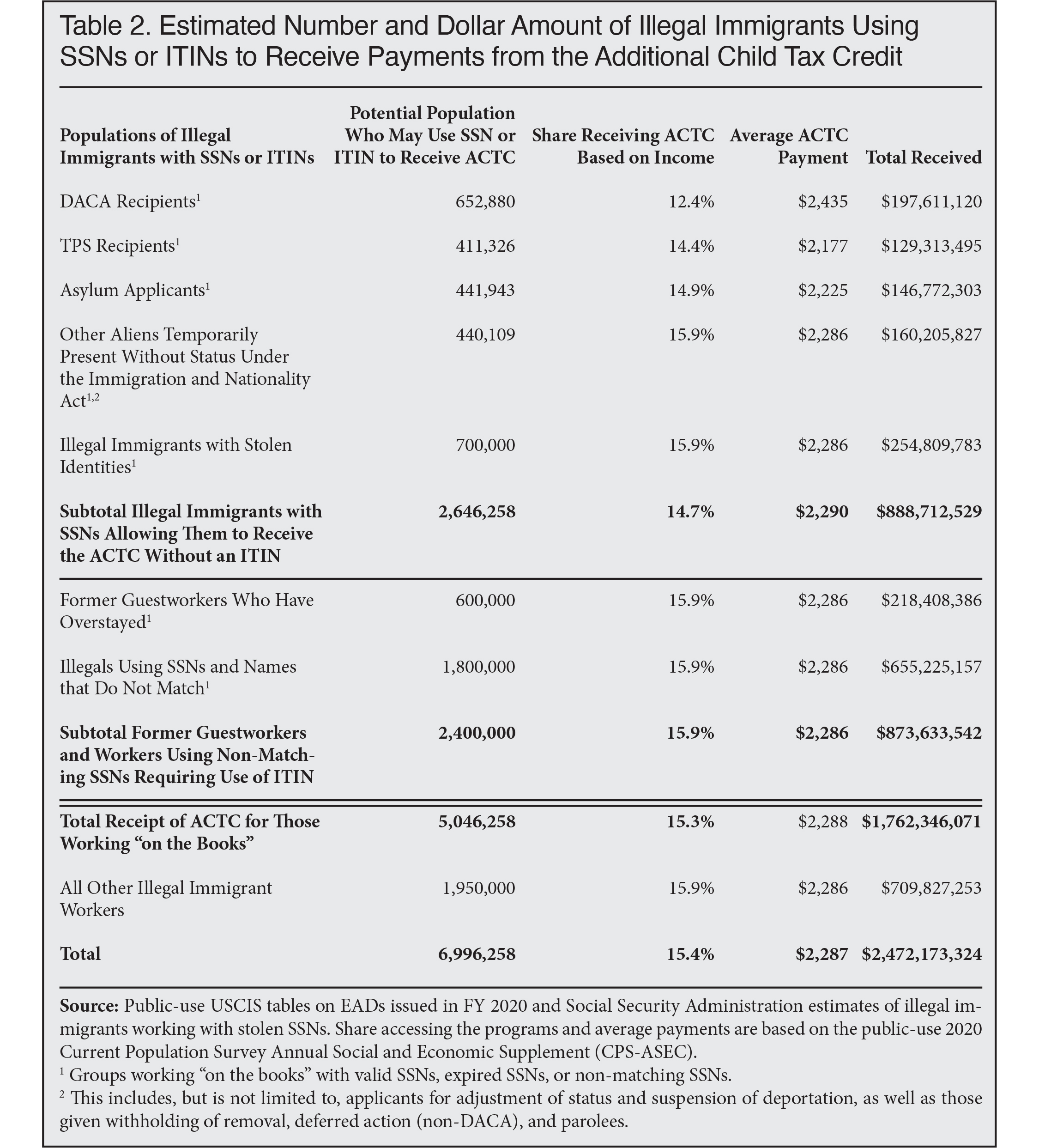

ACTC Payments. In Table 2, we assume that the 2.65 million illegal immigrants with valid Social Security numbers or stolen identities who have children and qualifying incomes receive the ACTC. These individuals should receive the $889 million shown in the total that reads, “Subtotal illegal immigrants with SSNs allowing them to receive the ACTC without need of ITIN”. We make the same assumption for those illegal immigrants with Social Security numbers that were previously valid and those using names and numbers that do not match. These two groups would receive the $874 million shown in the total that reads, “Subtotal former guestworkers and workers using non-matching SSNs requiring use of ITIN”. It seems almost certain that both of these groups of illegal immigrants will receive the ACTC because they have provided their employers with Social Security numbers and taxes should be withheld from their paychecks, making it advantageous for them to file returns, especially those who qualify for refunds or the ACTC. Taken together, Table 2 shows that all illegal immigrants paid “on the books”, which includes those with valid or stolen SSNs and those with previously valid SSNs or non-matching SSNs, would receive $1.76 billion from the ACTC based on their income and number of children.

|

Estimating receipt of the ACTC for illegal immigrants who have not provided employers with Social Security numbers is more challenging. The primary difficulty in estimating receipt of the ACTC for those not paid on the books is that the government has not published the number of tax filers who used ITINs since 2015, when 4.35 million reportedly used them to file.18 Without knowing the number of ITINs used to file taxes in recent years, it is difficult to know how many illegal immigrants are receiving the credit.19 To qualify for the ACTC one needs to claim at least $2,500 of income (reporting self-employment income is allowed), and there is no clear mechanism even to verify such income.

Obtaining an ITIN is free and the IRS has tried to make the process as easy as possible. In addition to submitting a W-720 — the ITIN application form — directly to the IRS, the agency also allows an applicant to give the form to “acceptance agents”.21 These are private accounting firms, many of which are the largest in the country, including Deloitte and Ernst & Young. These firms have offices all over the country. The IRS has undertaken significant outreach efforts to encourage use of ITINs. In both English and Spanish, a 2019 press release on the IRS web page expresses great concern that millions of ITINs are set to expire and urges those who need them to apply without delay, otherwise their refunds may be delayed.22

The bottom line is that the credit could be available to a very large share of the illegal immigrant population paid off the books, if they apply for an ITIN. Table 2 shows our best estimate for the number of illegal immigrants not paid on the books who are in the labor force, which we estimate at 1.95 million. This population could receive nearly $710 million annually from the ACTC based on their income and number of U.S.-born children. In total, we estimate that illegal immigrants receive between $1.76 billion (those paid on the books) and $2.47 billion (if those off the books are included) from the credit.

Illegal Immigrants Compared to the Native-Born. In addition to showing total amounts, Tables 1 and 2 show the estimated share of illegal immigrants who can receive the EITC and ACTC and their average payments. Table 1 shows that 19.2 percent of all illegal immigrants with SSNs have income allowing them to receive the EITC. The corresponding figure for the native-born is only 6.2 percent. Focusing only on those with children, we find that 24.6 percent of illegal immigrants compared to 11.8 percent of the native-born have income allowing them to receive the EITC. The situation for the ACTC is similar. We find that 15.4 percent of illegal immigrants (with and without children) have incomes allowing them to receive the ACTC, compared to 4.4 percent of the native-born. For only those with children, the figures are 24.6 percent for illegal immigrants and 13.0 percent for the native-born. The much larger share of illegal immigrants with incomes low enough to qualify for these programs reflects in part the lower average education level of the illegal population.23

In the modern American economy, educational attainment is one of the best predictors of earnings, tax payments, and receipt of income transfer programs like the EITC and ACTC. This points to an important issue with illegal immigration or any policy that admits less-educated workers to the United States. Employers may wish to have access to such workers in order to fill jobs that require modest levels of education and pay relatively low wages. But such a policy cannot help but to create very large costs for taxpayers. Of course, employers do not see those costs because they are diffuse — borne by all taxpayers — while business owners get access to the low-wage workers they want. But if policy-makers are to formulate public policy that reflects the overall interests of the country, they cannot focus only on the desire of businesses for more workers. The potential impact on public coffers must be part of any immigration policy debate.

Conclusion

Under current law, illegal immigrants may receive the EITC if they and any dependent children included on their tax returns have valid Social Security numbers. Department of Homeland Security data and other information indicate that about two million illegal immigrants have such SSNs. There are other illegal immigrants with stolen identities who are also likely able to receive the EITC. Based on an analysis of the CPS-ASEC we estimate that about one-fifth of illegal immigrants with SSNs have incomes that allow them to receive this credit, totaling $2 billion annually. Illegal immigrants with valid SSNs may also receive the ACTC. We estimate that this population likely receives $890 million from the ACTC.

Illegal immigrants who do not have valid SSNs may still receive the ACTC, but not the EITC, if they have U.S.-born dependent children. To do so they must obtain an Individual Taxpayer Identification Number (ITIN) to use on their tax returns. We estimate that illegal immigrants with U.S.-born children using ITINs receive between $874 million and $1.58 billion from the ACTC each year. Our uncertainty stems in part from the fact that the government has not published updated figures on the number of tax filers using ITINs in recent years. We do know that the number of new applications for ITINs remains very high, indicating that a significant number of illegal immigrants are likely still using them to file tax returns and receive ACTC cash payments.

In total, we estimate that illegal immigrants may receive upwards of $4.5 billion in payments from the ACTC and EITC combined. It must be emphasized that with the exception of those using stolen identities, the vast majority of illegal immigrants receiving cash payments from these programs are not doing so in violation of the law. Yes, these individuals do not have permission to be in the United States. But under the current system they are issued SSNs or ITINs as a matter of policy and they are allowed to receive payments from these programs. This fact may be more important than the actual dollar value they receive. The decision to issue SSNs and ITINs to people who are not supposed to be the country, allowing them to collect billions from public coffers, certainly undermines immigration laws and conveys the message that America simply is not serious about enforcing immigration laws.

End Notes

1 One must have an income of less than $56,844 if married filing jointly with three children. See “Earned Income Credit (EIC)”, IRS Publication 596, January 26, 2021.

2 “Statistics for Tax Returns with EITC”, IRS, January 29, 2021.

3 “Who Qualifies for the Earned Income Tax Credit (EITC)”, IRS, March 22, 2021.

4 “2019 Instructions for Schedule 8812, Additional Child Tax Credit”, IRS, January 14, 2020.

5 “U.S. Tax Guide for Aliens”, IRS Publication 519, February 25, 2021.

6 “Child Tax Credit and Credit for Other Dependents”, IRS Publication 972, January 14, 2021.

7 Steven A. Camarota, “Estimating the Number of Illegal Immigrants Who Might Get Covid Relief Payments”, Center for Immigration Studies Backgrounder, March 22, 2021.

8 See Stephen Goss, et al., “Effects of Unauthorized Immigration on the Actuarial Status of the Social Security Trust Funds”, Social Security Administration, April 2013. We are not 100 percent certain that all illegal immigrants with stolen identities would be able to receive the EITC. It is not entirely clear how the IRS would identify stolen identities in many cases. We think it likely that individuals with stolen identities could use them to get the EITC if they are income-qualified. Later in this report, we also assume that guestworkers who have overstayed and are using previously valid SSNs cannot receive the EITC, though they could use an ITIN to receive ACTC payments. We are not completely certain of this assumption, either. It is possible that all or some of these individuals are able to receive the EITC if they are income-qualified. The IRS has not clearly indicated how they prevent such individuals from using their previously valid SSNs to get EITC payments. It is clear that individuals with such numbers are not supposed to use them to receive the EITC, but enforcement means are unknown.

9 Michael E. McKenney, Kyle R. Andersen, and Larry Madsen, et al., “Individuals Who Are Not Authorized to Work in the United States Were Paid $4.2 Billion in Refundable Credits”, Treasury Inspector General for Tax Administration, July 7, 2011.

10 “PATH Act Tax Related Provisions”, IRS, January 22, 2021.

11 “The Child Tax Credit: How It Works and Who Receives It”, Congressional Research Service, November 17, 2020.

12 For an explanation of how we estimate illegal immigrants in Census Bureau data, see Steven A. Camarota, Jason Richwine, and Karen Zeigler, “The Employment Situation of Immigrants and Natives in July 2020: Employment and labor force participation improved more for immigrants”, Center for Immigration Studies Backgrounder, August 19, 2020.

13 “Statistics for 2019 Tax Returns with EITC”, IRS, January 29, 2021.

14 “A Budget for America’s Future, Appendix”, Office of Management and Budget, undated, see p. 1029.

15 See payment table in “Earned Income Credit (EIC)”, IRS Publication 596, January 26, 2021. So, for example, if an illegal immigrant identified in the CPS-ASEC shows they have three children, but only two are U.S.-born, we adjust their payment downward to reflect only two children rather than three.

16 Jeffrey S. Passel and D’Vera Cohn, “Most unauthorized immigrants live with family members”, Pew Research Center, November 27, 2018.

17 We used this same assumption in our prior research on illegal immigrant receipt of stimulus checks. See Steven A. Camarota, “Estimating the Number of Illegal Immigrants Who Might Get Covid Relief Payments”, Center for Immigration Studies Backgrounder, March 22, 2021.

18 The 2015 “National Taxpayer Advocate Report to Congress” shows the most recent information on ITINs starting on p. 198. Strangely, the 2016 report cites the ITIN figures from the 2015 report (footnote 2, p. 239), but contains no updated numbers. No Advocate’s reports after 2016 have updated ITIN figures. Further, the most recent Treasury Inspector General for Tax Administration’s report on problems with ITINs also does not report how many people are using them in recent tax years.

19 Legislation in 2015 and 2017 changed the laws governing the administration of ITINs. Therefore, extrapolating from the 2015 data, the last year ITIN data was reported, is problematic given that no data has been reported after those changes. The 2020 “National Taxpayer Advocate Annual Report to Congress” does show 1.53 million applications for new ITINs in 2019 (see p. 77). So we can say that use of ITINs remains extensive, but not how extensive. The 2015 Taxpayer Advocate report showed 900,000 new applications were filed for ITINs and 4.35 million were used on tax returns. So the ratio of new applications to the number used on returns was more than four to one in that year. But whether that ratio remains true in more recent years is unknown.

20 Form W7, “Application for IRS Individual Taxpayer Identification Number”, IRS, revised August 2019.

21 “Acceptance Agent Program”, IRS, April 22, 2021.

22 See “Millions more ITINs set to expire in 2019; IRS says renew early to prevent refund delays” and “Millones de ITINs vencen en 2019; IRS pide que se renueven temprano para evitar retrasos en reembolsos”, IRS, June 19, 2019.

23 In the 2020 data, 41.0 percent of adult illegal immigrants have not completed high school and only 19.0 percent have at least a bachelor’s degree. For the native-born, the figures are 7.3 percent and 34.6 percent.